This continues our coverage of the recent online WorldDAB Summit 2021.

To drive DAB+ receiver sales in Europe, the radio industry has to educate consumer and retail sales staff more effectively. How to do that and more were addressed during Session 2 of the WorldDAB Summit 2021 on Nov. 9. (Recordings of the sessions are on the WorldDAB YouTube page.)

To motivate consumers to buy DAB+ receivers, they first have to understand what DAB+ is all about. Jacqueline Bierhorst, project director with Digital Radio Netherlands, outlined how this education is being delivered in the Netherlands, Germany and Belgium in the presentation “Working With Retailers to Help Listeners Upgrade to DAB+.”

“The Netherlands has a 360-degree campaign to influence behavior and improve the actual use of DAB+,” said Bierhorst. “The campaign has been heard and seen on radio TV, through native ads and Facebook links, out of home, on the back of trucks and online video. On top of that, we have a collaboration with the five biggest Dutch retailers.” The payoff, she said, “All these efforts have resulted in a great uplift of sales [with a growth of] 271 percent.”

Meanwhile, “Digital Radio Germany is very active and a great inspiration for other countries,” she said. “The team in Germany made sure that all retail staff get guidance and new updates on DAB+ and its advantages. This makes sure that the shop seller is well-informed and can give a good explanation of DAB+ to customers.”

[Read more from Radio World about Digital Radio]

Then there’s Belgium, where this year “the first joint national DAB+ campaign was aired a two-week radio campaign aired on the main French- and Flemish-speaking stations, starting on Sept. 13 in association with the retailer Vanden Borre,” Bierhorst said. Again, both national efforts are increasing DAB+ receiver sales in their respective markets.

Similar promotional efforts in the United Kingdom were touched upon during a session about “Working With Retailers to Train and Educate Their Staff,” presented by Ford Ennals, chief executive officer of Digital Radio UK.

In the U.K., “digital radio sales are challenging,” Ennals said. To find out why, Digital Radio UK surveyed audio sales staff, most of whom were in their mid-20s.

The results: Young audio sales staff tend to view radio as being “more for older people,” said Ennals. “When they’re pressed [by customers], ‘Should I buy a smart speaker or a digital radio?’ they would advise consumers to buy a smart speaker because they see it as an easier and perhaps a more sexy sale.”

Based on this knowledge gap, Digital Radio UK spent the past six months educating sales staff about the full benefits and options provided by DAB+

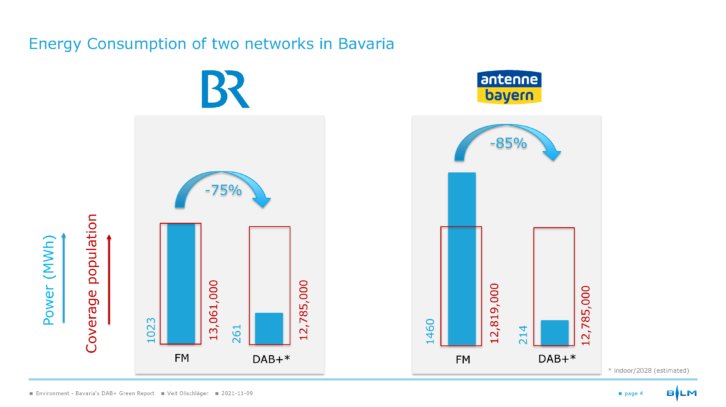

One way to sell digital radio to consumers is to outline how “green” its transmission system is compared to conventional FM broadcasting. One real-life comparison was offered during “Environment — Bavaria’s DAB+ Green Report,” which was presented by Veit Olischläger, head of technology, media management and public relations for Bayerischen Landeszentrale für neue Medien (BLM), the Bavarian public-service broadast operator.

BLM compared the FM and DAB power consumption levels, on a per-service basis, for two Bavarian broadcasters. The results were impressive: “The given FM power consumption for Bayerischer Rundfunk is around 1,000 megawatt hours per year, and on the DAB side it’s 261 megawatt hours, which results in a reduction of 75 percent,” Olischläger said.

Similar savings were seen for the private radio broadcaster Antenne Bayern. “The energy consumption on FM is higher … [while] the energy consumption on the DAB side is slightly reduced to a slightly reduced data rate,” he said. “Overall, the reduction is 85 percent for the private network.”

The final Session 2 presentation was titled “Performance — GfK Analysis.” It reported trends in consumer electronics sales.

The bare facts: “Total 2021 spending was up versus 2020,” said Max Templeman, insight director for consumer electronics at research firm GfK. Digital radio sales only showed “a small value increase,” he said. “Germany, France, Italy and Belgium increased share of total Europe DAB sales, but the Czech Republic saw the highest growth rate.”

As well, “over half of all DAB sales occurred online in quarter one this year,” said Templeman. “DAB radios over €200 still provide a healthy market share and gain importance in quarter four.”

See our coverage of WorldDAB Summit 2021 Session 1 and Session 3.