One in a series of articles wrapping up news and themes from the recent NAB Show.

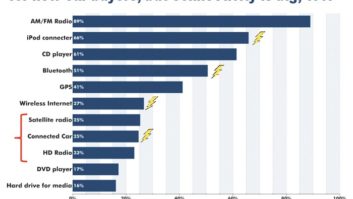

While broadcasters improve their audio and in-dash displays, the penetration of Internet radio in the car could grow significantly over the next few years. In the third column to the left, ‘BT’ indicates Bluetooth capability. Source: CEA

Rising cellphone use in cars, longer commute times and the introduction of newer tech in the dashboard are creating a wild, wild west atmosphere that’s hard even for automakers to navigate, according to consumer electronics and auto experts.

“We’ve seen more change in the vehicle dash in the last five years than in the previous 20,” said Connected Vehicle Trade Association Vice President of Industry Programs Valerie Shuman at the recent NAB Show.

The convergence of such disruptive forces is both a challenge and an opportunity for radio, experts agree.

Addressing industry talk about radio’s future in the car dashboard, veteran engineer Barry Thomas said it’s not so much that radio would be left out of the dash as that the medium could get “lost in the shuffle” by busy consumers, given the proliferating competing technologies in the car and those to come.

The smartphone has had a tremendous impact in the connected car, said Shuman. She said no one is thinking of taking radio out of the car, but that the so-called “center stack” is becoming more like a big-screen computing platform.

At the same time, drivers are spending an average of 16.5 hours a week in the car. Sixty-seven percent of drivers own a smartphone and 70 percent of cellphone use takes place in the car, according to Jon Bucci, an automotive consultant who recently retired from Toyota’s connected vehicle division.

The big push regarding connected cars is in the area of safety.

“We kill 33,000 people a year on our roads,” Shuman said, adding that automakers are developing vehicles to operate more efficiently in stop-and-go traffic. Under development are cars “that can hit the brake and the gas for you” as well as well as keep a good distance between your vehicle and the one ahead of you, freeing up some of a driver’s time.

Changes coming to the car dashboard are huge, and local radio’s competition isn’t limited to other stations. Lots of people want to make money from that transformation, Shuman said, including automakers, their suppliers and the telecom industry.

SAFETY VS. CONSUMERS WANTS

Building a new car platform typically takes three to five years. Connected car services cause disruption in the car industry because those changes are happening more quickly, according to Bucci, now executive vice president of strategic planning for Concannon Business Consulting.

Toyota introduced its Entune infotainment system in 2011 after only 17 months of development. At the time, “that was unheard of,” Bucci said.

He agrees with Shuman that automakers have their eye on safety. Young buyers are eco-conscious. They want to stay connected while driving, to decompress or stay productive. “Customers are saying, ‘Why can’t I just plug in my device directly?’”

“Customers want their content, when they want it on the device,” Bucci said, and potential car buyers want a full browsing experience in the dash; but, he continued, they can’t have that, for safety reasons. “All it’s going to take is one celebrity to wrap their car around a tree, and the car company didn’t disable something to prevent that activity.”

In developing Entune, Toyota looked at factors such as “task time” and menu depth” when determining which connectivity features to offer in the vehicle. For safety reasons, Bucci said, the automaker must determine “how far do you let them go before the screen locks?”

Circling back to how dashboard disruption affects radio, Bucci advised broadcasters to create “a simple environment.

“We’re too overloaded.” Listeners still appreciate air personalities and speak to automakers about the surprise and delight of discovering new music from radio. “We still think content is king,” said Bucci, speaking of automakers in general.

CD PLAYERS ON THE WANE

What of trends for the physical radios still found in the dash?

RW has reported that the in-dash CD player is on the wane. CEA Senior Director of Technology & Standards Mike Bergman confirms that trend in the aftermarket product world.

The average aftermarket receiver purchaser is a young male age 18 to 34. The average car is 11 years old. In general, purchasers want more features than are found in the original in-dash receiver, so they’re buying replacement equipment. Some aftermarket purchasers include families with kids who want to purchase more capable navigation systems, Bergman said.

He uses the new Pioneer AppRadio as an example of an in-dash aftermarket receiver with no CD player.

“They don’t believe it’s necessary anymore in that product. It does have a radio,” said Bergman; and the radio image on the lower left of the touchscreen “is as close to the driver as you can get.” RW featured the Pioneer AppRadio in our post-CES coverage in the Feb. 13 issue.

And what is the impact of all of this dashboard activity on HD Radio?

Shuman says iBiquity Digital has been doing a good job of getting HD Radio receivers into the car; Bucci predicts 100 percent OEM penetration “very soon,” broadly estimating to RW that this could happen in the next two to three years.

However Bucci said quality issues — such as the digital signal sometimes cutting in and out “in what is supposed to be an HD experience” — are a concern. It has taken awhile for automakers to really incorporate HD Radio, he believes, because some carmakers “were confused” initially about what HD Radio is. “Is it HD? Is it these substations?” Carmakers at first “didn’t really know the promise of HD.”

Bergman said iBiquity “did a great job” of telling the HD Radio story to retailers and manufacturers, but said the “consumer pull still isn’t there.” Consumer interest can only be generated by broadcasters, he said, acknowledging that conveying a technology story to consumers “is difficult.”

The execution of HD Radio at the station level has become more complicated, Bergman said; in addition to keeping digital signals on the air, stations need to monitor text displays, streams and features like Artist Experience. “You’re not just looking at an FM modulator anymore.”

More Dashboard

This is one in a series of articles about radio’s role and future in the evolving automobile dashboard. To read other articles visit https://www.radioworld.com/dashboard.

He urged broadcasters to apply a “whole product strategy” and to employ best practices regarding dashboard displays. Stations that send no text are, essentially, presenting “dead air” on the display, he said. Static text such as call letters or “become a member of WXXX” equates to “Don’t look at me.” Redundant text such as “now playing” constitutes visual noise and blocks a station’s text message.

While broadcasters improve their audio and in-dash displays, penetration of Internet radio in the car could grow significantly over the next few years, with 8 percent penetration in vehicles in 2011 and a projected 80 percent by 2016, according to CEA estimates.

Bergman said Fortune Magazine projects U.S. smartphone sales to total 120 million in 2013. As smartphone sales rise, so too will Internet radio listening in the car, Bergman predicts, as manufacturers make the mechanics of in-car Internet connectivity easier over time.