MALVERN, Pa. — Radiate Media executives believe the traffic reporting service now has the pieces in place to challenge market leader Total Traffic Network.

Radiate, which provides on-air traffic reports for radio stations in the United States, recently entered an agreement to be acquired by Global Traffic Network, a company that supplies traffic update services to Canada, Australia, the UK and Brazil.

The companies describe the next step in the sale process as the “due diligence” phase. The sale is expected to close soon. A final sale price has not been disclosed.

Radiate’s TruTraffic system delivers on-air traffic reports to some 1,000 radio stations in approximately 160 markets in the United States, according to its website. It is the exclusive provider of traffic info for all Cumulus Media radio stations. Radiate says it controls 25 percent of revenue generated by traffic reporting services in this country.

The other major player in the market is iHeartMedia’s Total Traffic Network. It provides traffic information to iHeartMedia radio stations and numerous U.S. stations not owned by iHeartMedia.

Radiate, which also provides visual traffic maps for radio station websites and mobile applications, is privately held and does not release financial results. Its lead investor is Level Equity, a New York-based growth equity firm, according to company officials.

President Ivan Shulman at the NAB Show.“POISED FOR GROWTH”

Ivan Shulman, president of Radiate Media, said the agreement with GTN provides Radiate with the financing to aggressively seek affiliates.

“This is not consolidation. This is growth. GTN wants to be the largest traffic provider in the world. By adding a U.S. component to their other countries, GTN believes we are ready to grow. This gives Radiate a much larger footprint in the global marketplace,” he said.

Shulman sees major changes coming to the traffic space for broadcasters in the United States and abroad.

“Radio broadcasters will now have a viable and well-funded competitor to Total Traffic Network. Broadcasters won’t be stuck giving away their inventory to a competitor.

“We are poised for growth. We haven’t grown a lot the past few years; some of that was due to product development and making sure our content was the best. And quite frankly, we had some bad deals with affiliates that we had to get out from under,” Shulman said.

Contacted by Radio World for this story, an iHeart spokesperson said the company does not comment on its competition. She said Total Traffic & Weather Network provides services to some 2,000 radio affiliates in approximately 200 markets. “TTWN operates the largest traffic data gathering network, staffed with over 800 local traffic reporters, in the United States, Canada and Mexico.”

Radiate’s history dates to 1998, when current CEO Chris Rothey founded Traffic.com. That company was acquired in 2007 by NAVTEQ, part of the Nokia family, and later known as NAVTEQ Media Solutions. NAVTEQ is a geographic information system provider of electronic navigable maps. In 2011, Nokia sold NAVTEQ Media Solutions to Matchbin, a CMS solutions company that hosted websites for radio and television stations. The newly consolidated company was renamed Radiate Media.

The company is headquartered in Malvern, Pa., with sales offices in four major U.S. cities. Radiate has approximately 290 full- and part-time employees.

GTN expects to close the purchase of Radiate this summer. GTN was co-founded by Bill Yde and Dale Arfman in 1997. In 2011, the company was acquired by GTCR LLC, a private equity firm based in Chicago.

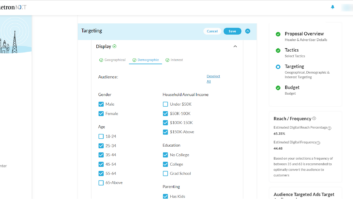

An image from Radiate Media partner WPVI(TV), an ABC-owned station in Philadelphia, depicts a skyline view with overlay traffic data from Here (formerly Nokia) and Radiate Media Traffic Operations. The company offers 2D/3D satellite map views with incident and speed overlays, travel times, traffic cameras and weather info from AccuWeather.DATA-DRIVEN

TruTraffic Radio on-air traffic reports are filed from a series of operations hubs across the country, Shulman said. Each traffic report contains a 15-second commercial slot controlled by Radiate. Most of the company’s agreements with radio station clients are straight barter.

“We work out individual arrangements with stations. We generally sell the inventory and pick up the costs. Then we either work on a revenue share model with the broadcaster or a straight comp model,” Shulman said.

TruTraffic Radio uses Radiate Media’s traffic incident, travel time and map data technology, Shulman said, most of it aggregated through resources provided by Nokia, Shulman said. Radiate has exclusive rights to use Nokia’s speed and flow data, which consists of cameras, traffic sensors, GPS data and other sources.

Shulman described TruTraffic as a “white label” traffic service that radio stations can brand any way they wish. “It’s our reporters who deliver the traffic report but the radio station generally identifies the traffic as their own content. We want it to look like each radio station has the resources to gather all this data and disseminate it. Our reporters become personalities on the radio stations. The report is delivered with our sponsor’s message,” Shulman said.

Radiate has several major operations centers plus numerous smaller ones where reporters are positioned. “Many of our traffic reporters work from their own home studios,” Shulman said.

Its audio distribution technology has evolved over the years from dry-pair 8K analog lines to ISDN and private digital audio circuits to standardized configuration of audio over IP, according to Radiate’s technical staff.

Radiate utilizes a number of codecs but its preferred device is the Telos Z/IP One. “We’ve got quite a few of these installed at our operations centers and also at work-from-home reporters. We prefer using audio over IP as it gives us the capability of quickly providing service to clients, on-demand, and then connecting to other clients for subsequent reports in a way similar to ISDN dial-up,” Shulman said. “That flexibility is now available without any kind of routing hardware that was needed in the past.”

Radiate uses generic, wired, internet connectivity to make the link, although it has cellular 4G LTE fallback, just in case, Shulman said.

In addition, a lot of the audio is loaded to FTP sites, which can be accessed by clients with automated operations. Radiate can also package audio into an MP3 file and email it to a client.

Radiate traffic reporters typically use Electro-Voice RE20s, although some clients prefer the sound of their standardized mics, which they will provide, Shulman said. “The mics are then connected into a small USB-capable mixer, which allows a reporter to record and edit on their computer workstation.”

Collection of traffic data has been revolutionized, Shulman said, with the familiar “eye in the sky” no longer needed.

“Traffic data reporting today is very technology driven. We rely on data from about a hundred sources, including road sensors, GPS data, traffic cameras and official accident and incident reports,” Shulman said. “Some of our ops centers have walls of monitors that could rival NASA.”

Mobile applications have been a growing focus for Radiate, which announced partnerships in 2015 that it hopes will help drive new traffic audio platforms. The company is joining with the Shout to Me messaging platform to develop crowdsourced geo-audio traffic products. An agreement with Rivet Radio will allow it to deliver on-demand audio traffic reports via the app on iOS and Android devices.

“It’s all about getting our traffic reports on as many products as possible. That’s on-demand, geo-based traffic information as people need. Services like Shout to Me need content and we can provide that. It also provides us with additional commercial inventory,” Shulman said.

Radiate also has a strategic partnership with AccuWeather to develop traffic and weather graphics for broadcast media, mostly for the TruTraffic TV platform, Shulman said.

Once the sale to GTN is complete, Shulman said Radiate plans to pursue additional radio stations in the marketplace aggressively.

“In order to grow, we need access to more capital. GTN has always wanted to enter the U.S. market and this was a chance to move in with a ready-made operation in place that is functioning and profitable,” he said. “Radiate will be better funded and an option to Total Traffic Network. We know we won’t get the iHeartMedia stations, since they own Total Traffic, but we will be going after all their other affiliates.”

Shulman said the breakdown of the revenue in the radio traffic reporting industry, according to their data, has Total Traffic at 70 percent market share, Radiate at approximately 25 percent and another 5 percent coming from independent producers.

“Total Traffic Network does CBS Radio traffic, but the rest of the major groups are split fairly evenly. We have Emmis in some cities, Cox in others and Hubbard in some others. It’s really a city-by-city decision by many broadcasters. We want to grab more market share,” Shulman said.

Radiate, which has a range of national and regional advertisers, does not have an automated sales process yet, “but programmatic ad inventory will come one day, I’m just not sure when,” Shulman said.