WASHINGTON�The broadcast incentive auction is officially under way, starting with television broadcasters making their initial bid commitments by end of day March 29. The FCC will use these commitments to begin the reverse auction aspect of the proceedings, and the reverse auction will determine the price at which broadcasters will voluntarily relinquish their spectrum usage rights in the 600 MHz band.

Television broadcasters interested in giving up some of their current spectrum holdings in the 600 MHz band had until Jan. 12 to file an application with the FCC. The National Association of Broadcasters indicated �robust� participation from television broadcasters, and 2,166 of the country�s approximately 8,500 TV stations are eligible to participate.Still, there’s some concern expressed that not enough stations planned to participate in the auction; only one in ten broadcasters expressed an interest in selling its spectrum in discussions in advance of the auction, reportsUSAtoday.com.

�

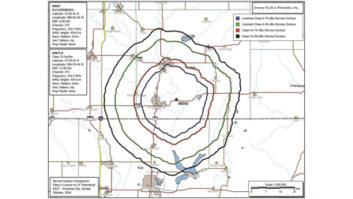

It�s important to note that TV broadcasters have the choice of moving to a lower-frequency�channel; or, sharing�the bandwidth of a neighboring station; or giving up broadcasting altogether. As the FCC reorganizes spectrum allocations after the auction, some TV channels may need to be reassigned during the 39-month transition period. Any reassignment requires that the FCC�preserve a station�s current audience and geographical reach.

�

The reverse auction process is expected to take anywhere from three weeks to two months, at which point the FCC will take a break in the proceedings to �repackage� the spectrum offered up by the broadcasters into chunks that can be used by commercial cellular providers. Analysts predict the FCC could have between 80 MHz and 110MHz of spectrum available for the auction�s more conventional forward auction process, according torcrwireless.com.� No one company is expected to emerge with significant spectrum from the auction, yetAT&T is expected to spend at least $10 billion on the auction; Verizon, between $8 billion and $10 billion, and T-Mobile between $6 billion and $10 billion.�Google has already said it won�t participate; tier-two and tier-three carriers like U.S. Cellular, C-Spire and Cellcom will�likely be selective in their bidding approach, targeting licenses in areas they currently serve.�

�

�