Consumers buying new cars cite radio as their No. 1 entertainment choice. That’s according to a new Edison Research survey across six countries. The survey was commissioned by WorldDAB and released during Session 3 of the WorldDAB Summit 2021 on Nov. 9. (Recordings of the sessions are on the WorldDAB YouTube page.)

WorldDAB commissioned this survey “to make sure the carmakers fully appreciate the consumer’s attitudes towards broadcast radio and broadcast digital radio in particular,” said WorldDAB President Patrick Hannon. “Our hope is that car manufacturers can use some of these insights when they’re planning their radio systems in the future, which we firmly believe need to be hybrid radio with broadcast at its heart,” said Laurence Harrison, director of automotive partnerships at Radioplayer Worldwide.

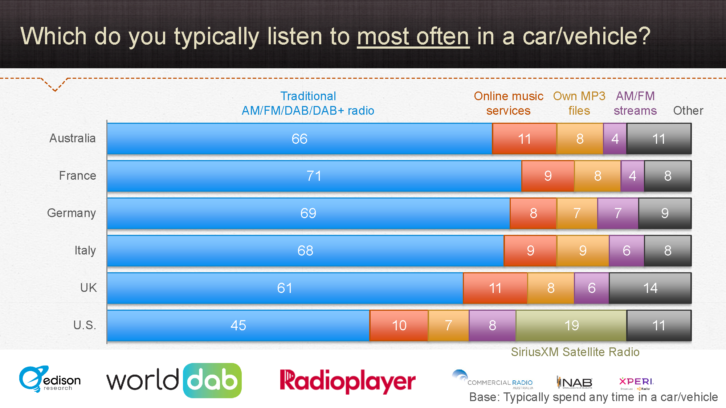

The results of the Edison Research study were detailed by Tom Webster, the company’s senior vice president. “We did a survey of at least a thousand people [per country] in France, Italy, Germany, the U.K., the U.S. and Australia,” he said. “In all six countries, we looked at people who had either just bought a new car, a 2018 or newer, or were going to buy one in the next 12 months.” Webster added that weekly radio listenership across all six countries “is well over 80 percent.”

[Read more from Radio World about Digital Radio]

The big takeaway: “In all six countries, at the top [of the list] amongst recent car buyers, radio was most often cited as the top audio source that was wanted in the vehicle,” he said. “That’s given all of the other options that are currently available …. [and] one of the key findings of the whole study is that people think that radio should be standard in a car.” Conversely, well over 80 percent of those surveyed said they would be less likely to purchase a car if it did not come with a radio in it.

“The bottom line here is that radio [in the car] is an expectation for people,” said Webster. “Radio does exactly what they want it to while they’re driving, which is to be easy to use, to be free, to be entertaining, [and] to be informative.”

Tasked with giving the carmaker’s reaction to the Edison Research, Martin Koch, head of development entertainment & car functions for Volkswagen Group’s CARIAD, said, “my personal opinion is that radio is No. 1 in the car, but seeing this in … official research … really surprises me.” Speaking to Hannon and Harrison during their “Broadcast radio in the car audio entertainment landscape” segment, Koch added that, “I’m very happy with the results.”

In his presentation on “Integrating broadcast and connectivity in the digital dash,” NXP Semiconductors Senior Product Marketing Manager Jan Bremer spelled out the “must-haves” for modern car radios. “The unified station list has to become the de facto standard,” he said. “Seamless blending of analog, digital and IP radio is a must. We have to work to enhance the radio experience with digital radio and IP services like album art, station logos, lyrics … [And] it’s important that the user experience can be personalized.”

Commercial Radio Australia CEO Joan Warner wrapped up Session 3 with a call to action aimed at radio broadcasters.

“We can’t just sit on our hands,” Warner declared during her “What broadcasters are doing to thrive in the digital era” presentation.

“We’ve got to be talking about the importance of radio and in particular broadcast radio. Radio can’t be passive passengers during the journey towards the connected car,” she said. “Find the vehicle manufacturers’ contacts in your country, and reach out to them. Spread the word about the importance of broadcast radio. Lobby your governments for further regulations to enable broadcast radio to easily be found in new and connected cars.”

See our coverage of WorldDAB Summit 2021 Session 1 and Session 2.