Getty Images/Avesun

“The blood of the local radio industry will be on everybody’s hands if we do not get relief from these archaic and rusty shackles.”

That comment about regulation was made by Jeff Warshaw, the CEO of Connoisseur Media; and while the sentiment may be familiar to many in commercial radio, it was delivered in an unusual setting: the chamber of the Federal Communications Commission in Washington.

The FCC hosted a symposium in late 2019 to ask industry representatives about trends and challenges facing the radio industry. Anyone who wanted to compile a list of business challenges heard plenty to be worried about.

The discussion, led by Fred Jacobs, president of Jacobs Media, covered topics like music licensing fees, the future of AM radio, new revenue sources and minority ownership. And you knew regulatory relief was going to come up too.

UNLIMITED CONTENT

The speakers certainly were in agreement that the ways in which Americans watch, listen and read to content are evolving fast.

“People are consuming media in different ways and in different places. There is an unlimited amount of content available now, but is it quality enough to attract listeners and in the places they need it?” said Hartley Adkins, president of Integrated Revenue Strategy for iHeartMedia.

“If you have good content but someone can’t access it, or if you have poor content to begin with, it doesn’t work. … Even when you look at smart speakers, radio needs to be in position to deliver quality content in 2020 and beyond.”

Caroline Beasley, CEO of Beasley Media Group and former joint board chair of the NAB, told the symposium that radio must commit further to its local communities while exploring new platforms, as her company is doing with gaming and other initiatives.

“We’re providing great local content via our local signals, but we need to be everywhere our listeners are. That is a business model significantly different than the over-the-air model. So we are making decisions on where to spend our resources. We are facing and making some very challenging decisions, especially now during budget season, thinking about next year.”

Beasley said radio revenue in its radio markets has declined 30% over the past 10 years. “Our piece of the advertising pie is shrinking. It is going to digital, so if we want to stay in business we have to diversify our revenue streams. At the same time our costs are going up because we are being forced to distribute our programming over multiple platforms.”

[Learn about Media “Efficiency” Vs. Media “Effectiveness”]

The panel visited the question of whether such companies are in “radio” or simply “media.”

Jeff Warshaw, CEO of Connoisseur Media, said he considers himself in the radio business but that its definition has broadened.

“The [traditional] radio business, the business of broadcasting over the air and monetizing that service to advertisers, is shrinking, and will continue to shrink until it becomes an unviable business,” he said. “Just because we can now take our content and try to monetize it against a myriad of competitors on multiple platforms, doesn’t mean that the radio business isn’t shrinking and getting more difficult each it year. It is,” he said.

“We are now competing with companies that are hundreds of times larger than the biggest radio broadcaster. They are selling subscriptions, they sell data and they sell devices. They are unregulated, and we are stuck with regulations that could have never foreseen the types of competitive pressures we are facing.”

NEW VENTURES, NEW COSTS

Karen Slade, VP and GM of KJLH Radio in Los Angeles, said her view was not from “30,000 feet up like the other members of the panel, but more like 10 flights up,” which gives her a different perspective.

“We have about 500,000 listeners; but I’m also trying to reach more through local programs across platforms. It becomes almost cost-prohibitive for me, because every new venture and every new platform comes with a cost,” Slade said. “When can I get a return? There is additional licensing involved. Sometimes the better you do, the more expensive it gets.”

Mark Fratrik, senior VP for BIA Advisory Services, said radio must press ahead to roll out additional digital services. “It’s really the only potential for growth they have.”

Fratrik, in charge of BIA’s advertising forecast, predicts radio will never return to the OTA ad revenue levels it saw before the recession ending in 2009. “It just won’t ever get back to that; and when you consider inflation, radio revenue is really down 30 to 40% from just over a decade ago,” Fratrik said.

Delivering quantifiable results is crucial, according to the panelists. “Digital makes that a lot easier. ‘Last-click attribution,’ if you will,” Adkins said. “Radio was a little slower to that new reality, but now that we are doing it, advertisers are more comfortable giving us their money because we can prove our performance.”

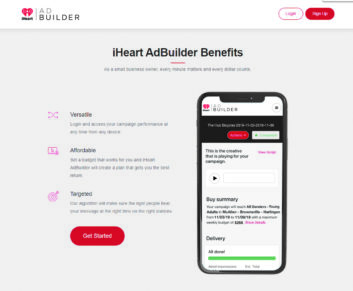

Adkins said iHeartMedia continues with efforts to make the buying of advertising “friction-free” for advertisers.

[FCC Takes Your Questions on AM All-Digital]

“We have something in beta right now called AdBuilder that includes a user experience similar to Facebook and Google and allows advertisers to share information about the business and spits out a commercial for them. Then they can purchase time on the formats targeting the audience they want without spending any time with a sales rep. That’s the sort of modernization we are doing,” Adkins said.

Alfred Liggins, CEO of Urban One, said FCC regulations often leave radio broadcasters at a disadvantage in the current marketplace.

“Basically, technology [companies] right now are eating traditional media. And they are eating traditional media from a standpoint of making media become a loss leader,” he said. “You [have] Amazon and Apple entering the business, and their core business is not to provide audio to provide local news and information, they want to sell more product and devices.”

Liggins said he is not under the illusion that radio can compete with Google and Facebook and Yelp. “They are technology platforms, and we cannot offer all of the services, even with our digital products, that they can. However, scale will be necessary in order to survive the onslaught of new competition,” he said.

The problem with digital for radio, Liggins said, is it “turns analog dollars into digital dimes, since there are so many entities taking a slice of the pie it makes it unprofitable. Yet consumer consumption patterns demand that we are serving that space. We have to modernize.”

Liggins realizes terrestrial radio listenership continues to drop. “Persons using measured media is dropping significantly each year. There are so many more options. The time spent listening has significantly dropped,” he said.

“A NEW MARKETPLACE OUT THERE”

The panel discussed AM radio and its future amid the possibility of future deregulation.

“If ownership restrictions are loosened on FM, then what we expect to see is some of that content that you can only get on AM moving to FM,” Adkins of iHeartMedia said. “That could be the death knell for AM radio. AM is too important to us though. We feel there are plenty of opportunities on AM, the diversity is incredible whether it is sports play-by-play, Rush and Hannity and other content.”

Liggins of Urban One, though, was emphatic in answer to a question about AM’s survivability in the current marketplace: “I think it’s done. It’s just a matter of time. The fact of the matter is that AM content is already moving to the FM band, either on full-power FM stations or FM translators. Kids don’t know what the AM band is. It’s just an inferior listening experience.”

When Fred Jacobs asked Caroline Beasley if her broadcast company is shopping for AM properties, she replied with a simple “no” and chuckled.

There was ample sentiment on the panel for further deregulation.

[Community Radio Seeks More Engagement]

“The blood of the local radio industry will be on everybody’s hands if we do not get relief from these archaic and rusty shackles,” said Warshaw. “It’s not fun and games. Radio is the one who provides local services. Spotify is unregulated. They are not going to promote anything locally. Pandora is not doing local news. Sirius FM is not raising money for local shelters. We couldn’t even get Apple to turn on the FM chip in the iPhone.”

The ability to “consolidate and have economies of scale has absolutely helped us increase news programming and increase public affairs programming,” he added.

Fratrik of BIA Advisory Services summed up the tenor of the discussion: “For radio to grow and remain viable, it does need some level of relief from regulation that was fostered during an earlier period. We are in a different audio and entertainment environment, and certainly in a different advertising [one], and there has to be some recognition of that by the FCC and the DOJ that there is a new marketplace out there.”

You can watch the video archive of the symposium at https://tinyurl.com/rw-fcc-symposium.