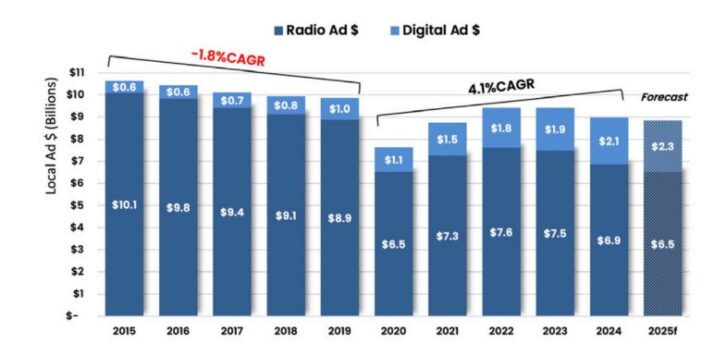

In its annual benchmarking report to RAB about radio digital sales, Borrell Associates found that 2024 digital sales in the United States reached the $2 billion mark, up 10.2% from 2023, and the forecast for 2025 is $2.3 billion.

“Digital income has doubled in the past five years and is no longer a sideline business,” the authors wrote. “In 2024 the average for a radio station was $482,470, accounting for nearly one-quarter of its annual income.”

The report was sponsored by Marketron, whose CEO Jimshade Chaudhari wrote in the introduction: “As radio becomes a more mature digital sales engine, it’s critical to understand the local environment and what matters to these advertisers.”

Radio World asked Chaudhari and Todd Kalman, Marketron’s senior vice president and head of revenue, to discuss the challenges facing radio sales departments and how Marketron fits into the picture.

Chaudhari joined Marketron in a senior executive role in 2019 and was named CEO in October of 2023. His background includes management and product roles at Sling TV, DISH Network and Sprint Nextel (now part of T-Mobile).

Kalman is senior vice president and head of revenue for Marketron, which he joined in 2015 after holding national sales roles with iHeartMedia and CBS Radio.

Radio World: What’s the most important technology trend or challenge for radio sales?

Jimshade Chaudhari: Many broadcasters are using a variety of technology stacks, some involving older products, which is driving inefficiency. We hear it when we talk with sales managers: “My people are spending more time in systems than they are out on the streets or selling virtually.”

Digital is the poster child for this. When radio companies first got into selling digital, many didn’t really know what they were doing, so they’d listen to a couple of vendors and kludge things together. They ended up with a digital tech stack that doesn’t talk to the traditional linear tech stack supporting their core business, which is still radio advertising.

If stations don’t modernize and optimize these systems, it’s going to be hard for them to stay competitive. The good news is that a lot of customers are asking the right questions about this now.

RW: Briefly summarize your company’s business.

Chaudhari: Marketron is 100 percent focused on the radio industry. Our headquarters are in Haley, Idaho, with offices in several other places, and a significant remote workforce since COVID.

For over 50 years, radio traffic systems have been our bread and butter, with mainly backoffice tools that help station teams sell their advertising, put orders in, and handle the billing and invoicing.

As our customers began to evolve and as digital became a bigger component, we built a sales enablement tool, Marketron NXT, that helps them sell both radio and digital in a simple manner, from proposal to order execution and reporting.

Then, we layered an embedded payments product on top of that, to make it easier for broadcasters to collect money from advertisers at a time when they are being forced to do more with less.

RW: Given its challenges, why are you optimistic about the radio business?

Chaudhari: What we see in radio is a core set of assets that just need to evolve to stay competitive.

In the broader media landscape, radio is not big enough to attract outsiders to come in and innovate. The innovation is going to come from people with roots in radio.

We know radio has to change because of the highly competitive landscape and changing consumer behaviors; but radio also has assets. One is the local sales teams and their relationships with advertisers and small businesses in their communities. Big companies have tried to recreate those relationships or provide advertisers with self-service tools; but many local companies need the handholding, and they want somebody they trust.

Also, in many smaller markets, the newspaper might be gone, and the local radio website has filled its place. Meanwhile, radio is well-positioned to create compelling content for opportunities like podcasting.

So we’re bullish on radio, we just think it has been slow to adopt technology, and there has been little innovation for the reason I described.

The big challenge is this transformation or evolution. We’re seeing companies starting to take those steps, which aren’t easy. But companies are changing their business models and giving up how things were done historically for the sake of a more successful future.

RW: Can you be more specific?

Chaudhari: There has to be a mindset shift, for one.

Traditional radio is where all the dollars came from. It’s a high margin. And it’s a product set that reps know really well and feel confident about. Now the industry has bet on digital as an alternate revenue source that will continue to grow and ideally offset the loss in radio.

The mindset must be that traditional radio advertising is just one piece in an overall advertising campaign that may involve several complementary digital tactics.

Also, from an efficiency standpoint, you can’t just train people and expect your business to get more efficient. You have to modernize your tech stack.

Few broadcasters seem happy with their tech stacks right now — they might be happy with pieces of it, but they have more problems than satisfaction. Many of them reacted earlier to trends without fully realizing the implications — “We gotta do something in digital, and a vendor pitched me something. Let’s go stand that up because I can use it to create a great proposal.” But what happens after the proposal? “Oh, well, it has to go connect into a DSP, and the vendor doesn’t do that.” Now you have to find a vendor for an order management system. “Oh, that vendor will execute the order, but they’re not going to pull back any reporting.” Broadcasters have cobbled systems together.

RW: Todd, with that in mind, what are Marketron’s priorities right now?

Todd Kalman: We want to bring radio companies back to Marketron. We’re the only ones that are significantly investing in the space, and really the only ones with a unified traffic and digital enablement platform. We invested significantly to do that, but it’s our goal to continue to modernize as more tactics and digital technology becomes available.

Digital does grow revenue for the station, but it builds upon the customer’s results. A station’s customers get better results when they have a unified message going over the air and on digital platforms, whether it’s OTT or desktop displays, whatever it might be.

RW: How does AI play into this conversation?

Chaudhari: It’s still early in the evolution of AI. There are really cool use cases popping up everywhere — prospecting tools, proposal tools, spec audio spots. Radio people are experimenting with AI tools as efficiency drivers to help them gather useful information before doing their customer needs analysis.

But you may have to pay $30 a month here, $10 a month over there, and it all has to work together. For us, simplification is one of the hardest things to do, but the most important.

So we’re experimenting with AI too. In this learning phase we’re looking at how we can help people in their roles from an efficiency standpoint and how we can build more useful features into our various products

RW: What are clients saying about the marketplace and their own pain points?

Chaudhari: In broad strokes, a lot of them are struggling with headwinds facing the industry. Because traditional radio advertising dollars aren’t growing, they’re being forced to cut costs.

Then with fewer people, the companies are struggling with operational efficiency, asking their staff to do more with less. How do you do that? By leveraging technology, automating things where you can, integrating different products where you can, so that you can reduce errors, or swivel chairs.

Also, our customers are confronting the transformation we talked about, getting good at selling digital. But while publicly held broadcasters are touting their growth in digital, the conversation seems to have shifted over the last six months. “I know how to grow my digital revenue,” they’re saying, “but I don’t know how to grow digital profit.”

To do that you have to be executing digital in a much more efficient manner — through technology and through that mindset change.

This can all be scary for folks who have never sold digital, especially when there are so many options. Today, maybe connected TV might be hot, but the next day it’s geofencing or streaming audio. We don’t want to overwhelm them with 50 choices. We want to curate the tactics, train people in the right way, and remind them that radio is still an asset to be used with digital, rather than having digital cannibalizing radio.

The bread and butter for most of our customers is still traditional revenue, while digital is growing at a really nice clip. It’s the combination of the two that’s unique to radio, there’s nobody else that can do that. Digital inventory just has to be more easily accessible and complementary.

Kalman: And it’s not about Marketron telling the industry what it has to do. Radio knows it has to change. Companies just don’t necessarily know how to do it, the procedure and steps. That’s where we help. We really see ourselves as a partner. We have many people on staff whose role is to grow our customers’ digital revenue. That’s how they get paid — they are compensated for growing the digital revenue of customers on their lists.

Radio people have always been great sellers, they’re some of the best I can think of in any industry. They can get an order, no question. The question is, can they get a renewal? You get that when you deliver what you say you’re going to deliver, which is results.

You can read the report about digital revenue mentioned in the story here.