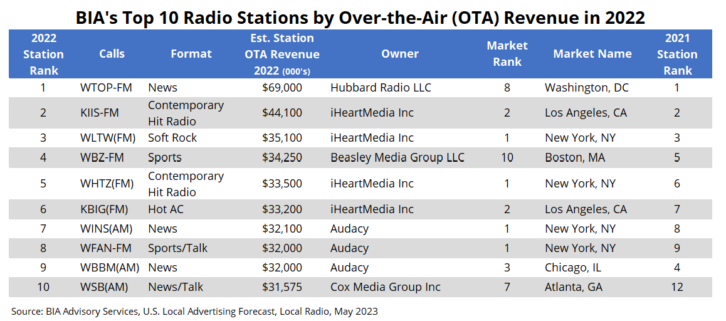

BIA Advisory Services has crowned the 10 highest-grossing U.S. radio stations for 2022. In the first edition of its “Investing In Radio Market Report for 2023,” BIA also reports that overall local radio over-the-air and digital revenue last year topped $13.6 billion, growing 7.4 percent from $12.6 billion in 2021. Over-the-air advertising grew 2.2 percent to $11 billion (up from $10.7 billion in 2021) and digital income rose 35 percent to $2.6 billion (up from $1.9 billion in 2021).

Of OTA revenue, Hubbard Radio’s WTOP(FM) claimed $69 million, maintaining its long-time leading spot. While the Washington, D.C. all-news station continues to lead the pack in terms of advertising revenue, other all-news stations struggled, says BIA. Compared to the 2021 list, WBBM(AM) in Chicago dropped to the number nine position, and all-news station WCBS(AM) in New York dropped to the eleventh position. New to the list is WSB(AM) news/talk in Atlanta, Georgia, claiming $31.6 million of total 2022 revenue.

Per the BIA report, Audacy and iHeartMedia own the majority of the top-earning stations. Outside of those radio groups, Beasley Media and Cox Media join the leadership board alongside Hubbard. The top 10 consist of two AM and eight FM stations.

“Looking at last year’s ad revenue results, it shows that radio is maintaining an important position in their local markets, particularly as it expands and improves its online digital presence,” said Nicole Ovadia, VP of forecasting at BIA, in a press release. “This year, we are making a particular effort to track the digital revenue of local radio stations and believe this breakout in our forecast will be valuable to everyone in the industry.”

For 2023, BIA says Ovadia forecasts that the bump in revenue experienced in 2022 will be harder without significant political spending, but “[she] expects that 2024 political advertising will start earlier in the cycle than usual, potentially bleeding into late Q4 of 2023.”

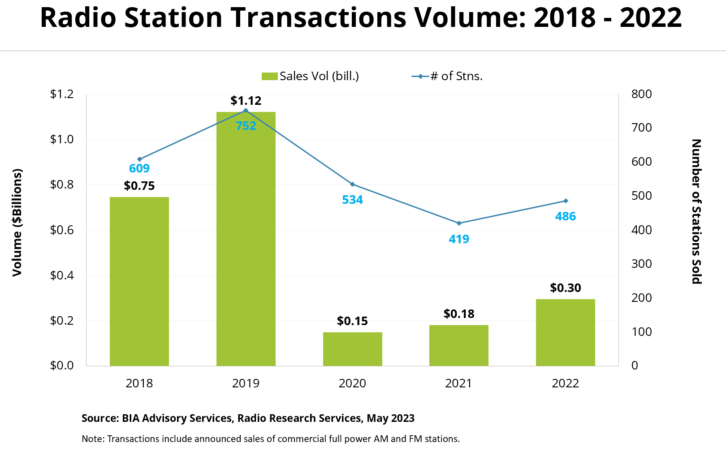

BIA also released its latest report on station transactions. In terms of radio station sales, when looking at more recent trends, BIA VP of Media Valuations Lauren Ross describes the past three years of the radio deal market as “sluggish.”

“Although deal volume increased by two-thirds in 2022 to $300 million from $190 million in 2021, total radio station sales have been very low since 2018,” said Ross. “All totaled, there were just seven radio buys of $10.0 million or more in 2022.”