The Radio Advertising Bureau recently released its numbers for 2008 radio revenues. Unsurprisingly, they were not good: down about 9 percent overall for the year.

Clearly the economy was a factor, with fourth-quarter revenues down 11 percent from the same period the previous year. But this means that the rest of 2008 was almost as bad, indicating that radio’s problems run deeper than the current financial crisis. In fact, the turn toward shrinkage began back in 2007, which showed an overall 2 percent drop from the previous year.

Nevertheless, the 2008 decline would have been into double digits overall if not for substantial growth in radio’s Internet-based advertising revenues, which were up 7 percent for the year. (They were even up 1 percent in the fourth quarter.)

Compared to what

Savvy observers will look at these numbers and respond that it’s always easy to show relative growth when a new trend first emerges and the absolute returns are still low.

In fact, this revenue sector is still new enough that RAB and others are still trying to decide what to call it (see RW’s editorial “A Poor Choice of Words,” March 1). RAB had called it “non-spot” revenue when such reporting started in 2004, but now refers to it as “off-air.”

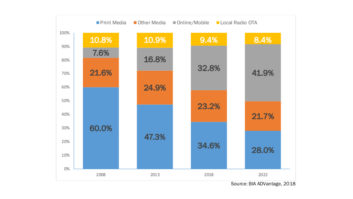

The proportion of radio revenues coming from online advertising sources continues to grow, while traditional sources declined at double-digit rates last year. Source: Radio Advertising Bureau/Miller, Kaplan, Arase & Co. But a closer look here reveals that even the absolute returns — not just percentage growth — are impressive for this sector, with online sales now accounting for an amount that is greater than 10 percent of radio stations’ traditional revenues. (RAB’s data for 2008 shows that off-air revenues totaled $1.79 billion, with stations’ “on-air” revenues — local plus national spot sales — accounting for an estimated $16.5 billion during the period.)

By any measure, this online revenue represents a considerable chunk of change. Crossing into double-digit territory by this analysis only breaks through an arbitrary and conceptual boundary, of course, but it is a good indicator that online is no longer a marginal component of the whole. The growth in this sector is even more welcome when other sources are heading the other direction.

RAB expects the positive trend in off-air revenue to continue in 2009, economic crisis notwithstanding, with this year’s total forecast to approach $2 billion.

To be clear, this revenue is not just coming from stations’ Internet radio (streaming audio) advertising, but includes all of stations’ online advertising, including banner ads on station Web sites and the like. It will be useful in the future for stations to have this particular breakdown specified, to better understand the dynamics of this brave new business world.

This knowledge is particularly important because the cost-per-listener-hour is also very different between on-air and online radio. Having this data could be advantageous to stations as they develop new inventories and apply economies of scale to optimally cultivate their still-emerging online services.

Additional investment in the online space will likely be required, and given current trends, this is well warranted for maximizing stations’ survival prospects.

As revenues from this sector grow, however, it will become critically important to ensure that as much as possible falls to the bottom line. Traditional radio sets a pretty high bar for profitability, so stations will want to press their online services to that level or beyond.

Any port in a storm

It’s worth remembering that traditional revenue streams still bring home the bulk of the bacon for stations, so expectations should not be hastily recalibrated.

Yet while there’s still a long way to go, the trend is plainly shifting, and it appears that the giant crossfade has already begun.

Rather than fearing this trend, broadcasters should embrace the opportunity to reverse (or at least moderate) an otherwise dismal picture. It’s also likely that online revenues will continue to account for a growing percentage of station revenues, but it’s less probable that the crossfade will proceed all the way through. It is far more plausible that the shift will slow and stop somewhere in the middle, as stasis is achieved between on-air and online returns at stations.

Having timely data that accurately describe the arc of this transition in a timely fashion will therefore be extremely beneficial. This is new ground for broadcasters, and having the best possible maps and navigators on hand is essential.

What is already clear, however, is that old notions like “online is a fringe feature,” “it’s just a fad” or “this environment cannot be monetized by broadcasters” have been disproven.

If you can’t make new technology trends fit your business model, make your business model fit the technology. Online is a new-found fertile ground for broadcasters, and they should rush to stake their claims there with all due speed.

Skip Pizzi is contributing editor of Radio World.