What technologies will make your station money? What business models will succeed at bringing in revenue for radio broadcasters?

These are questions managers ask themselves often. Equipment manufacturer Wheatstone has taken a crack at answering in a paper titled “Revenue-Generating Radio Technologies: A Progress Report,” done with market research firm Alethea Research.

“While it is hard to predict which of the radio industry’s newest business models will succeed in generating new revenues, we can better anticipate the winners by measuring how fast the technologies that enable them are being adopted,” the company states; so it surveyed radio professionals involved in technology management, including engineers and operations and other technical management.

Wheatstone and Alethea found that almost all radio tech people believe the Internet will play a bigger part in the future of radio, and that among new revenue-generating technologies, streaming a station’s signal has the biggest earning potential (see graphic).

Further, “The day will come slowly, but in 15 years a majority of radio stations expect they will have more online listeners than RF listeners.” Despite that expected long-term decline in over-the-air listeners, however, the study found that few radio stations expect to ever turn off their transmitters.

Also, technologies that require little or no capital investment are being deployed at similar frequencies by standalone and group-owned stations. However, “A technology gap is emerging as standalone stations deploy revenue-generating technologies requiring investment at only half the frequency as group-owned stations. … These numbers should be alarming to anyone at a standalone station looking to compete for revenue in the future. Group-owned stations seem better able to finance the deployment of new revenue-generating technologies — at about twice the rate of their standalone competitors.”

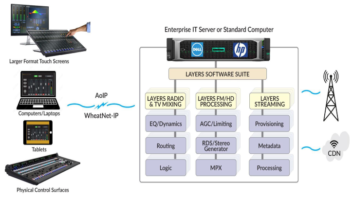

Other findings: Radio station technology will be more IT-centric than ever, “with more automation, as well as more networking between stations, IT networks, and office and audio networks. Three years from now, the stability of each radio station network will be more important, as will networks with no single point of failure.” More audio consoles will be networked, and the bandwidth of those networks will be required to increase.

The authors also asked about audio over IP networks. “The top reason group-owned stations bought an AoIP network was to reduce maintenance costs,” they found, while the top reason for standalone stations was to share talent. Further, at stations that have installed an AoIP network, more than a third of standalone stations found installing it harder than anticipated, while only 16.7% of group-owned stations found installation harder than anticipated. And at stations with an AoIP network, more than one in four standalone stations and one in three group-owned stations report latency problems.

The authors think their findings will be beneficial: “If you want to know where the technologies that are driving radio’s new business models is going, there is no better way to find out than viewing it through the collective opinions and actions of radio’s technical managers.”

More:

“Mobile Apps Are Popular Choice”