Local and national radio ad revenue in the United States will continue to decline slowly in coming years, according to a forecast from S&P Global Market Intelligence.

And although radio’s digital revenue will grow, it won’t be enough to avoid a drop in total revenue over the coming six years. The firm thinks total radio revenue in 2023 will be about $15.15 billion but will drop to $14.26 billion by the end of 2028.

“The local ad market continues to be stronger than the national side of the spot ad business for broadcast stations, with major brands and ad agencies shifting budgets to streaming, mobile and social media platforms,” wrote Principal Research Analyst Justin Nielson.

“Our 2023 projection breaks down to $21.86 billion from TV stations — including core national and local spot, political and digital/online — and $11.97 billion from radio stations, which includes national and local spot and digital, excluding network and off-air.”

Nielson wrote that radio’s big sales categories of auto, retail, travel and entertainment were burdened by the pullback in advertising during the pandemic and now are hurt by interest rates and price inflation.

“Consumer spending that rebounded post-pandemic with shelter-in-place and masking orders being lifted has now come under pressure, although has not dipped into recessionary levels yet,” the analyst wrote.

He noted radio’s competition from streaming audio and on-demand options such as Spotify and Pandora, as well as an overall decline in listenership due to WFH plus issues with AM radio being removed from some EVs and hybrids.

The firm is projecting that U.S. radio’s core local spot ad market will decline 3% to $8.49 billion in 2023, then decline 1% in 2024, down 3% in 2025 and then down 1% to 2% over the remaining forecast period. National radio ad revenues are forecast to decline by 4.5% to $1.97 billion in 2023 and by 6% in 2024, then start to decline more steeply, by 7% to 8.5%, after that.

“We project digital gains of 6.5% in 2023, 6% in 2024 and a range of 5.7% to 5.1% growth through the rest of the projection period. Radio station owners are continuing to invest in streaming, podcast and digital marketing service initiatives, with digital revenues expected to rise to $1.98 billion by the end of 2028.”

Off-air revenue is forecast to grow 3% in 2023 and 2.3% in 2024. He said live events remain a growing segment for radio and will reach $2.45 billion by the end of 2028.

“Radio’s lower ad cost, local audience and relatively high return on investment compared to other media will keep it relevant, although digital investments point to future growth opportunities, with the spot ad market for radio expected to decline over the forecast period,” Nielson concluded.

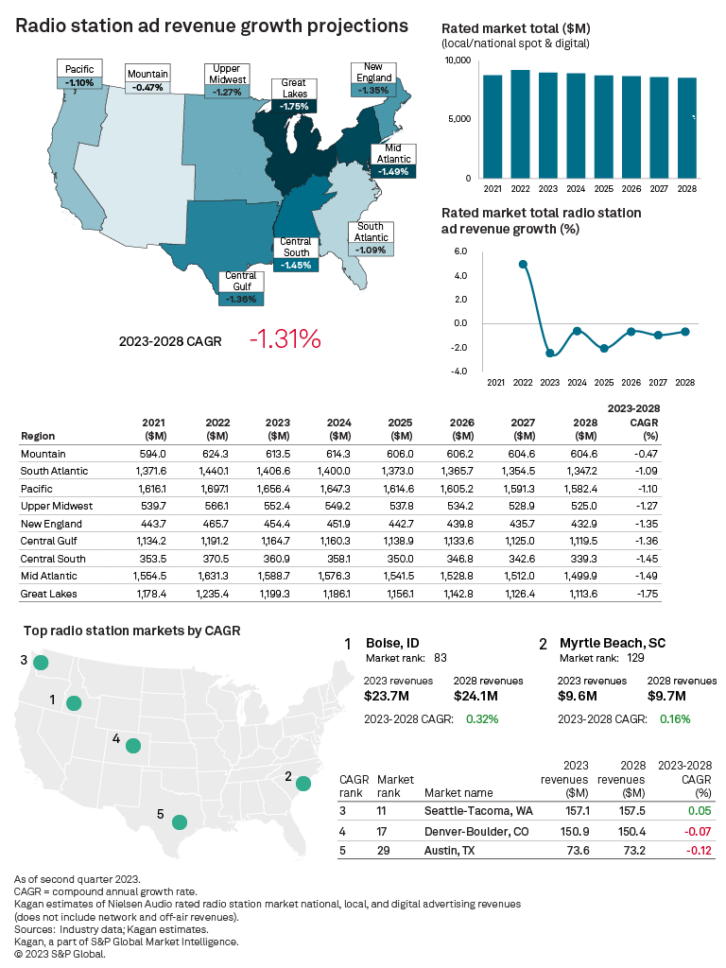

Over five years he expects radio station local and national spot ad revenues, including digital, to decline at a compound annual growth rate (CAGR) of 0.98% in rated markets, with non-rated markets declining at a CAGR of negative 2.68%.

“Total radio revenue, including national and local spot, digital, off-air and network revenue, is expected to decline slightly at a five-year negative CAGR of 1.2% from an estimated $15.15 billion in 2023 to $14.26 billion by the end of 2028.”

The company published the chart below with more details.