The question of return on investment has always been a big one for broadcasters when it comes to HD Radio, as with any technology decision. But it’s even more so for smaller and medium-sized broadcasters who may not have been involved in the IBOC initiative at the outset and for whom the ROI argument needs to be very clear indeed.

For a new Radio World eBook published in December, we asked a dozen or so broadcasters and other industry participants about this. You can read it online at http://tinyurl.com/rw-hdroi.

Is the “translator play” as effective as widely believed? What revenue can stations expect if they participate in the Broadcaster Traffic Consortium? Are stations discovering revenue opportunities from leasing digital subchannels? Could such revenue help cover the cost to upgrade to digital? Who is willing to purchase such capacity? Can we quantify how HD Radio might help an AM owner justify the investment?

Ebook respondents include executives of Cromwell Group, WDGY(AM), Emmis, Scott Communications Inc./Alexander Broadcasting Co., RUSA Radio, BTC, HERE LLC, as well as our eBook sponsors and other observers.

Here is a summary from my introduction of the ebook.

CONTEXT

The percentage of vehicles sold in the United States in 2015 with HD Radio was about 35 percent, according to HD Radio parent DTS Inc., and three dozen vehicle brands now offer the technology. The number of U.S. stations with HD Radio installed is about 2,300 out of 15,500 or so licensed stations.

The great majority of installed stations are FMs. While these tend to be in larger markets to date, about 95 percent of Americans now have access to at least one HD Radio broadcast. Three-quarters of U.S. radio listeners listen to stations that have HD Radio, though many of these consumers may not actually be listening in digital. There are about 1,700 FM multicasts, including 50 or so HD4 channels. HD Radio has made its biggest inroads in the car, compared to mobile and home listening.

When talking about the ROI from a digital investment, be clear on what, exactly, you’re discussing. One might be referring to an AM or FM station’s main HD1 digital signal, or to one of several FM multicasts, or to an analog FM translator that is rebroadcasting content of an HD multicast. To a listener in the latter case, the role of HD Radio might be invisible, but that digital component is now a key part of many stations’ ROI considerations.

This chart from HD Radio parent company DTS Inc. documents growth in multicast-only listening over the past five years.

IN TRANSLATION

Proponents have argued that “content is king” and that HD Radio is an important tool to be used not for its own sake but to gain listeners. They say the cost to add digital is roughly comparable to the cost of going FM stereo in the early 1970s and that radio cannot afford to remain analog in an increasingly digital world.

Much of the discussion about immediate ROI from the investment focuses on the strategy of programming an HD2 or HD3 multicast in order to feed a separate FM translator. Proponents point out that certain groups like Saga, iHeartMedia and Cox jumped early on this idea and have been successful in markets large and small. DTS tells us numerous broadcasters have done this, realizing monetization and recovering their investments.

Some show up in the ratings. Rick Greenhut, director of broadcast business development for HD Radio at DTS Inc., has tracked HD-on-translator simulcasts in PPM markets since early 2014, when there were 23 multicast stations in 11 markets meeting minimum reporting standards to be included in Nielsen monthlies. “As of this month,” he said in December, “there are now 54 multicast channels that appear in their respective monthlies in some 26 markets, despite the higher listening requirements (Nielsen MRS or minimum reporting standards) for inclusion in the monthlies in these major markets.”

As a case study for translators, DTS points to WLZX(FM) in Springfield, Mass. This Saga station uses the HD2 channel to feed programming to a translator that targets five major area colleges, “super-serving” student populations and supporting the effort with a dedicated sales team. DTS says that by introducing a CHR station in the market, Saga realized “a significant source of ROI.”

Ed Christian, president/CEO of Saga, has been quoted using the term “metro station” to describe the HD-on-translator opportunity. After all, the thinking goes, local advertisers don’t know the difference between a primary FM and a translator as long as the signal covers the market.

Critics may carp that the translator approach only further demonstrates the proven desirability of access to frequencies on the FM dial. But there’s no question many broadcasters find this strategy attractive. While stations we contacted were reluctant to cite numbers, Radio World had no trouble identifying a number who embrace and endorse the translator strategy.

Further, while there is a 250-watt limitation on translator power, there’s no height limit, so you don’t have the “tower vs. power” issue that applies to traditional FM signals. “You can put your translator antenna on top of someone’s 2,000-foot TV tower, and have a signal that rivals a Class A FM in many smaller markets,” one HD Radio insider says.

Backers also believe HD-on-translator is not a “zero-sum” game. Add a unique format to a market and there are additional listeners and dollars that come into a marketplace from those not currently involved with radio, both on the listener side as well as the advertiser’s, supporters say.

Niche formats, foreign-language broadcasts or even an oldies channel targeting baby boomers can serve to generate audience and dollars. As this proponent put it, “You don’t rob Peter to pay Paul by adding a new way to serve underserved listeners.”

“ENLIGHTENED USE”

Evidence supports the idea that at least some smaller operators are putting this HD2/FM translator strategy to good use. Translators that originate on HD multicasts are an increasingly important part of the FM landscape.

Obviously the overall market for translators has been heated, with plenty of money being spent by groups large and small; it’s due also to the special recent opportunity offered to AM stations, unrelated to the HD Radio sector. But clearly the package of an HD2 feeding a translator to gain more FM footprint has been a successful one in many situations.

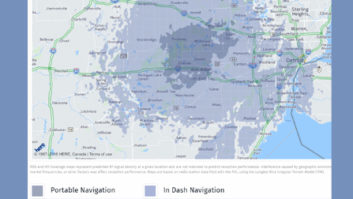

Map, described in the article, shows 60 dBu coverage of Cromwell Group’s WYDS(FM) in Decatur, Ill., and its three translators fed by its multicast channels.

Click to Enlarge

The best guess is that there are about 250 HD-on-translator simulcasts on the air; there may well be more.

An interesting case is demonstrated in the accompanying graphic from DTS Inc. It shows 60 dBu coverage of Cromwell Group’s WYDS(FM) in Decatur, Ill., and its three translators fed by its multicast channels.

The image is an example of what one pro-HD source calls “enlightened use of HD-on-translator” to maximize coverage, ROI and ensure market dominance. The main channel and the HD2/HD3/HD4 60 dBu coverage are indicated by the large red circle. The main channel (analog + HD1) plays CHR. It is 4.6 kW Class A at 367 feet HAAT. The HD2 is urban adult contemporary, simulcast on a 250-watt translator at 244 feet HAAT; the translator’s 60 dBu coverage is the yellow circle. HD3 is classic country, and simulcast on a 250-watt translator at 538 feet HAAT; its circle is cyan. HD4 carries sports and simulcasts on a 175-watt translator at 277 feet HAAT; it is blue.

Based upon the target audience of the formats on the multicast channels, Cromwell apportioned translators to ensure that to the extent possible, coverage of the translator and the highest population density of the target audience coincided. Between those four formats, the argument goes, Cromwell can make the case for a piece of virtually any local or regional ad buy, either as a standalone or sold in combination. A buyer who wants to reach African-Americans can buy the HD2. A buyer who seeks to reach men 18–49 can buy a combo of the HD3 and HD4.

Multicasting thus lets a station create spot packages that can reach an advertiser’s primary and secondary demographic targets.

Translator signals typically are smaller than the native HD2, HD3 or HD4 signal. “As more HD Radios hit the marketplace, we expect a natural migration from the analog simulcast to the digital original,” says this DTS source.

OTHER MODELS

But what about other revenue opportunities?

“Pureplay” HD multicasts are not uncommon, both commercial and public. Stations might, for instance, use their HD2 channel to replicate a legacy sound from the 1960s or ’70s, using period jingles and air personalities.

HD Radio, its backers say, also allows a station to bundle digital assets. “Package banner ads on your website along with spots on your HD2 for clients who might not be able to afford your main channel rates,” a marketing piece states. “Your additional multicast channels can serve to bring new advertisers into radio by lowering the cost of entry for smaller clients.”

Proponents say public stations in particular do a good job in general of promoting their alternate programming on their main channel; they also often cross-plug program reruns: “If you can’t listen to all of this show now,” a public radio station might tell listeners, “we’ll be repeating the program at 8 o’clock tonight on our HD2 channel.” Talk and religious stations find this useful too.

Demand for multicast capacity also comes from highly targeted program sources, often ethnic or religious — echoing the days when stations built revenue streams from their analog SCAs. Now, however, the receivers required can be readily available HD Radios rather than custom-built SCA radios, helping the sub-channel broadcaster solve the “receiver availability” problem.

In our eBook, we interview an enthusiastic supporter with such a lease, Anna Pekerman of RUSA in New York. Other organizations reportedly using HD multicasts as part of their distribution include Sputnik Radio, Saigon Radio, YTN radio (Korean in Los Angeles), G & E Chinese Radio, Pillar of Fire and Radio Hamrah (Persian language in L.A.). The scope of the leasing marketplace is difficult to quantify; but as one of our interviewees told us, the lease argument is supported by a universal truth: Spectrum remains scarce and in demand.

In another example of how HD2 channels can be used, in 2015 the iBiquity-owned HD Radio Ad Network (now part of DTS) announced a deal to broadcast Radio Disney content 24/7 via numerous HD2 and HD3 stations owned by several major broadcasters. The ad network sells advertising on them and shares the majority of revenue produced with the stations. That agreement remains in place and is being expanded to more stations in 2017, a DTS official confirmed.

Yet another approach of which we hear are one-off lease arrangements that broadcasters sign with local churches broadcasting in Spanish, Korean or Chinese. Anecdotally, at least some stations have added HD because they knew they had a lease with a church for an HD2 channel. (I welcome information about such deals that we can share with readers; my email address is at the end of the article.)

To be sure, there are 13,000 AM/FM stations that have not yet made the digital choice or have opted for a long-term waiting approach. At one big group, an engineering executive told me that smaller/medium markets aren’t producing revenue and “we are looking at not replacing [HD Radio] as they die. Translators are really the only justification.” Another industry leader is supportive of HD Radio but feels it’s too hard for consumers to find HD and multicast options on car hardware, compared to one-button access for services like Spotify.

And more than one person wished for better and more detailed industry analytics and ratings for these forms of digital consumption. Nielsen does not report who listens in analog-only vs. who is listening in “native” HD; the diary and PPM meter encoding just note call letters or frequency. There’s no way to capture analog vs. digital, nor a percentage of listeners listening to an analog simulcast of an HD2/3 in HD vs. analog.

Another observer with significant major-group experience thinks the ROI remains difficult for small-and medium-market stations. Yet like his colleague quoted above, he too immediately qualified this by adding: “… unless you can get a lucrative HD2/HD3 lease, or unless you can secure your own analog FM translator that can relay HD2/HD3 content.”

Those are the kind of applications that we heard about in the market. And he expects the outlook to improve over time as receivers proliferate further and hardware becomes more affordable.

Tell us your own ROI story, and let me know how our eBooks can serve you better. Email me at [email protected].