Radio World is tracking how domestic and international tariffs are affecting the broadcast industry and its equipment suppliers. Technology equipment buyers and manufacturers, send us an email at [email protected] to share your own story.

Economic uncertainty casts a long shadow, not just on manufacturers’ bottom lines, but also on the strategic decisions behind projects like studio renovations.

Inrush Broadcast Services operates solely within the U.S. and currently has no international presence. But customer hesitance has a trickle-down effect.

Founder Mike Dorris told Radio World he has closely monitored President Trump’s announcement of tariff impositions on April 2 and the dizzying developments since. There was a pause on import duties a week after the original “Liberation Day” announcement, which caused plummeting stocks to skyrocket. More recently, China’s impositions were delayed for 90 days. And there’s been all sorts of speculation in-between.

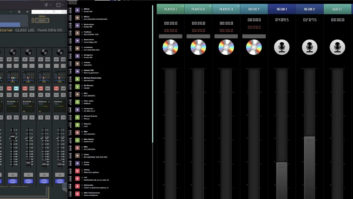

Inrush quotes a variety of projects, from studio designs and buildouts to transmission site design and remote control. Understanding the needs and concerns of existing clients is essential. Business is currently stable; he reports no pullback in planned rollouts.

[Related: “Workflows Demand a Cohesive Design Approach”]

“At the moment, it’s kind of just a cloud hanging over our planning,” he said.

What’s the long-range outlook?

The forecast for these economic storms seems to change daily. Some argue that it is all unnecessary doom and gloom.

The May 12 announcement that the U.S. and China agreed to lower most tariffs to 30% for 90 days calmed some nerves. Yet, effects have already been felt — according to the U.S. Census Bureau, Chinese imports to the U.S. dropped in March to their lowest levels since the COVID-19 pandemic.

Dorris noted that every part, material and component Inrush uses or recommends to clients is potentially affected by the discussed tariffs.

“Nearly every product will face some cost increases, or require the manufacturer to absorb the costs,” he said.

PCBs a focal-point

Like most technology products, the majority of items used by Inrush and other broadcast suppliers are designed, produced or sourced outside the U.S. This is particularly true for raw printed circuit boards. PCBs are found in most applications that require RF transmission.

According to EMSNow, a publication covering the electronics manufacturing industry, even the temporarily reduced Chinese tariffs are causing significant cost increases for many PCBs, with some seeing up to a 100% rise due to multiple import duties. Even two- and four-layer rigid PCBs, which had been exempt from Section 301 tariffs, are subject to the reciprocal tariff.

I-Connect007, a website covering the electronics industry, reports that China accounts for approximately 50% of the global PCB production market.

“Right now, we haven’t felt the wave of changes yet, but it’s clear that it is coming,” Dorris said.

He said that the big questions concern if price increases will come from both traditional broadcast vendors and vendors who source interconnectivity components, such as CAT6 cable, connectors and cable management tools.

Dorris has heard anecdotal reports from manufacturers, but so far these remain unconfirmed. “We haven’t experienced any material or equipment shortages, but this is something we are closely monitoring,” he said.

The resilience of manufacturers varies. While some, like Wheatstone we profiled, say they are well-positioned with ample inventory domestically, others may struggle to avoid price increases if their stockpiles are insufficient.

Estimating costs for new projects has become more complex. Dorris said that the company is factoring in buffers in its pricing due to the uncertainty.

“It’s more a concern of the fear of the unknown,” he said.