Radio World’s “Guest Commentaries” section provides a platform for industry thought leaders and other readers to share their perspective on radio news, technological trends and more. If you’d like to contribute a commentary, or reply to an already published piece, send a submission to [email protected].

The author is program manager for France at WorldDAB. He has been involved in the digital audio broadcasting world as early as 2009, focusing on the automotive sector.

Radio broadcasting in France turned 100 years old in 2021. The same year, the official opening of the FM band to hundreds of community and commercial radios celebrated its 40s. 2021 also saw the launch of the national DAB+ multiplexes. And in June 2024, the 10th anniversary of the first DAB+ broadcast milestone was marked by the release of the white paper on the future of radio. The acceleration of the transformation of radio is happening. But don’t be mistaken: Radio in France has a bright digital future.

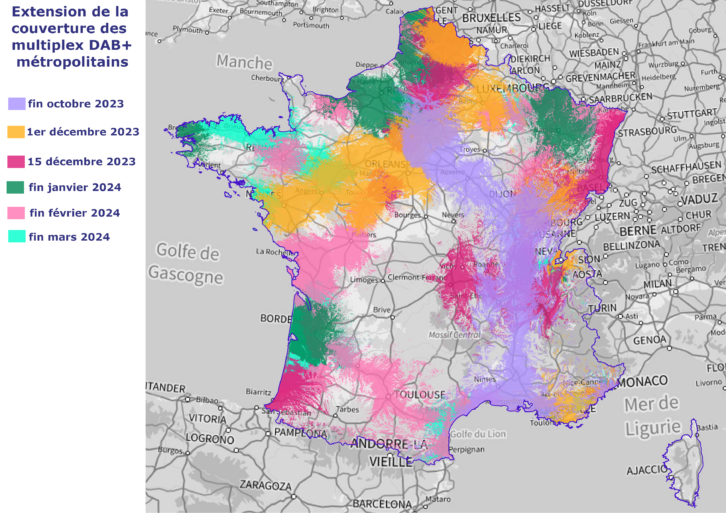

Let’s look at what we are talking about first — 40 million listeners per day. More than 900 FM radio stations, 90% being local, but a coverage far from being homogenous throughout the country. Also, 26 national DAB+ programs covering 60% of the population, and more than 100 local and regional DAB+ multiplexes and 500 services. And, of course, thousands of internet stations. Diversity and plurality are the buzz words. The sheer number of radio program choices is staggering. A radio in every house — more like 10 actually — and in every car. And new devices to listen to the most trusted medium.

Commercial challenges

This landscape would not be complete without the business model. Commercial radio stations are relying on advertisements. Although, under pressure, revenues generated from advertising represent €722m in 2023 — this is still a massive number. Advertisers remember that online is not the only way. They only need a reason to continue to invest. Community and public radio income is mostly from public grants and subsidies. But use cases are changing, competition is coming from everywhere and the industry revenue is under pressure.

The first challenge faced by radio is the proliferation of IP competition and gate keepers. A modern, digital competition was leapfrogging this long-established media industry. In France, a few years ago, IP may have also been seen as the only way to modernize the “broadcast” of radio. Radio could jump directly from FM to internet. But aggregators were only proposing certain services and making money out of it. Voice assistants and smart speakers did not present the content the listeners were expecting. Applications were blossoming in cars and the radio button was pushed away. The link with the end user was at risk of being lost, with intermediaries deciding what the end user would listen to.

The second challenge is the level playing field. Broadcasters are limited by the number of FM frequencies available. The spectrum is saturated. It is not on IP. Radio is a free media paid by subsidies and advertising. But the rules of advertising on air are specific and highly regulated (such as requirements to give legal information, number of minutes of advertising per hour). Also, “l’Exception Culturelle” mandates a quota of French songs per days for music programs. That constraint does not exist for on-demand music services. And last, radio’s competitors are global companies, with immense budgets.

The challenge therefore was to get the industry to agree on a path for a modernized broadcast radio model. After more than a year in the making, the media regulator, Arcom, published its “White Paper of the Future of Radio.” This is not just a publication by Arcom. This is the summary of what the industry professionals said will be required to “adapt the radio model to its new environment and the changes sweeping the sector.” It was born of the experience of France’s neighbors, from the real-world deployment of DAB+ and from the inputs of the industry and radio stakeholders.

DAB+ at its heart

The status quo was not an option. A road to digitization has been proposed by Arcom. DAB+ has a significant place in that strategy. A two-phase roadmap is being proposed. A preparation phase until 2027, followed by a migration phase between 2028 and 2033. The preparation phase will look at all aspects from regulatory requirements to broadcast planning, marketing of DAB+, DAB+ adoption and metrics.

Following the best-known methods coming from Norway or Belgium, to name just two, the transition to DAB+ must be managed by a dedicated body. The resources are not forgotten and will need to be reviewed. The second phase will be about the transition of the broadcast model to DAB+. Objectives are clearly set: 70% household penetration of DAB+, 50% digital listening, public support and a planning model. The FM switch-off could be in sight — prepared but not mandated. The industry will need to decide the “what” and the “when.”

The future of radio in France is not about choosing one technology over another. On the contrary, broadcast and IP offer complementary solutions. However, everybody agrees that the future of radio will be digital and multi-platform. The idea is to ensure the sustainability of the radio landscape in France — its plurality, its diversity, its place for the society, more choices and a better radio experience for the listeners with DAB+ at its heart.