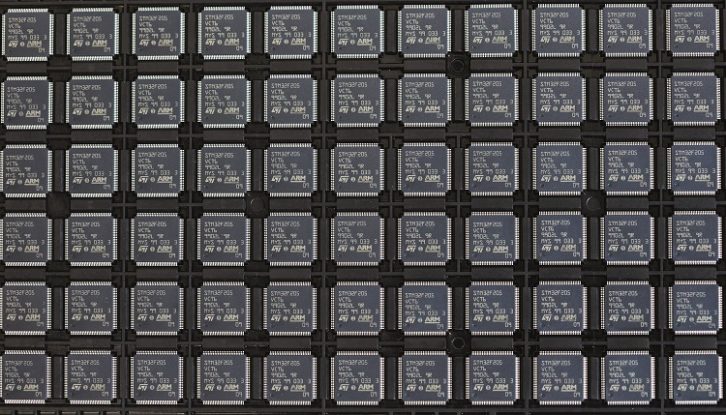

The severity of the global computer chip shortage has broadcast equipment manufacturers finding creative ways to manage supply channels while trying to meet product demand.

Despite the semiconductor shortages, people in the radio technology marketplace who spoke with Radio World say products are still being shipped, with mostly minor delays, thanks to prior planning. Equipment suppliers said they hope the semiconductor shortage will ease soon, perhaps by early 2022.

The pandemic has disrupted global supply chains for integrated circuits since early 2020, as factories closed and transportation was delayed. Surging demand for motor vehicles and other consumer electronic products, prompted in part by economic stimulus measures, have exacerbated the situation.

While some suppliers were reluctant to discuss workflow issues for this story, others confirmed that their difficulty in sourcing components has worsened in recent months. Broadcasters are primarily seeing delays on computers and computer-based audio gear, sources said, but even transmitter delivery dates are being affected in some instances.

The scarcity of chips has had an impact on HD Radio. General Motors this summer decided to exclude HD Radio on certain pickup truck models in the 2021 and 2022 model years.

HD Radio parent Xperi Corp. acknowledged there could be some “feature reductions in radios” in some cars but expressed confidence that HD Radio deployment in vehicles will continue to progress.

Global logistics

Scott Stiefel, COO of Telos Alliance, said a series of unplanned events — including fires at two chip factories in Japan — combined with the pandemic to contribute to the shortage.

“The same challenges affecting the auto, computer or household electronics industry are there for us,” he said.

“Chip shortages, end-of-life issues for low-volume components, as well as global logistics problems. But without question, the factory fires at the AKM and Renesas Fabrication facilities have impacted the electronics industry, already taxed by the COVID-related shortages. The mass buying and stockpiling over and above the normal demand have also created shortages in both supply as well as in logistics. Again not directly attributable to COVID, but a side effect of consumer behavior.”

Inovonics President/CEO Ben Barber said chips and virtually all components have been affected.

“Earlier this year we made the decision to ramp up our purchasing in order to get ahead of the delays. Making this type of investment has been expensive, but at the same time we have the raw inventory to continue to manufacture all of our product lines without being backordered,” Barber said.

Prices for chips are up. One microprocessor for which Inovonics normally pays $14 is now $60. “And lead times have also been extended in many cases to 42 weeks plus,” he said.

The shortage has affected virtually all parts including ICs, SMD parts, power supplies and even metal chassis, Barber said.

Tony Peterle, manager in the Americas for WorldCast Systems Broadcast, said the radio technology sector has been affected by the semiconductor shortage like every other area of industry.

“Broadcast equipment is certainly no exception, but thanks to all our partners all over the world we have found immediate solutions and we continue to deliver,” he said.

Peterle said most of WorldCast’s broadcast customers are thinking far enough ahead to give his company solid estimates on lead times.

“Most broadcasters are obviously aware of the component crisis and they are planning their project timelines accordingly.”

Another observer who asked not to be named said there are only a handful of companies that make the analog-to-digital and digital-to-analog components used in phones, cameras and just about anything that converts audio between analog and digital.

And of those, only two major chip makers, Cirrus Logic and AKM, produce the kind used in most pro audio and broadcast products.

To make matters more difficult, the observer continued, AKM ADC ICs pinouts are different than Cirrus Technology’s equivalent ADC/DAC ICs, which makes it impossible to substitute one for the other without some redesign.

“A year or more out”

The good news for broadcasters is that supply chain disruptions caused by the chip shortage haven’t necessarily resulted in immediate price increases for products.

“For now, we’re pricing our products based on our reserve inventories of components and materials, and re-evaluating by the month,” said Dee McVicker, a representative of Wheatstone. “We’ve been through volatile supply situations in the past — never this severe though, and one thing is always certain; things will change.”

She described lead times on important components as “insane.” Nevertheless, McVicker said, Wheatstone’s manufacturing runs haven’t been compromised.

“We do both production runs of some products and customized runs of others, and that hasn’t changed any. But since we’re our own plant, we can scale our production according to our own needs,” McVicker said.

“If we had to rely on third parties to manufacture our products, we’d probably be in a situation where we’d have to batch our runs or, worse, have long wait times competing for component availability.”

Several equipment manufacturers described extra steps taken to limit the effects of the shortage and control supply chain volatility.

“We are meeting daily with our vendors to make sure we can source chips and materials a year or more out. That takes a little bit of planning on our part and also close communication with our customers on their project time lines,” McVicker said.

IP audio codec maker Tieline said it manufactures its codecs in-house, which ensures as much control over the supply of critical components as possible; still, lead times have become exaggerated because of the chip shortage.

“We are definitely seeing lead times for components blow out, and it’s not always semiconductors that seem to have been affected,” said Charlie Gawley, vice president of sales for Tieline.

“For some components, average lead times of 26 weeks or less have extended out to 52 weeks or more. And in one case, as far out to 2024. As you can imagine, this adds an additional layer of complexity to ensure the bill of materials for each product is available for manufacturing when required.”

Tieline believes the chip shortage will extend at least into early 2022, Gawley said. “However, we do not expect to be impacted given our order placements for components already placed.”

Gawley said Tieline has been able to absorb any extra costs and has not adjusted prices.

Several equipment vendors told Radio World that the chip shortage is affecting their research and development efforts and work on new products.

Possibly softening the impact of the shortage is that more broadcast products now are based on software. However, “Our experience has shown us that not all products can be replaced by software,” said Todor Ivanov, CEO and owner of DEVA Broadcast. “Many of our devices are intended for use in the field and at transmitter sites where using PC-based solutions is not reliable enough. For all of those products, we have taken the necessary measures to make sure that no hardware shortages are experienced and that our customers can rely on our products at any given time.”

Sidebar: Steel Also Feels the Pinch

Steel prices in July were up 215% from 16 months prior, according to Fortune.

A worsening shortage may scramble supply chains and increase the cost of broadcast towers.

Tom Silliman, president of Electronics Research Inc., told Radio World in July that material for current projects was largely on hand and that work was continuing. However, he said, ERI’s supplier of steel for broadcast towers, O’Neal Steel, was unable to order additional material from steel mills other than what was on order.

“Rollings are closed at this time and there is not a date on when they will open them again. Definitely no additional orders for 2021,” Silliman said.

Prices for the material that goes into tower members are going up terribly, Silliman said.

“Some of the solid rod suppliers don’t want to sell any more solid rod tower material now because the cost of the material is so high. They would rather sell other material,” he said.

ERI designs, fabricates and installs self-supporting towers, guyed towers and antenna mounts used by the broadcast industry. As of mid-summer it was experiencing only minor project delays, due mostly to a shortage of guy wire insulators for AM towers.

“This causes a problem because it pushes our crews into late fall, causing higher numbers of weather days,” Silliman said.

For new tower orders, Silliman said broadcasters should expect higher material costs and long delays in receiving tower steel.

“Material delivery time is way out. In 2020, O’Neal Steal was quoting us six-week delivery of tower steel, and now they are quoting six-month deliveries. And since prices for material has gone way up, tower prices will have to go up, too.”