U.S. broadcast stations, TV and radio, are expected to bring in $36.47 billion in ad revenue this year, up 12.9% from 2021, according to the newly released S&P Global Market Intelligence Radio & TV Annual Outlook.

It said the radio station ad business specifically is “expected to rebound from the pandemic and receive a mid-term political ad spending boost, although to a lesser degree than TV,” and be up 4.8% to $12.32 billion, excluding network and off-air revenue.

However, “The recovery is expected to be short-lived and partial as national advertising continues to shift away from radio to streaming audio and podcasting alternatives,” S&P Global wrote.

Across radio and TV, “Core ad categories have mostly bounced back to pre-pandemic levels, with the exception of the automotive, retail and travel categories, which are still soft,” it said.

The research company noted the impact on radio of the competition from streaming and on-demand audio as well as a drag on listenership from the economy’s hybrid or work-from-home models, which reduced commuting hours.

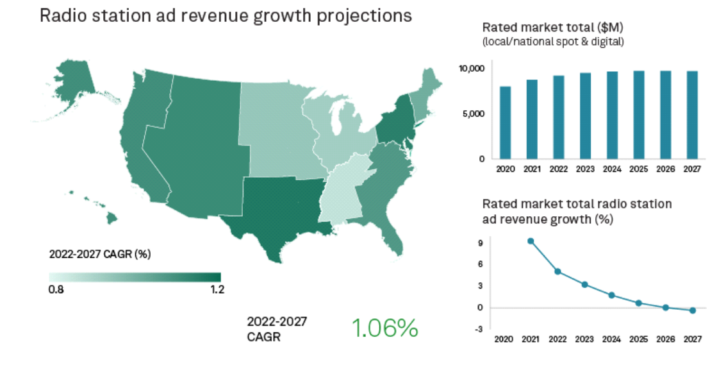

“Radio’s core local spot ad market is projected to grow by 5% to $8.83 billion in 2022 and by 3% to $9.10 billion in 2023, with growth rates leveling off and then slightly declining over the remaining forecast period to $9.03 billion by 2027,” it projected.

“National radio ad revenues boosted by political are forecast to grow 3% to $2.07 billion in 2022 and by 1.5% to $2.11 billion in 2023, level off in 2024 and then start to decline by 1% to 2% over the remaining years in the forecast period to $2 billion by 2027.”

The company projects digital gains for radio of 6% in 2022 and 4.8% in 2023 and a range of 4.3% to 3.8% through the rest of the period to 2027.

[Visit Radio World’s News and Business Page]

“Radio station owners are continuing to invest in streaming, podcast and digital marketing initiatives, with digital revenues expected to rise to $1.73 billion by the end of 2027. Off-air is forecast to grow 4% in 2022 and 3% in 2023 with the return of live events and should remain a solid segment for the radio industry long-term, reaching $2.42 billion by the end of 2027.”

It said radio’s lower ad cost, local audience and relatively high ROI will keep it relevant. But total radio revenue is expected to be mostly flat for the five-year period.

The report also listed the fastest-growing markets for radio revenue in the next five years as Dallas/Fort Worth; Seattle/Tacoma; Boise, Idaho; Salt Lake City-Ogden-Provo, Utah; and Atlanta.

The chart below is from the report.