Members of the Broadcaster Traffic Consortium — pitching their aggregated signals as a data delivery platform, in competition with Clear Channel — are now putting more emphasis on building out the HD Radio infrastructure.

According to BTC President Paul Brenner, the consortium is receiving another look from carmakers and data service providers who believe HD Radio is the most economical way to get data into cars — a better alternative than mobile broadband services that don’t fully exist yet. Brenner is also senior vice president/chief technology officer for Emmis Communications, one of the group’s members.

He says financial models support the conclusion that HD Radio data is the cheapest way to get data into vehicles, so he’s lobbying stations to adopt the HD platform.

The 16 BTC radio broadcast members represent 1,500 stations. They cover 92 U.S. markets with traffic data using RDS and 75 with HD Radio. BTC also covers seven Canadian metros. In addition to traffic, some BTC stations are transmitting location-based advertising using RDS; other BTC stations are transmitting local and national weather, local fuel prices as well as location-based advertising using HD Radio.

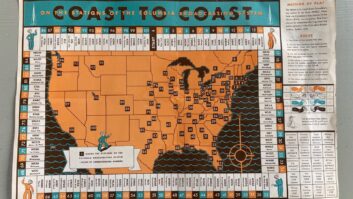

This slide captures the thrust of BTC’s argument that IBOC offers a much broader platform for data distribution than other technologies. Source: Broadcaster Traffic Consortium The BTC has a partnership with Navteq — owned by Nokia — to distribute real-time traffic and other map-related data. Member stations embed Navteq data in their broadcasts, allowing Navteq to sell navigation products and supporting data subscriptions. The members share revenue according to a formula based on Arbitron population coverage; with a higher level of bandwidth commitment, a member’s level of revenue rises.

Brenner said BTC members are making a profit from this shared revenue and that BTC is forecasting continued growth; he declined to disclose revenue figures.

BTC also is working on a handful of additional arrangements and says it has attracted the attention of several companies — undisclosed at this time — looking for a single nationwide company to provide low-cost digital data distribution.

The consortium’s largest competitor for traffic is Clear Channel Radio’s Total Traffic Network, which distributes traffic data to more than 125 metropolitan markets in four countries, including the U.S., Canada, Mexico and New Zealand. TTN has more than 500 FM signals transmitting traffic information with RDS-TMC. Of those, 353 also are transmitting traffic data with an HD Radio signal, according to the broadcaster.

Brenner spoke with Radio World News Editor/Washington Bureau Chief Leslie Stimson. While he declined to discuss certain specifics citing confidentially agreements, he talked about what the BTC is up to as the economy shifts and automakers take another look at radio-based data delivery systems.

RW: What are broadcasters doing to compete with mobile broadband, streaming and satellite radio in the car?

Brenner: It has to be the same listener experience that we get from satellite radio, mobile broadband and streaming [with] album art, artist and title, and data services like traffic, weather and fuel. That’s what everyone else is developing towards.

So we’re just FM analog radio. How do we get to that place where we provide that same experience in the dashboard?

RW: Are enough stations transitioning to HD Radio so the BTC has enough coverage footprint to send navigation data?

Brenner: There are enough HD stations on the air to serve as representative of a digital radio product. At 2,000 on the air, plus multicasting, it’s enough for the manufacturing community to say, “There are stations available in digital.” The other half is your question about the BTC, are there enough digital stations for that? Absolutely. We have well over 1,000 stations in the BTC that are HD Radio-capable.

A BTC diagram of how its system works. Source: Broadcaster Traffic Consortium RW: I was talking to an engineer who said his group has cut back so much he doesn’t have enough engineering help, and when they get capital again, HD Radio isn’t the first thing they’ll spend on for upgrades. They’ll spend money on replacing basics things like computers.

Brenner: Sure, the capital planning that slowed down in the recession has definitely hurt our ability to have more stations, but we still have enough stations today to represent a product to the automaker community. That’s there.

Now, the hurdle that’s going to come around is the power increase and the reinvestment that you’ll have to make in capital to get to that –14 dB, –10 dB, whatever range you fall into.

I guess the strategy I am taking with it is: You have to have an incentive to spend that money. Capital goes to the priority where there’s a return on investment.

So if I look at what the BTC does, if I land deals with automakers that generate revenue for a station, then it’s a moot point, right? You say to a station, “Here’s how much money you’re going to make by participating, with the caveat that you represent that market accurately — make the investment in HD Radio.”

By “represent the market accurately,” I mean stations must make an ongoing investment in digital that provides full market coverage, e.g. the HD power increase implementation. HD Radio must also be treated with the same level of service and uptime commitment as their analog signals.

RW: I asked [iBiquity Digital President/CEO] Bob Struble how they’re going to get mid-level stations to transition to digital. He said they’re trying to convince them that they can make money at HD Radio. He said right now, the receiver story is better, they’re selling more radios. But to me, it seems like the top-level stations have transitioned but the rollout still hasn’t permeated down to the smaller stations.

Brenner: Its markets 75 and up. From my experience, that’s where you have enough listenership and you can do something with it that makes revenue. I’m in 82 markets now with the HD BTC and 92 with RDS; and I’ll go much further than that if [the stations] have an incentive. Market expansion planning is ongoing. BTC could easily represent 100 markets and beyond with the right business opportunity.

To support Bob’s comment, after you get that 80 mark, the incentive to get people up to 90, 100, 110 to participate — they need a revenue return on it, a clear one, a very clear one, and that’s what I’m trying to represent with the BTC.

RW: What turned automakers around? You said suddenly they’re more interested in HD Radio.

Brenner: The downturn of satellite, the risk of Sirius XM financial problems has definitely caused some of them to reevaluate their all-in strategy with satellite being the only digital data delivery service. Many automakers just rolled the dice with that. They were getting subsidies from satellite. That was a revenue stream for them.

But that’s their dashboard, and I have heard directly automakers fear [that satellite’s] financial problems could put them in a bad situation, so they need to have alternatives. That’s caused them to come back to us.

Mobile broadband has a lot of sizzle right now — a lot of two-way talk in the car. Probably 2013 is when you’ll see the first real heavy discussion about mobile broadband, at least in my meetings.

Paul Brenner RW: In the car?

Brenner: Yes, in the car. Not all cars, just some. That’s where you’ll see a heavier effort to get in. It’s a very expensive proposition. We show a financial model that says HD Radio data is the cheapest way to get data into that vehicle.

By comparison, HD Radio, where you might pay a set amount to get data into a car, over a year, is equivalent to about a month of mobile broadband in the car. We can do that same service for more than one year — of equivalent service for the same cost. It’s a very different economic model.

RW: It sounds similar to the argument that iBiquity’s giving to the cell phone companies, why they should use HD Radio.

Brenner: It’s consistent.

RW: HD Radio can help with their bandwidth issues.

Brenner: It helps with their bandwidth issues and that’s another argument. This is just directly by cost, by cost-per-bit, to get into that dash, the data that you can to help that consumer. That’s a big one.

I think one of the primary things that have brought them back to us is we’ve come up with some pretty innovative products, between Navteq and BTC. My goal when I went out and got Navteq was to bring in some capital infusion into our industry.

Navteq, literally, represents HD as the best way to get data into the vehicle. We make that pitch to the automakers — by cost, by efficiency, by differentiating product. In 2013 I think you’ll see some automakers, with every class of vehicle that they produce, will have a screen. You will not be able to buy a car from some automakers without at least a 4-inch screen in the dashboard. And they want to do something with that screen to make, not just a good experience. They want it to be a selling point, like Ford Sync.

RW: To help them sell the car?

Brenner: To help them sell the car. Ford Sync ate GM’s lunch with this simple little technology — A phone that also gives somebody a little bit of entertainment. And I think folks underestimated that value.

The collective effort of BTC technology members, Navteq and iBiquity have come up with some really cool things that I can’t talk about that actually make the HD application services do something for people [manufacturers and consumers], beyond multicasting and great audio, but some imagery and information and some things that actually could make the lowest socio-economic automobile have a dashboard that has information on it.

Who’s in It, How It Works The Broadcaster Traffic Consortium was formed in 2008 to build a nationwide terrestrial broadcasting network to distribute local traffic and other map-related data via radio technology.

Founding members are Beasley Broadcast Group, Bonneville International Corp., Cox Radio Inc., Emmis Communications, Entercom Communications Corp., Greater Media, NPR and Radio One.

Subsequent members include Cobalt Media, Corus Entertainment, Cumulus Media, Hubbard broadcasting, Journal Broadcasting, Lincoln Financial, Regent Communications and Saga Communications.

BTC would like to expand membership and is in negotiations with several other commercial broadcast groups.

The organization has a board represented by legal, business and marketing leaders from the founding members as well as a technical standards committee with engineers from the founding members.

The build-out for BTC’s current level of coverage took about 18 months from design to live commercial product.

The infrastructure used for BTC distribution of Navteq content was designed by a team of radio engineers, IT experts and software engineers from Navteq. “Our system requirements were specifically written to address any challenges we might face with diverse HD systems [from different vendors], diverse broadcast environments and use of the public Internet for distribution,” said Paul Brenner.

Navteq maintains a processing and feeder system that provides data for Verizon VZcast, Sirius/XM data services and other large organizations; BTC is one output from that data center. BTC stations are linked into the Navteq data center for real-time content streaming and monitoring, he said.

How does the data system work?

The RDS data rate for BTC content is 27 percent of capacity. HD data service allocations are initially set to 13 kbps with the potential to expand that number by nearly 100 percent, according to Brenner, who added that RDS traffic and location-based-advertising reaches millions of devices and that figure is growing rapidly. Large-scale HD data products continue to be in development with manufacturers; their potential could be larger than the RDS value, Brenner believes.

To participate in the BTC, a station must be able to cover its market with both its FM and its HD Radio signals. The required equipment consists of an Audemat-Aztec FMB80 encoder for RDS as well as an HD Importer and Exporter running BTC-approved software versions, and Internet access.

A station must meet the BTC’s infrastructure stability guidelines for factors such as HD software versions, IT readiness, up-time, power redundancy, bandwidth capability, ISP, etc. Typical costs a new station might expect are small if a station is already multicasting and has implemented IT properly its engineering operations.

“Aside from the typical costs a member station will spend for implementing and supporting the current requirements of an IT-enabled broadcast facility (RDS, artist/title, HD Radio, systems support and controls), the incremental cost has been negligible. Each member has been accountable for their own infrastructure costs if needed,” said Brenner.

— Leslie StimsonRW: You mean album art?

Brenner: Beyond that. Album art. I could talk all day with you about — that’s a totally different conversation — about how radio broadcasters need to make investments in the experience, and make that listening experience include everything that it should normally be attributed to, tagging, artist, title, album art, EPG — all the things that make HD Radio look and feel just like every other medium that somebody can get access to.

Pandora is putting stuff in the dashboard. Broadcasters need to work towards that total car experience.

RW: Pandora was all over CES this year with announcements from Ford, Pioneer and Alpine.

Brenner: They’re everywhere, and now you’ve got RadioTime that’s integrating with BMW MiniCooper. They’ve done their EPG and streaming search guide built into the dashboard for BMW; they announced that around CES.

That’s my Emmis side, where I try to forge ahead with trying to find ways to get broadcasters to — It’s not good enough to just say HD’s on the air. It’s just not good enough. You have to say — and these aren’t big investments. You have to say, “Here’s HD. We have tagging, we have album art, with artist and title.”

RW: And all the other stuff.

Brenner: Right, and all of the things worked towards that. I know there’s a lot of people behind the scenes working hard at it, BIA’s EPG project and those kinds of things. I think people are trying to move that forward. I’m not sure broadcasters, in whole, are embracing that yet.

RW: Clear Channel Radio’s Total Traffic Network announced an expanded partnership with Inrix for predictive traffic data. TTN makes the claim that their traffic services are faster than other broadcast and satellite radio solutions. Do you have a reaction to that?

Brenner: This announcement from CC/Inrix is good for competition but primarily draws attention from people who are not frequently exposed to the navigation and traffic-gathering industry. In other words, they had to support predictive in order to keep pace with demand and competition.

In regard to the “faster” comment, automakers perform scientific and intensive real-world tests to assess the speed and accuracy of our [BTC/Navteq] data processing and transmission speed. I am not sure of the source of the CC data, but automaker reports provided to me indicate BTC/Navteq fares very well in the testing of our speed and accuracy.

Navteq is the dominant provider of real-time traffic and has offered predictive traffic for some time now. They are the automobile industry’s traffic supplier of choice, powering 90 percent of full-screen, in-vehicle systems in North America.