Using data compiled by Nielsen, Maru/Blue and Edison Research, this week, Cumulus Media released a report “disproving eight of the biggest perceptions brands hold about AM/FM radio.”

When referring to AM/FM listening habits, Cumulus says the realities of consumer media behaviors are drastically different than brands’ perceptions of radio’s shared influence.

Mirroring the recently released 8 Misconceptions Brands Have About Radio from Canada’s Radio Connects, here are the highlights from Cumulus Media | Westwood One’s Perception vs. Reality: Eight Things Brands Have Completely Wrong About AM/FM Radio report.

Perception #1: “Due to the pandemic, no one is listening to AM/FM radio.”

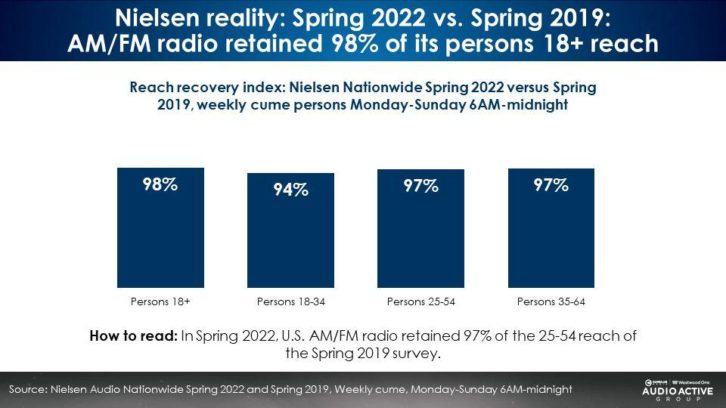

According to the latest Nielsen Spring 2022 Nationwide Report, AM/FM radio has maintained a consistent and steady reach among American adults, retaining 98% of its persons 18+ reach as compared to the spring 2019 survey. Nielsen’s Nationwide study aggregates total American AM/FM radio listening from all 253 Nielsen local markets and all U.S. DMA markets.

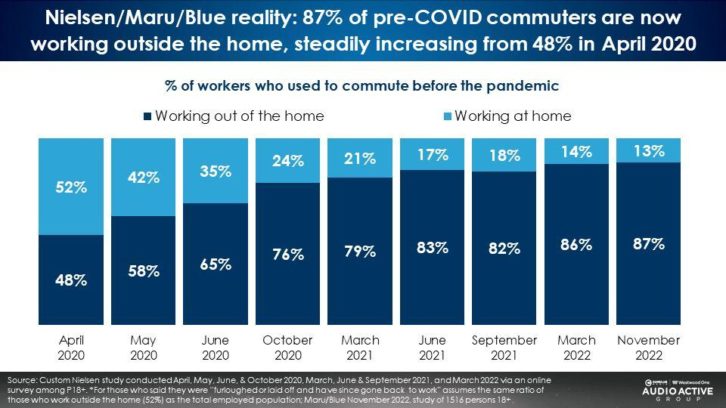

Perception #2: “Due to the pandemic, everyone’s working at home and no one is commuting.”

Cumulus says, according to a November 2022 Maru/Blue study, most of pre-COVID commuters are now working outside the home (87%). This is compared to only 48% of pre-COVID commuters who were working outside the home in April 2020, according to a custom Nielsen study.

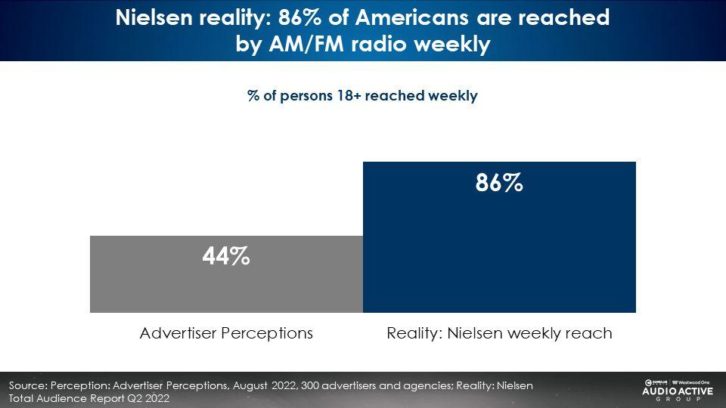

Perception #3: “AM/FM radio has very low reach.”

An August 2022 study by Advertiser Perceptions found marketers and agencies believe AM/FM radio’s weekly reach is 44%. Cumulus says that is “a massive miss” as 86% of all Americans are reached by AM/FM radio on a weekly basis, according to Nielsen’s Q2 2022 Total Audience Report.

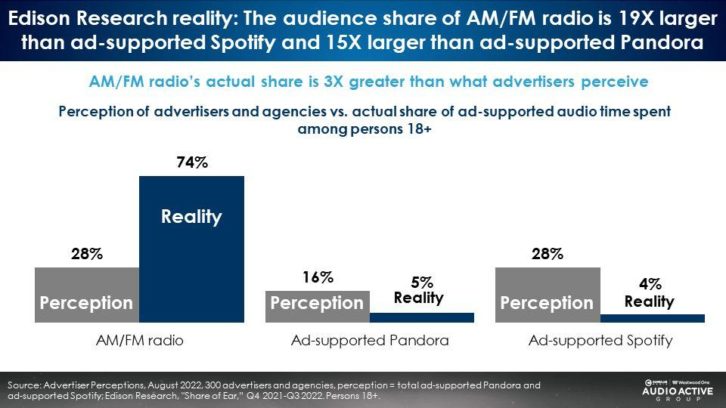

Perception #4: “Audience shares to Pandora/Spotify are nearly equal to AM/FM radio.”

Edison Research reports AM/FM radio is nineteen times larger than ad-supported Spotify and fifteen times that of ad-supported Pandora. Marketers and agencies told Advertiser Perceptions they feel audience shares of AM/FM radio are pretty similar to Pandora and Spotify. “The buzz is wrong,” says Cumulus. “The share of time spent listening to AM/FM radio dominates the two streaming audio services.”

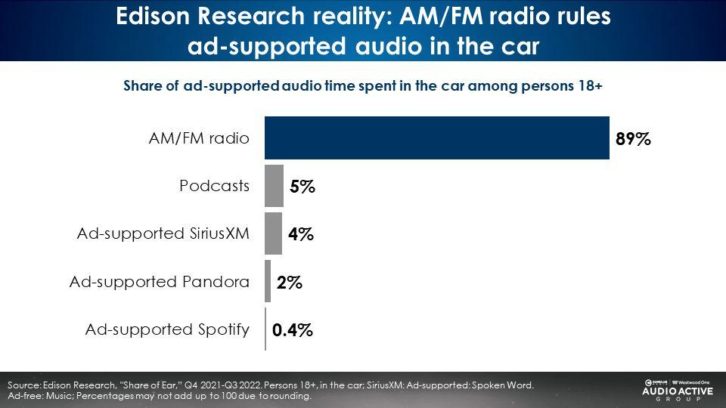

Perception #5: “In the world of the connected car, the number one thing people do in their vehicles is stream online radio on their smartphones.”

AM/FM radio still rules the road. Among ad-supported audio, AM/FM radio has a dominating 89% share of in-car time spent, according to Edison Research’s “Share of Ear” report.

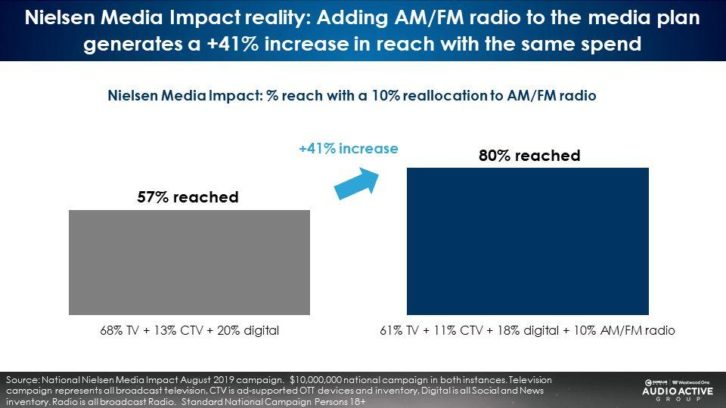

Perception #6: “Today’s optimal media plan: Put all of your money into TV and digital.”

Adding AM/FM radio to the TV and digital plan generates incremental reach for the same spend, says Cumulus. While TV and digital are mass reach media that will deliver audiences, AM/FM radio is a powerful tool for marketers and agencies.

To illustrate, below is a case study with two approaches analyzed by Nielsen Media Impact, the media planning and optimization platform. The media plan on the left represents a typical mix of 68% linear TV, 20% digital and 13% connected TV. That plan achieves a 57% reach.

The media plan on the right, with the exact same budget, keeps linear TV, digital, and connected TV in the plan and allocates 10% of spend to AM/FM radio. This plan generates an astounding 80% reach. The same budget yields much bigger reach. Putting AM/FM radio into the plan at a modest 10% allocation lifts reach by +41%.

Perception #7: “I would love to consider audio. However, there’s a total lack of ROI and sales lift evidence for AM/FM radio.”

Since 2013, Nielsen has conducted over a dozen return on investment studies across a variety of consumer categories that prove that AM/FM radio generates significant positive return on advertising spend.

Cumulus says Nielsen has found time and time again that AM/FM radio delivers impressive ROI. For example, for every $1 invested in an auto aftermarket AM/FM radio campaign, there is a $21 sales return. The Nielsen ROI data below showcases AM/FM radio’s proven track record as a sales driver.

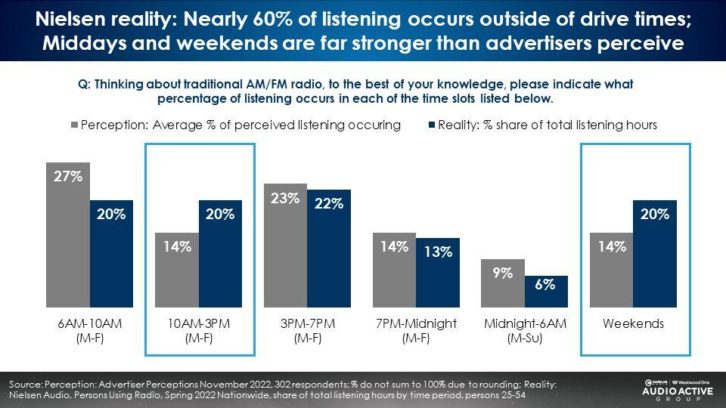

Perception #8: “AM/FM radio listening only happens during drive times.”

Dats shows that nearly 60% of total American AM/FM radio listening occurs outside of drive times. Many Americans listen to AM/FM radio during middays and weekends.

When thinking about AM/FM radio, Advertiser Perceptions reports marketers and agencies believe 27% of listening occurs during weekday morning drive, 6 a.m.–10 a.m., followed by Monday-Friday afternoon drive, 3 p.m.–7 p.m., at 23%. Middays, 10 a.m.–3 p.m., were third at 14%, narrowly inching out nighttime and weekends.