The latest Share of Ear report from Edison Research reveals radio continues to dominate in several key areas.

But can one go so far as to say that AM/FM radio shares are pandemic proof?

The fourth quarter 2021 report examines American audio listenership in several ways, including examining ad-supported audio use among key voter segments and by location and demographic.

Cumulus Media and Westwood One’s Audio Active Group recently dug into the data.

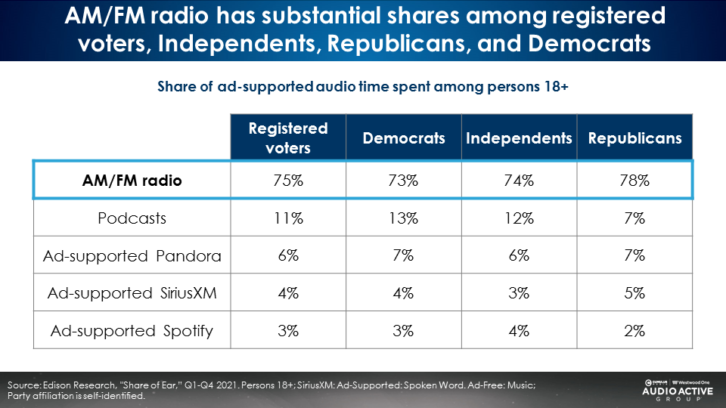

Among the conclusions is that AM/FM radio continues to grab a sizable share of registered voters’ listening time. When calculating the share of ad-supported audio time spent among persons aged 18 and older, registered voters who were surveyed by Edison say they spend 75% of that audio time listening to AM/FM radio. Those numbers fall significantly when compared to other outlets: 11% for podcasts and into the single digits for the ad-supported platforms Pandora, SiriusXM and Spotify.

The report also revealed that AM/FM radio leads when tracked across major demographics. Leading the charge are those aged 35–64 who say they spend 79% of their ad-supported listening time with AM/FM radio. Persons aged 25–54 fall in the second range with 72% of time spent with radio, followed by ages 18–49 (66%) and ages 18–34 (59%).

In comparison, the age group spending the largest percentage of time listening to podcasts is those 18–34s at 21% followed by 17% for those aged 18–49, 13% for those aged 25–54 and 9% for those aged 35–64.

[Read past coverage of the Share of Ear report]

But what about the charge that AM/FM radio shares are pandemic proof? An analysis of the report by Brittany Faison, insights manager for the Audio Active Group of Cumulus Media | Westwood One, found that time spent listening to AM/FM radio changed relatively little — 79% to 76% — from 2019 to 2021. Compare that with a drop in listening to an audio service like Pandora, which saw its numbers fall from 8% in 2019 to 6% in 2021.

One area of growth? Podcasting, which almost doubled from 6% to 11%.

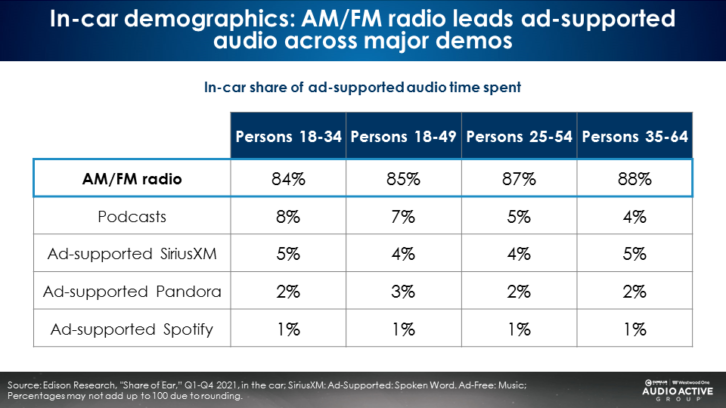

The report also found that in the car, AM/FM radio leads ad-supported audio across all age groups with AM/FM radio accounting for 84% and 88% of their time spent listening to ad-supported audio. By comparison, podcasts at best get 8% of listening and ad-supported streaming between 1% and 5%.

The analysis by Faison found that advertisers looking to reach people in their car with advertising should seriously consider those in-car ad-supported listening stats.

“When it comes to ad-supported audio in the car, AM/FM radio is the ‘queen of the road’ with shares in the mid to upper 80s across every buying demographic,” wrote Faison. “Looking at ad-supported audience shares in the car, even among persons 18–34, AM/FM radio’s share is a whopping 84% — 84 times larger than Spotify’s one share.”

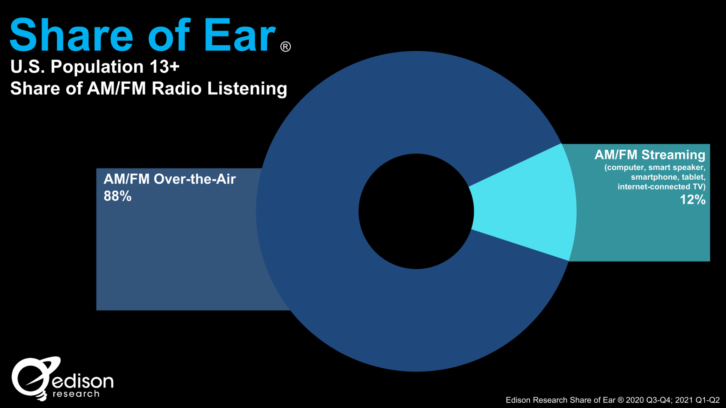

Faison also noted the importance of considering online streaming. Over the past six years, the proportion of AM/FM radio listening occurring via online streaming has risen from 8% to 14%, with Nielsen finding that 10% of radio listening is to the AM dial.

“Currently, there is more radio listening occurring via the stream (14%) than the entire AM dial,” Faison wrote. “Smart advertisers should allocate 14 cents out of every dollar spent on AM/FM radio to the station stream.”

AM/FM radio also leads ad-supported listening on smart speakers with a 43% share, the report revealed. With 40% of U.S. homes now owning a smart speaker, AM/FM has been brought back into the home.

The report also revealed other key details, such as the fact that podcasts and certain online listening services seem to skew higher in larger markets when compared to other services.

Radio World invites industry-oriented commentaries. Send to Radio World.