U.S. radio technologists look forward each April to hearing about new developments from David Layer, the vice president, advanced engineering of the National Association of Broadcasters.

But with the NAB Show cancelled, Radio World asked our correspondent Davide Moro to report on Layer’s presentation in February at the Digital Radio Summit 2020 in Geneva, an annual meeting at European Broadcasting Union headquarters.

That presentation — about HD Radio developments, all-digital AM, hybrid radio and voice platforms — doubles as somewhat of a state-of-the-industry technical report for U.S. radio.

Among other things, attendees heard about potential new costs for U.S. broadcasters that could result from wider deployment of new “hybrid” receivers that combine over-the-air and online connectivity. NAB technologists are involved in research that may help resolve the problem.

They also heard him describe an NAB effort to create a standardized broadcaster database so that stations can interact more consistently with the many new voice-controlled audio platforms.

DIGITAL DATA

CREDIT: David Layer/NAB

Speaking first about the status of HD Radio, Layer described continuing uptake in Mexico and Canada. In the United States he noted the proliferating number of receivers, though on the station side, “frankly there’s still work to be done.”

The majority of radio stations in the U.S. are not yet broadcasting in digital. However, FM stations doing so now cover the large majority of the population with their signals, so overall coverage is very good, but many smaller-market broadcasters in particular haven’t converted yet. “We at NAB understand that and are trying to work with Xperi and equipment manufacturers to develop less expensive ways for broadcasters to deploy HD Radio.” Xperi is the owner of HD Radio technology.

On the receiver side, deployment continues to grow at a steady pace, to an overall figure of 70 million receivers sold as of the end of 2019. Layer said roughly 25% of 275 million vehicles registered in the U.S. are capable of receiving digital broadcasts now. Noticeably, penetration is greater in the major markets like New York (37.5%), Miami (35.9%) and Los Angeles (34.3%).

Layer said how those figures are potentially important for AM broadcasters. Awareness of a proposed all-digital option for the AM band is growing, and it is inherently supported in all existing HD Radios. He noted however that when a given station decides to move to all-digital AM, listeners won’t be able to receive those signals on analog-only receivers.

He said solid, well-established digital radio receiver penetration is key if broadcasters are to consider offering an all-digital AM service.

In November, as RW has reported, the FCC announced plans to give AM stations the flexibility to voluntarily adopt all-digital broadcasting, and it has been taking comments from industry about it.

ASYMMETRY

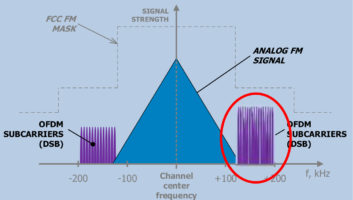

Layer also updated attendees on the proposed use of the FM IBOC asymmetric sidebands mode. Under this mode, which currently requires an experimental authorization, FM HD Radio broadcasters in the United States can increase their digital power on just one side of the signal (Fig. 2).

When first-adjacent channels are closely spaced on one side of the signal but not on the other, this waveform helps broadcasters achieve better digital coverage since the entirety of the digital broadcast is present in both sidebands. NAB, Xperi and National Public Radio recently filed a Petition for Rulemaking with the FCC asking for a routine authorization for this, but no decision has been forthcoming yet.

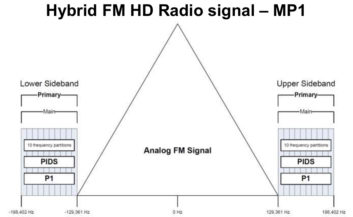

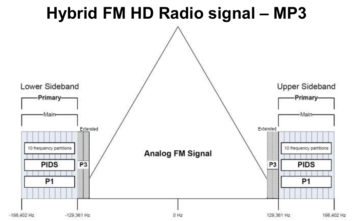

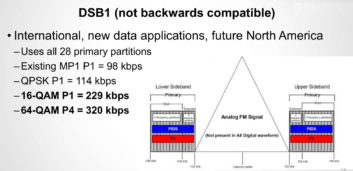

Like most digital standards, HD Radio also allows for a number of different operating modes. NAB recently investigated the mode called MP11, which until recently was not supported by commercially available transmission and reception equipment.

Compared to the standard hybrid HD Radio modes MP1 and MP3 (Figs. 3 and 4), which are currently used by most broadcasters, MP11 adds additional digital sidebands (Fig. 5) and offers broadcasters an additional 25 kilobits per second of capacity.

“Working with Xperi and equipment manufacturer Nautel, PILOT, an innovation initiative of the NAB, tested this mode using the PILOT radio test bed, confirming that it works great and manufacturers are now implementing that,” Layer said. MP11 mode also has been demonstrated to have minimal impact on analog FM reception and audio quality, he said.

Layer reported that Xperi is also looking for new operation modes for digital FM broadcast, especially targeting a long-term potential future where FM could be all-digital in the United States. The HD Radio standard dates to the early 2000s. Since then, hardware technology and coding methods have improved and it’s now possible to do much more with the same signal and spectrum, he said.

Xperi and NAB PILOT are investigating new modes that provide much higher throughput, up to 320 kbps (Fig. 6), to support higher levels of service as well as new applications.

AM CHALLENGES

In-car listening accounts for more than 50% of overall radio listening in the United States, so Layer also is paying attention to new car and dashboard designs.

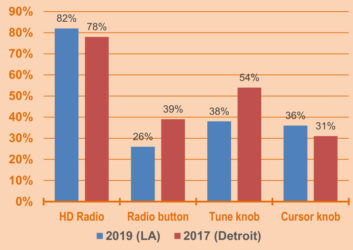

“As the great U.S. philosopher Yogi Berra used to say, ‘You can learn a lot by just watching.’ So I visited the November 2019 LA Auto Show, sitting in over 50 cars and operating the radios. I was looking for certain things like the radio button, whether there was a tuner knob, HD Radio capabilities and so on.”

Layer compared the experience with his prior findings from the Detroit Auto Show of January 2017 and provided a brief comparison (Fig. 7). In a couple of years, HD Radio availability in the vehicles on display at these auto shows rose from 78% to 82% while the presence of a physical “radio” button dropped down from 39% to 26%.

In addition, the presence of a physical tuning knob dropped from 54% to 38% while cursor knob presence rose from 31% to 36%. Layer says this expanded use of cursor knobs is evidence of how the dashboard is becoming more like a computer platform.

He also found that Apple CarPlay was more prevalent than Android Auto (92% vs. 70%).

Three out of nine all-electric vehicles he saw did not feature AM radio at all, presumably in part because of issues with electric motors creating interference to the AM signals.

At the most recent CES, NXP demoed a solution to solve this issue; but an obstacle for car manufacturers is the cost of these advanced tuners. The challenge for U.S. broadcasters, considering the huge number of AM stations on air, is to ensure there will continue to be consumer demand for AM services based on their content; Layer said this will be the best reason for automotive manufacturers to keep AM radios in electric cars.

HYBRID RADIO

Meanwhile, hybrid radio is poised to be of growing importance. Here the term refers to emerging platforms that combine over-the-air broadcast reception with online connectivity that extends a station’s coverage beyond its OTA footprint (with the use of audio streaming), offers the possibility of enhanced metadata and listener interactivity, and provides the ability for analytic feedback to broadcasters about listening.

Layer noted the hybrid radio platform 360L recently announced by satellite company SiriusXM as a remarkable example of hybrid radio capabilities, user experience and listener engagement (see a video tutorial at http://tinyurl.com/rw-hybrid).

But the growing popularity of hybrid radio comes with a major drawback for local U.S. broadcasters. Once a driver tunes to a given station, a hybrid radio receiver may silently look for and stay connected to the broadcaster’s streaming audio signal to support time alignment of the over-the-air and streaming versions of the signal. This is done so as to allow seamless switching to the streaming feed in case the broadcast coverage weakens.

In this scenario, the streaming signal is in use even when a receiver is playing the RF feed and no one is listening to the stream. As a consequence, performance rights costs significantly rise.

“I’ve heard a broadcaster say, ‘This just completely breaks the business model,” Layer noted. “This is a big problem; hybrid radio offers so much promise but there’s a peril for U.S. broadcasters because of the streaming fees.”

BROADCAST-ONLY ZONE

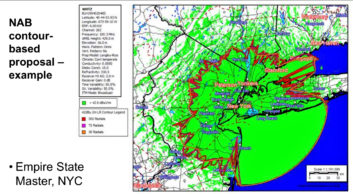

NAB is seeking to define a way for broadcasters to try to control such costs. The idea is that the broadcaster creates a description of a “strong signal area” in which streaming is not allowed; the receiver gets information about the broadcast-only area via the internet-delivered portion of the hybrid radio signal, exchanging data with the onboard GPS system.

Thus the receiver can detect the position of the vehicle with respect to the broadcast-only area and, when within that zone, the receiver tunes to broadcast signals only, with no streaming. Beyond this broadcast-only area is a “gray zone” where the receiver selects either source according to RF reception metrics. Outside these two areas, the receiver is allowed to force streaming.

This process would give the broadcaster an opportunity to better manage streaming costs.

Layer believes it may be a challenge to convince receiver manufacturers to implement this solution because it adds cost and complexity. “But it’s very important and it’s something that we’re going to continue to work on,” he said. “Maybe we can come up with a simpler way to achieve the same goal.”

The idea of conditioning a receiver’s action on its geographical position is not virgin territory; it is one of the pillars on which emergency alerting in mobile phones is based. It’s common practice to create a contour and dictate that an alert will only be received by smartphones in a certain area. So the basics are proven, but it has not been applied to radio broadcasting in this fashion. NAB is exploring this with the RadioDNS technical group, Xperi and receiver manufacturers.

Layer believes a basic broadcast-only area can be adequately shaped by using a contour with well under 100 points (an example using 36 points was shown during the EBU presentation), thus making communication to receivers a relatively “light” task.

POSITIVE THINKING

Finally, Layer discussed voice platforms, which are becoming a major channel through which consumers receive audio services. When listeners attempt to access broadcast stations using, for example, smart speakers, he noted that they have to face some issues.

Instead of asking for the name of their favorite station, many Americans are accustomed to asking for the frequency on which a station is broadcasting. So, when a listener asks for 97.1, they might end up hearing the wrong 97.1 which disadvantages the local broadcaster and annoys the listener. (Read about an effort to resolve this problem in Australia at https://tinyurl.com/rw-smart-3.)

For the broadcaster, one issue is that voice platforms often connect the listener to a station only via a particular aggregation platform. The audio feed is not coming directly from the broadcaster, meaning it is out of the loop in controlling that experience.

“We are talking to Google and to Amazon,” Layer said, “and we are working at a solution where broadcasters can be more involved in selecting where a stream originates from, maybe from broadcasters’ own platforms.”

Layer feels positive about this process and hopes that broadcasters in various countries can work toward a common approach because the web companies are accustomed to targeting global audiences through global solutions.

With that in mind, NAB PILOT is working on creating a standardized broadcaster database of how voice platforms find and ingest data, with the goal that each station would have a say in what information is shared with the voice platforms, such as station name, frequency, branding, location and market. The database would allow stations to prioritize stream location for voice platforms.

“If we can collaborate on these activities and develop a database that broadcasters have access to and control, I think that would really improve the experience from both the broadcasters’ and listeners’ perspectives,” Layer concluded.

Comment on this or any story to radioworld@futurenet.com.