In October, the FCC released a Notice of Proposed Rulemaking that called for comments on the relaxation of the foreign ownership rules for the broadcast service. The FCC is considering bringing the broadcast foreign ownership rules in line with the rules for other services regulated by the FCC, which have been revised in recent rules.

Regulation over foreign ownership of the broadcast service dates back to the dawn of AM radio. The precursor to the Communications Act, the Radio Act of 1927, incorporated regulations on limiting foreign investment to ensure that foreign countries would not gain control of the broadcast stations in time of war. When the Communications Act was passed in 1934, the current foreign ownership cap was established, preventing foreign investment above 25 percent of broadcast licensee and a direct foreign ownership interest of more than 20 percent.

Over the years, the FCC has relaxed the foreign ownership cap in connection with non-broadcast services. During the 1990s, the FCC adopted rules and policies to permit foreign ownership stakes above 25 percent, if the investor was from a World Trade Organization member country � and if the FCC determined such stake was in the public interest. In May 2013, the FCC extended this policy to non-WTO member countries.

Following this action, the FCC took the first step to bring the broadcast service in line with other industries in November 2013 by indicating that investments above the caps would be reviewed under the FCC�s public interest standard on a case-by-case basis.

However, this approach came under fire when the FCC held up the acquisition of an FM station by Pandora because the publicly traded company could not establish that it was under the ownership caps. (Read more about the Pandora case in our June 2015 issue.)

In light of the Pandora case, the FCC is proposing to adopt rules that would limit the number of public interest reviews required for foreign investment in broadcast licensees. For example, the FCC is proposing to permit a foreign investor to seek authorization to have up to and including 100 percent foreign investment.

Specifically, the FCC proposes to permit an entity that has already gone through the public interest review and has been approved to make an initial investment of less than 100 percent controlling interest to increase its stake up to 100 percent without seeking a new public interest review. Similar rules would apply to non-controlling interests, with an entity that has already received prior approval to increase its non-controlling stake up to 49.99 percent.

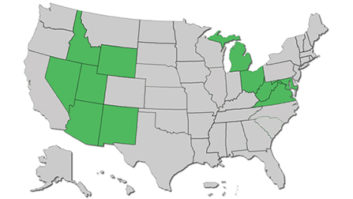

Further, the FCC is proposing to eliminate the need for entities to identify foreign equity holders that have 5 percent or lower voting interest (10 percent or less for certain foreign institutional investors). This proposal would eliminate the situation in Pandora in which the publicly traded company could not confirm the identities of its investors because much of the widely held stock is held in the �street name� of brokers, rather than the individual interest holders. The FCC has historically taken the �worst-case� approach to the identification of investors, with a presumption of foreign interest unless the licensee could confirm non-foreign status. As a result, Pandora was required to adopt a detailed reporting regime to obtain FCC authority to acquire the FM station in Box Elder, S.D., as a result.

The FCC believes that the proposed rules will spur investment in the broadcast industry, while reducing regulatory uncertainty and delay in obtaining authorization for investments. The proposed rules would be applied prospectively only, so that any entity that had previously gone through the public interest review will be required to comply with the conditions imposed at the time. Such entities can seek application of the new rules, but the FCC proposes the requirement that they seek review under the proposed standard.