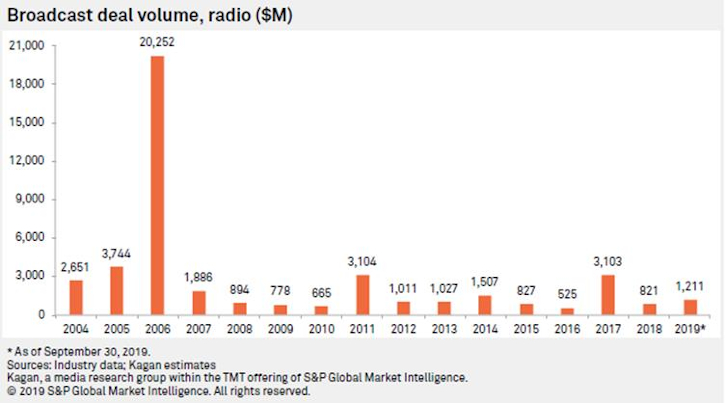

The pace of mergers and acquisitions in the U.S. broadcast industry is slow.

According to Kagan, a research group of S&P Global Market Intelligence, U.S. broadcast station M&A volume was $215.1 million in the third quarter of 2019, the lowest quarterly volume since late 2016.

“In the radio business, the largest deal of the quarter took place in New York, where Emmis Communications Corp. partnered with investment firm Standard General L.P. and founded a new public company, Mediaco Holding, which will own and operate Emmis FM stations WBLS and WQHT,” the company noted. “Standard General will pay $91.5 million in cash and a $5 million note receivable to Emmis, while Emmis will have a 23.7% minority stake in the new company.”

The second-largest radio deal was Stephens Media Group’s acquisition of Mapleton Communications, which agreed to sell its 29 FM and eight AM stations, together with a number of boosters and translators, for $21 million.

Another notable sale, done in two parts, was 12 AM stations and seven FM translators from Salem Media Group to Starboard Media Foundation, the parent company of Immaculate Heart Media, for $16.9 million.

In the TV sector, the only major deal of the quarter was the announced sale of KMBH(DT) in Harlingen, Texas, from MBTV Texas Valley LLC to Entravision Communications Corporation for $2.9 million.

[Subscribe to our newsletter and get it delivered right to your inbox.]