The author is manager of the EBU Media Intelligence Service.

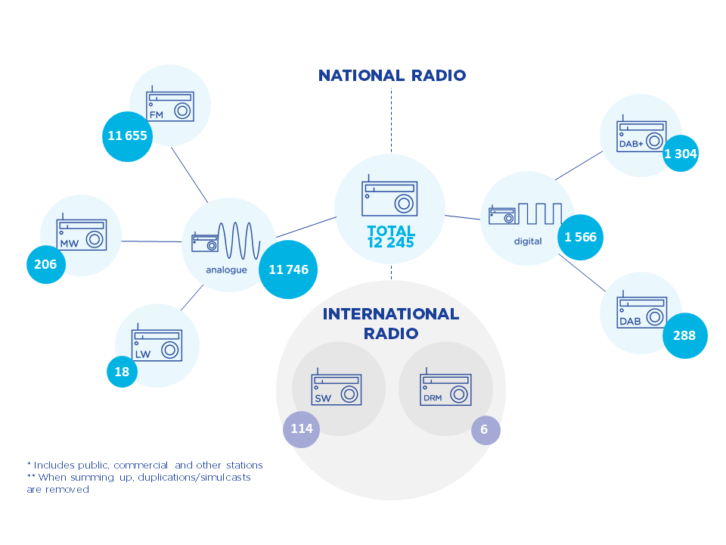

GENEVA — At the beginning of this year it was possible to tune into more than 12,000 radio stations across the 56 countries (plus Liechtenstein) where the European Broadcasting Union has members. More than 95% of those stations broadcast an analog signal, mostly FM, which continues to be the main distribution channel for radio.

Norway may have switched off its nationwide FM transmission, but some countries are actually expanding their FM networks, most recently Ukraine and soon Belgium.

Thanks to its universality, its popularity with listeners and its massive receiver installed base, FM will remain the main distribution network for radio broadcasting in the foreseeable future.

Thanks to its universality, its popularity with listeners and its massive receiver installed base, FM will remain the main distribution network for radio broadcasting in the foreseeable future.

For other analog networks, such as long- and medium-wave, it is a different story. Both are falling into disuse. At the start of 2019, barely 18 longwave services remained, scattered across 13 countries, while 206 medium-wave services were on air in 39 markets. One-third of those markets only had one station available and thus risk joining the 18 countries that no longer have medium-wave transmissions. Both long- and medium-wave are hampered by the lack of tuners in new radio devices and the high costs involved in running infrastructure for what is a decreasing, aging audience.

DIGITAL IS HERE

Many of the costs saved from the phase-out of analog networks are currently being funnelled into digital transmission. Digital is already the main means for listening to radio in Norway, Switzerland and the United Kingdom. In each of these markets, terrestrial is the backbone of digital distribution.

Digital terrestrial radio (mostly DAB+) is gaining ground, with more than 1,500 services in operation across 32 markets in the EBU area. These stations have the following characteristics:

- Two-thirds are commercial services; public stations represent just one-quarter of the offer

- Most digital stations target local areas, but regional services are the ones growing the fastest

- One-third of those stations are exclusive services; the rest are simulcasts of an existing analog channel

- Music is the main genre, representing 63% of the stations broadcast, while stations targeting minorities and religious groups are increasing the quickest

- 80% of digital stations use DAB+, while the original DAB standard continues to be phased out: it is currently used in only in five countries

WHAT ABOUT THE INTERNET?

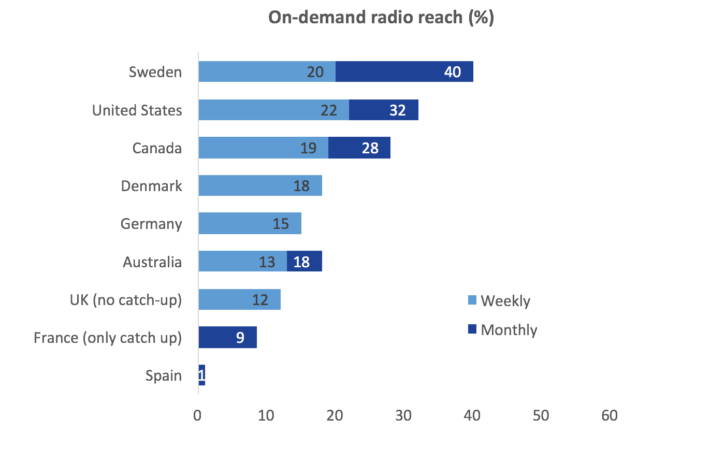

Broadcasters and new entrants alike are investing in online audio, based more on its potential than on its reality. At the EBU, we estimate that online radio consumption represents around 10% of total radio listening, which is 90% broadcast. Online is making steady inroads but the original baseline was very low.

Online listening to linear services, both simulcasts and exclusive channels, does not seem to be growing quite as briskly as on-demand audio. The buzz surrounding podcasts might make this phenomenon look like a runaway success. Closer to the truth, the podcast market is growing at a firm rate but represents only a fraction of radio-listening time. Nevertheless, on-demand allows broadcasters to reach listeners who do not tune in to linear streams, notably target groups such as young people. Beyond the hard numbers, which are not all that impressive for the time being, the incremental reach afforded by on-demand listening is one of the main reasons why broadcasters are embracing it.

THIRD-PARTY PLATFORMS

THIRD-PARTY PLATFORMS

Radio gives broadcasters a direct relationship with audiences. This differs from online distribution. In addition to broadcasters’ own platforms, external platforms (owned by third parties) are increasingly being used to reach listeners online. On the positive side, these platforms allow the audiences using them to quickly access the station they want. On the negative side, broadcasters are losing control of their relationship with listeners, since the platforms own the interface.

These platforms, growing both in number and in market dominance, have become vital for reaching the growing number of listeners who use them for radio listening, sometimes exclusively.

With sales of traditional radio sets plummeting in many European countries, devices such as smartphones and smart speakers are making radio ubiquitous. The price for this is handing some of the control to “gatekeeping” platforms, which come pre-installed on devices. In most cases, users simply stay loyal to the pre-installed player. Even if available as an alternative, they will never install a broadcaster’s proprietary app.

Examples abound. For linear radio, Amazon Echo devices use the aggregator TuneIn to deliver linear radio streams worldwide. For on-demand services, Apple pre-installs its own app as the default option for listening to podcasts on iOS devices.

[Read: Survey Says…Radio Is Still Going Strong, But Digital Is Moving Up]

The rise of these platforms is threatening the privileged direct relationship that broadcasters have with their audiences. That’s why intermediate solutions are becoming popular among broadcasters: National radio players operated jointly by broadcasters are becoming more common; and hybrid radio systems built around open standards are attracting attention, notably from car manufacturers.

THE FUTURE

The future of radio distribution looks increasingly digital and increasingly online. Above all, however, complementarity will probably be the watchword: Broadcast and online, analog and digital.

FM still has plenty of life left in it and hence promises to remain the backbone of radio distribution in most countries for many years to come. DAB+ will move increasingly toward the center of the stage, even becoming dominant in more countries. But the transition will take time.

Online distribution will become more prominent, and even predominant in reaching certain audience groups. This applies notably to on-demand consumption, which promises to gain even more ground. Online distribution will also become more dependent on third parties, thereby raising concerns and generating potential conflicts with broadcasters and producers.

The future of radio will be a more complex place but one also which is more dynamic and exciting to observe.

David Fernández Quijada is Manager of the EBU Media Intelligence Service.