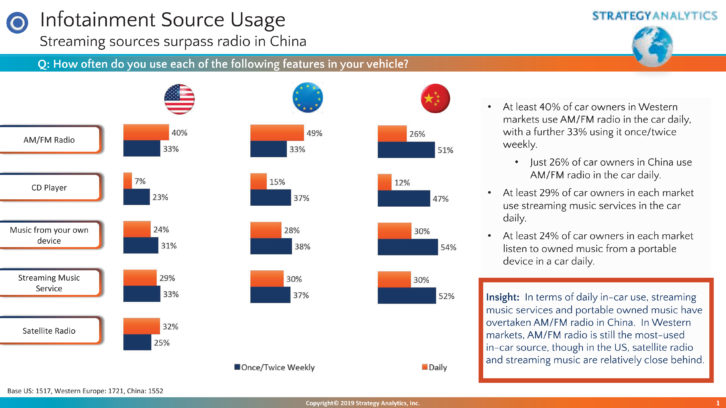

The in-vehicle user experience group at consulting firm Strategy Analytics recently surveyed consumers in six major countries about their use of audio infotainment sources in the car. Among its headlines was that “radio usage is in fast decline across the U.S., Europe and China, even though in the West it still remains important for some key consumer segments.”

Radio World invited Roger Lanctot, the company’s associate director in the Global Automotive Practice, to comment about that conclusion, other results of the study and their implications for the radio industry.

The ongoing and intensifying struggle for control of in-vehicle dashboard displays between projected smartphone content and embedded terrestrial radio sources (and satellite, in the U.S.) has taken on an East vs. West tinge with a demographic edge.

U.S. and E.U. listeners continue to support broadcast radio sources, while drivers in China are shifting en masse to smartphone-based listening of streaming or owned content while driving.

At stake is determining what the dominant source of content in the car will be over the long term and, eventually, in automated or shared transportation scenarios. Surveying consumers across the U.S., U.K., France, Germany, Italy and China, Strategy Analytics found that after several years of explosive interest, consumer appetite for smartphone mirroring systems has finally levelled off.

As more mirroring systems come to market in high-volume cars, and more non-early-adopting segments are exposed to them, their limitations are becoming apparent. Despite this, most embedded systems still do not provide better user experiences than these mirrored systems, according to Strategy Analytics researchers.

FINDINGS

The key findings of the Strategy Analytics study include:

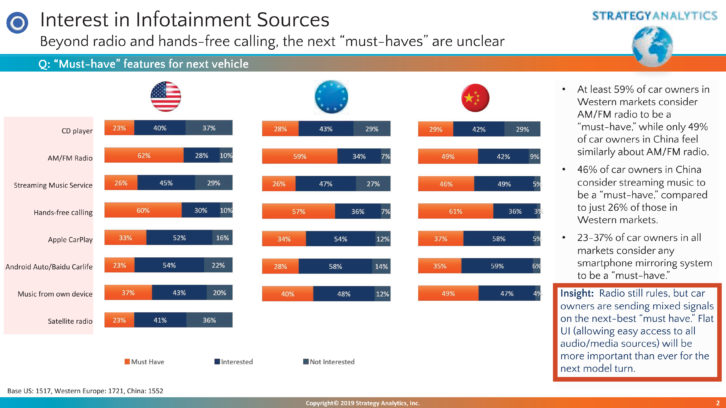

- Radio usage is in fast decline across the U.S., Europe and China, even though in the West it still remains important for some key consumer segments;

- Car owners are sending mixed signals on the next-best “must have” after radio. Flat user interfaces that allow easy access to all audio/media sources will be more important than ever for the next model turn;

- In the search for a successor to the CD player, streaming media has shown a remarkable surge in usage and interest, relative to owned media on portable devices;

- Not surprisingly, older demographic segments continue to lean toward broadcast radio content, while younger populations prefer streaming or owned media.

The reason this matters so much to broadcasters and carmakers is the reality that as much as 50% of radio listening today occurs in cars. Understanding the in-car experience of radio listening or, rather, all listening is essential to understanding how consumers are interacting with content sources in an increasingly connected world.

Google with its Android Auto smartphone streaming platform for use in cars and Apple’s CarPlay are seeing rapid uptake in the market with availability rapidly approaching saturation in the U.S. and E.U.

While this is occurring, digital radio is seeing its own robust rollout in the U.S. and a long overdue uptake — country by country — in Europe. Combining all of these trends means that carmakers have their work cut out for them facilitating access to new content sources with little or no historic guidance in the distraction-laden automotive environment.

[A Peek at Tomorrow’s Car Radios]

The confrontation between broadcast, streaming and brought in content comes down to a user interface exercise involving software, operating systems and a substantial toolkit including steering wheel controls, hardware controllers, touch screens, gesture recognition, speech recognition, drop-down menus and digital assistants. Each interface has its strengths for particular applications, which must be correlated to consumer preferences, which vary.

Apple and Google have taken strong stances in seeking to create uniform in-vehicle experiences across the displays of different carmakers. In fact, both companies now have certification control over how their systems are deployed and displayed in cars.

It is almost comical to note that Apple recently shifted its UX toward a more flexible display capable of simultaneously showing navigation and content sources — more along the lines of Android Auto’s look and feel. In the process, Apple signaled its intention to move away from on-screen icons — oriented toward touchscreen use.

Google, meanwhile, cast aside its dynamic Google Now-style interface in favor of a more “old-style” Apple CarPlay icons-on-screen look.

The clear message for carmakers is that both Google and Apple are themselves groping for the ideal user interface.

TURNING POINT

For carmakers and broadcasters, the onset of digital radio (HD Radio in the U.S. and DAB in Europe) marks an important turning point and an opportunity to redefine the radio experience. European broadcasters are introducing listeners to narrowband content as DAB enables an expanded assortment of broadcast channels. U.S. broadcasters, too, are expanding their broadcast portfolio.

But digital radio enables an additional range of capabilities suited to the new connected listening environment presented by automobiles. Digital radio comes with more metadata identifying stations and artists and enabling search for the first time.

The onset of digital radio has also opened the door to hybrid radio experiences capable of switching between streaming and broadcast sources for the same station. Digital radio also comes with a healthy dose of driving information encompassing everything from traffic and weather to local gas prices.

The key to unlocking the value of digital radio — which is intended to level the playing field with streaming and satellite sources — will be the user experience in the car. Global carmakers today are tasked with determining how to use the array of existing user interfaces and on-screen cues to facilitate a re-engagement of all demographic segments with broadcast content.

The first step forward for carmakers and broadcasters will be integrating broadcast sources with mirrored smartphone systems and digital assistants, such as Alexa. The next step will be to refine the built-in radio interfaces to make exploring the expanding range of broadcast content easier and more fun to use.

Radio is changing, and carmakers and broadcasters must change with it.

Roger Lanctot is a connected car and mobility services expert with 30 years of technology research and consulting background. He is a frequent blogger at www.linkedin.com/in/rogerclanctot/detail/recent-activity/posts/. He will speak in late August at Radiodays Asia in Kuala Lumpur, see www.radiodaysasia.com.