Make sure everyone gets a slice of that pie.

credit: iStockphoto/ChuckPlace Somehow it doesn’t feel right to receive 2014 budget questions already, but the reality is that a lot of companies are starting the planning process this summer. Sure makes vacation planning a challenge!

But enough about fun; let’s dive deep into budget mode and see if we can jolt your brain into forward-thinking about monetary requirements to build a successful next year.

I once worked with a company that did “zero-based budgeting.” Translation: They looked at the actual amount spent during the year, not the budgeted amount. This means that if you had $100,000 budgeted for marketing but they only let you spend $25,000 of that sum during that year, you could not put more than $25,000 into your budget for the next year.

If your entire $100,000 marketing budget had been cut during the year, then with zero-based budgeting for the next year, you would budget — yep, you guessed it — nothing. Follow this operation long enough and budgeting becomes unnecessary: Since you’ve spent nothing, you can budget nothing.

I bring this up because finance dudes (technical term) typically do look at “actual” spending when they are approving budgets, so it is vital that throughout the year you spend what you’ve got in each of your budget lines, or you could end up with less firepower the next year.

It’s easy to convince yourself you’re saving the company money — and indeed you might be for that year — but it’s possible that the next year you’ll have a competitor and no ammunition to fight because you out-smarted yourself.

COL increases

I always start the budgeting process with salaries. Without happy employees, what do you have?

Most media employees have become accustomed to a 3 or 4 percent cost-of-living increase. I urge even small operators to think hard before taking away what little cost-of-living increase they offer. You may be better off with one fewer employee to allow raises for others who need to feel appreciated and happy.

Not that I’m advocating smaller staffs. Goodness knows most station staffs are small enough already. For talent, you may be better off considering ratings bonuses over standard increases. When talent hits it big, everyone wins.

Speaking of which, if you have talent contracts coming up for renewal, do you have an alternate talent plan in mind if negotiations don’t work out? Have you considered how the incoming health care policy will affect your staff budget?

Here are a few more benchmarks.

Research: Can you afford not to know what your listeners enjoy and what they detest? Even if you don’t have enough money for perceptual studies, or music research, can you at least allocate enough for a few focus group sessions?

Software Licenses: Many a manager has neglected to investigate software licenses properly. Don’t wait until a product becomes unsupported to realize you need budgeted money to purchase an upgrade. Be sure to ask your staff what they believe they will actually need. This doesn’t mean you are obligated to make the purchase, but you should know how the people using the software think.

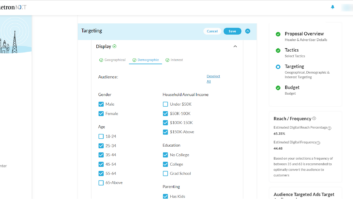

Marketing: You probably can’t allocate much, so what you have you must utilize wisely. Consider putting up the dough for Twitter and Facebook advertising. Once you capture new social media users, you can continue to market to them over and over. It’s the gift that keeps on giving.

Travel & Entertainment: You’ll have at least a few corporate trips, right? Allocate a few bucks for meals schmoozing with influential locals.

Content/Wire Services: Everything from show-prep materials to on-air guests to networks.

Licensing: Fees to the people you hate to pay but can’t live without.

Transmission: Costs change. Be sure and check.

Website: You’re paying something for hosting, bandwidth and other tools.

Equipment: No doubt you are creating a separate capital budget. It is rarely due the same time as your operating budget, but the two really belong together because they require coordinated planning. It’s a good idea to start it now even if it’s due later.

Consultants: Put lots of money in this line because an outsider with a fresh perspective and creative ideas can help move you the needle. Allocate at least a gazillion/trillion dollars.

Mark Lapidus is president of consulting firm Lapidus Media. Reach him at [email protected].