Audacy Inc. will ask its shareholders to approve a reverse stock split in May in an effort to boost its share price and avoid being delisted from the New York Stock Exchange.

The company told the Securities and Exchange Commission on Friday that, at its annual meeting of shareholders online in May, it will ask its investors for permission to do a reverse split of anywhere from one share for two shares, to one share for 30 shares. If approved, a committee appointed by the board would set the formula.

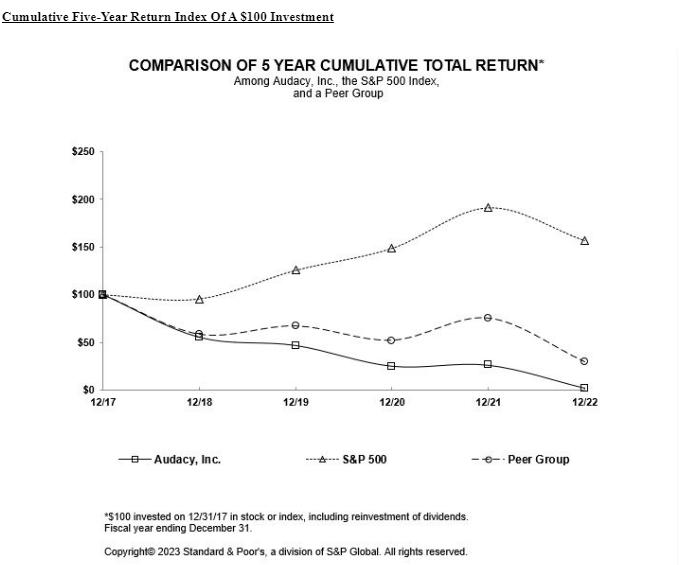

Audacy is the second largest radio company in the United States. Its stock traded at 10 cents on Monday morning. It hasn’t been above the critical $1 point since last summer. An investment of $100 in Audacy at the end of 2017 would have been worth $2.30 at the end of 2022 (see chart at bottom).

“We believe that if the reverse stock split proposal is not approved by our shareholders, it is likely that our Class A Common Stock will be delisted from the NYSE,” the company told the SEC.

Audacy “strongly encouraged” its shareholders to vote in favor in May, while acknowledging that reverse splits do not guarantee higher or stable share prices, and that they can have negative consequences including market perceptions and the possible effect on liquidity.

The company has more than $2 billion in debt, according to the Philadelphia Business Journal, which recently quoted financial analyst Craig Huber as saying Audacy would need to be very aggressive in cutting costs in the coming year if it wishes to survive.

A $100 investment in Audacy’s Class A common stock at the end of 2017 would have been worth only $2.30 by the end of 2022, including reinvested dividends, according to an Audacy filing with the SEC.

By comparison the same $100 investment in a peer group of big radio companies (Urban One, Beasley, Saga, iHeart and Cumulus) would be worth about $29 at the end of 2022, while an investment that tracked the S&P 500 would be at about $156.

The chart below from the company’s most recent annual report reflects those same data points.