Phil Argyris became CEO of GatesAir in August. He joined former owner Harris Corp. in 2008. The new CEO of GatesAir spent two decades of his career working as an executive in the oil and gas industry, where companies face billion-dollar decisions and where time “from concept to delivery” — from drilling an exploratory well to producing oil — can take more than a decade.

GatesAir, formerly Harris Broadcast, has been through a lot of changes in the past couple of years, as have the radio and TV industries on which it is built. I was curious to hear from Phil Argyris (“AR-jir-riss”) how he views his company’s mission and outlook.

I found that, like many top executives in broadcast supply, he tends not to get caught in the day-to-day whirl of ups and downs, and professes a confident view of our industry’s long-term soundness.

In 2013, Harris Corp. divested its broadcast operations, and they were acquired by the Gores Group, a private investment firm. Subsequently, Gores separated the broadcast business into entities called Imagine Communications and GatesAir, with Charlie Vogt leading both as chief executive officer at first. Imagine Communications would focus on IP, software-defined networks, cloud and multiscreen technology while GatesAir, a wholly owned but separate operating company, would serve wireless, over-the-air content delivery for radio and TV broadcasters.

This August, Vogt named Argyris to run GatesAir as CEO. Argyris holds an MBA in industrial relations and organization behavior from Temple University’s Fox School of Business Management and a bachelor of business administration in finance from Temple. He had worked in human resources with Amoco/BP from 1980 to 1999, then went to NCR Corp., where he was vice president of HR.

He joined Harris Corp. in 2003 and most recently held the position of VP/GM of transmission systems. His work for Harris/GatesAir has included R&D, product line management and marketing roles.

WIRELESS DELIVERY

I asked Argyris how he defines the mission of GatesAir now.

“We’re still in the business of helping our customers drive the wireless delivery of content,” he told me by phone. “It’s not always a product delivery — you need to be building a solution for them — but as to our overall products, we’re a transmission company, primarily. Our mission is to drive over-the-air content with lower cost of ownership.”

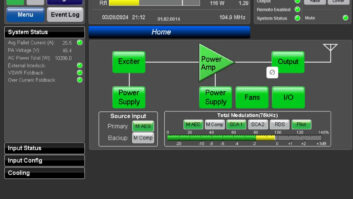

While the company considers itself the world’s largest provider of radio transmitters and among the biggest providers of TV transmission, its products also create and transport content; it makes audio consoles, routing systems and audio distribution/STLs as well as transmitters.

GatesAir and its 300 or so employees are not entirely separate from Imagine; Vogt continues to oversee it, and “we’re still finishing the carveout,” Argyris said. “We also have a relationship in cross-selling; we’re part of the Gores team. But independence is their direction. We’re 95 percent there. We’re on our own; I remind our team of that all the time.”

Manufacturing and service are centered in Quincy, Ill., while engineering and product lines are in Mason, Ohio, near Cincinnati.

Change has brought a different feel to the company, he said. Whereas former parent Harris Corp. focused largely on government business, “the speed at which we have to do things is really different. In our business at GatesAir, we have a more entrepreneurial view of things. And we don’t have to turn anywhere.” Important corporate decisions, he indicated, can be made in Quincy and Mason. His remarks echo what Chief Product Officer Rich Redmond told me earlier this year, that the company would be “a lot more nimble, focused, approachable.”

“FANTASTIC MEDIUM”

When Harris Corp. announced its broadcast divestiture plans in 2012, I wrote that companies tend not to exit markets they feel are strong and growing. The subsequent price paid by Gores seemed low compared to prior broadcast acquisitions Harris had made, particularly in TV; so taken together, along with the growth challenges faced by all commercial broadcast manufacturers in recent years, I wondered about the overall health of the underlying market.

In its public statements, GatesAir has indicated that booms in both content and demand for content are good for radio and TV networks. Also, it sees opportunities in the digital conversions happening around the world, particularly in emerging countries, as well as in a likely “repack” of U.S. wireless spectrum. And executives, at GatesAir and elsewhere, have told me the global RF market is healthier than many in the United States might realize.

Argyris himself is emphatic: He is bullish about over-the-air broadcast.

“We have a fantastic medium in the radio and TV world to deliver content in a really inexpensive way, because of our one-to-many technology. Whether it’s DAB in Europe or HD Radio in the United States, we’ve been able to allow the broadcasters to increase the amount of content they can deliver.”

The combination of technology, new standards and a “huge” global listening/viewing public is powerful, he said. As media evolve, broadcasters “are still an important piece of that formula. We were relevant 15 years ago, and we’re going to be relevant tomorrow.”

For instance, he said, “I had a conversation with four young people who described themselves as millennials. They describe how they cut the cord after growing up in a cable/satellite environment; they told me how they watch over-the-air TV as well as the Internet on demand.” The broadcast business, he said firmly, is viable. “I’m excited about it.”

TCO

Expect the company to continue its emphasis on power efficiency and the concept of total cost of ownership, a financial term that helps buyers and sellers calculate both direct and indirect costs. For Argyris, TCO goes beyond transmitter specifications to overall use of the spectrum.

As an example on the video side, he pointed to the GatesAir LTE Mobile Offload project.

This technology, developed by the Institute for Communications Technology at the Technical University of Braunschweig in Germany, uses broadcasting to supplement mobile network bandwidth. If mobile network operators could offload video content to “high-tower, high-power” transmitters from GatesAir, the thinking goes, operators can reduce network congestion. The system is for the DVB-T2 broadcast standard used in Europe and elsewhere; GatesAir is working with the university to commercialize it and views the concept as a natural progression for UHF broadcasting.

IP infrastructure demand continues to be strong, Argyris said; and HD Radio provides opportunities, too. “As a business decision, is it a slam dunk?” he said of HD Radio. “No, but do I see movement? Yes. We have a good business.” He senses opportunities for smaller stations and “fill-ins” to invest, for instance, and thinks HD Radio technology eventually may help bring more services to station offerings.

But he doesn’t expect to see global radio consolidating around HD Radio or any one digital standard anytime soon. “There’s too much invested in DAB in Europe. DRM has been a long-time standard but slow to take off; China has its own standard. For right now, I think that [global standard] train has left the station.” Similarly, he doubts that a global TV standard is ahead anytime soon.

I’d also heard that uncertainty over U.S. spectrum auctions had caused a slowdown in TV RF spending, so I asked him about that.

“It depends on your timeframe,” he replied. “We went through a massive amount of work for the [TV] analog shutoff; after that, things slowed.” Over the past year and a half, TV equipment buyers hesitated, “but right now we’re seeing some things pick up” as older infrastructure ages and as users pursue more efficient investments. While television “won’t make a massive move” until the spectrum repack is worked out, he said, “I have seen positive movement.”

Argyris, who moved abroad to work in oil and gas at age 30, knows every geographical region differs, as do the technical challenges from industry to industry.

But although petroleum infrastructure projects involved, as he put it, “a lot more zeroes,” businesses are businesses; you have to understand your clients.

“We’re here to stay. We plan on being an industry innovator. We do those things by listening to our customers.”