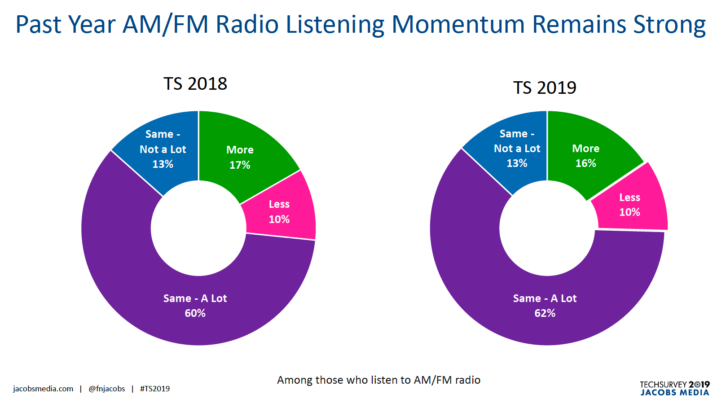

Jacobs Media has unpacked the results of its 15th annual Techsurvey, and the outcomes could be described as mixed for broadcast radio.

Essentially, the medium remains strong, yet digital competitors are making inroads with listeners — confirming some broadcasters’ fears while, maybe, also offering a new way forward for radio stations.

Note that Jacobs Media polls commercial radio listeners in the U.S. and Canada for its Techsurvey, so the results should be read as measuring behavior among current radio listeners and not necessarily all consumers. Results were also collected online, which could favor those who are at least somewhat tech savvy.

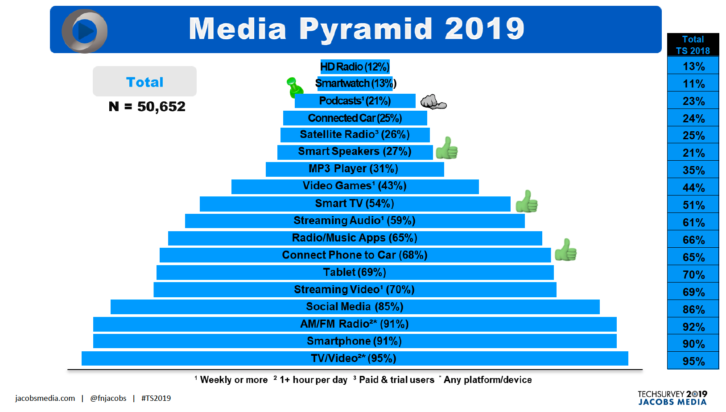

The 2019 Media Media Pyramid shows that 95% of the 50,652 radio listeners surveyed indicated they watched TV/video content for at least one hour per day, followed by smartphone usage and AM/FM radio listening, both at 91%.

[Infinite Dial: Podcast Listening Now a Majority Behavior]

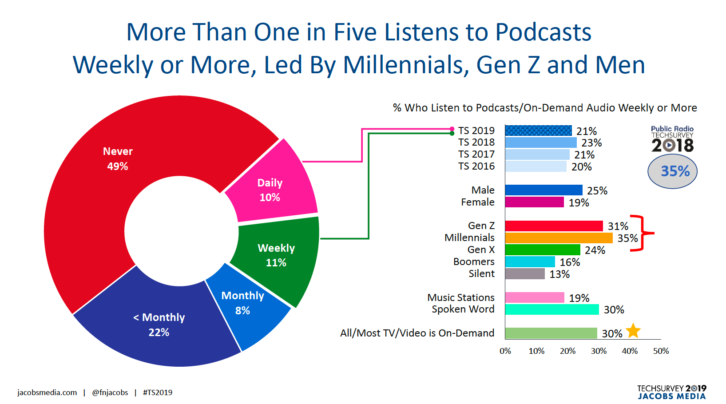

Only 65% of respondents indicated they use radio and music apps with that kind of regularity — but that number is much higher than the one-in-four who said they tune into satellite radio often. Time spent listening to smart speakers came in at 27%. Weekly podcast listening was reported by one-in-five respondents, and HD Radio was only cited by one out of every 10.

AM/FM radio’s brand usage remains extremely high at 91% (again, perhaps not surprisingly when polling a group of radio listeners). But Pandora is not faring so well, sliding to 20% from last year’s 25%. At 17%, iHeartRadio is basically flat and lagging far behind the 42% of respondents who say they weekly tune to their home station’s stream. However, iHeart continues to beat Spotify (12%) and TuneIn (6%).

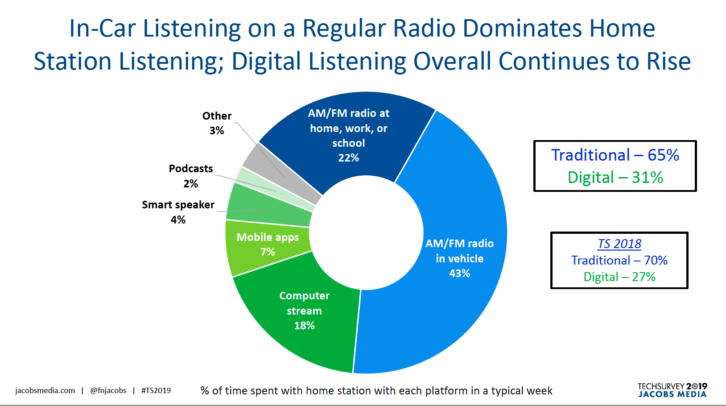

What is broadcast radio’s enduring appeal in the world of audio? According to the survey, radio’s very low price tag and ease of use are major factors for listeners — another reason for radio to fight for a prominent, accessible place in the connected car, since traditional radio receivers are becoming less commonplace in many homes.

What is broadcast radio’s enduring appeal in the world of audio? According to the survey, radio’s very low price tag and ease of use are major factors for listeners — another reason for radio to fight for a prominent, accessible place in the connected car, since traditional radio receivers are becoming less commonplace in many homes.

In fact, 65% of radio listening is done via what Jacobs Media called “regular radios,” but that drops a bit among Millennial respondents. As radios are on the decline, smart speakers continue their precipitous ascent. Smart speakers are now in the homes of one-third of respondents, up from 11% in 2017, and smart speaker owners are likely to own more than one such device, which further solidifies their ubiquity.

[Pandora Leads Audio Brand Awareness and Use]

Localism is another quality cited by about nine-in-ten as a primary advantage for radio. Despite industry concerns that radio is increasingly homogenized, this number is actually way up from three years ago.

While the number of podcast listeners remains relatively small — and slightly down from last year — the time spent listening to podcasts is increasing for this segment of the population. In fact, 40% reported that they are listening to more podcasts/on-demand audio content this year than they did in 2018. Podcasts also continued to be most popular among Millennial males, compared to other demographics.

Review the full report online or sign up for the “10 Key Takeaways from Techsurvey 2019” webinar, scheduled for April 15.