The loss of regular radios in the home, as consumers continue to favor digital platforms, was one of the main discussion points during Jacobs Media’s 2023 Techsurvey presentation — its 19th edition.

This year’s study, dubbed “Radio in the Post-Pandemic Era,” evaluated the current media and radio environment by examining listener behaviors and routines post-COVID. The data set was compiled by Jacobs Media, drawing information from 434 participating radio stations, and yielding more than 30,000 surveys from “core radio listeners” — who are considered to be avid and active listeners, and those already subscribed to a station’s email database.

Presenting the 2023 findings last week, Fred Jacobs said, as per usual, the most listened to formats among core radio listeners are Christian, Public Radio and Country, followed by Rock Contemporary Hit Radio and Classic Hits.

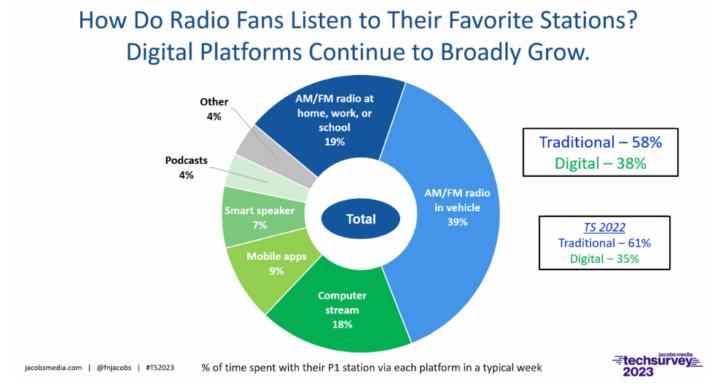

But how are fans actually tuning in to their favorite stations? Well, per 2023 data, fewer and fewer core radio listeners are listening via a traditional broadcast radio.

“One of the ongoing issues in radio is the digital transformation,” said Jacobs during the presentation. He said, at present, only 58 percent of respondents report listening to the radio on “traditional” platforms — i.e. an AM/FM radio in a vehicle, at home or at work/school.

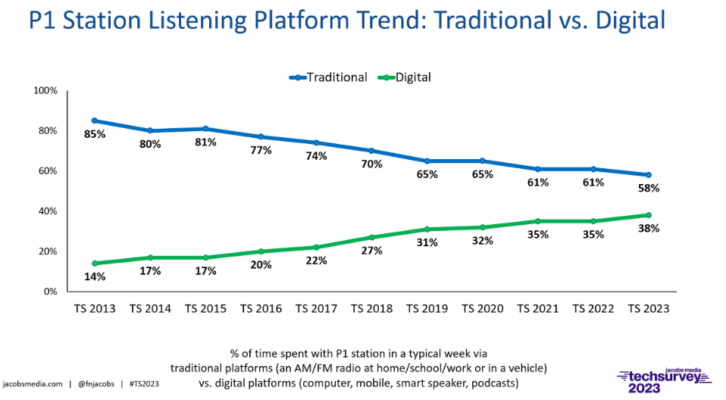

When comparing this year’s data to 2022 Techsurvey findings, Jacobs said digital devices are quickly becoming the preferred way to listen to broadcast radio; and they maintain a “steady and historic rise” over traditional ways of listening.

The graph below reports how respondents said they tune into their P1 station (the one which sent them the survey). The preference for digital platforms grew three percent in the last year.

Moreover, fewer than eight in 10 core radio listeners said they have a regular radio where they live, much less so for Millennials. While 85 percent of Baby Boomers report owning a radio in their home, only 67 percent of Millennials surveyed can say the same; and, as can be seen below, the divide between time spent listening via “traditional” or “digital” platforms continues to grow smaller.

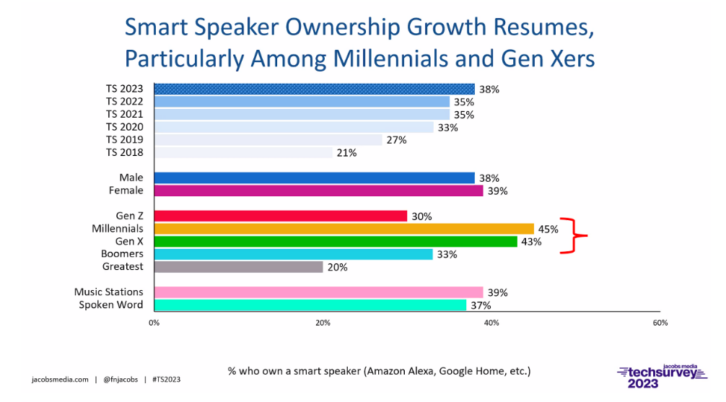

While regular radios at home continue to disappear, Jacobs said mobile phones and smart speakers have “become radio’s BFFs.” Because of these changing trends, Jacobs said “it’s good for radio to promote smart speaker usership” and for stations to consider taking advantage of what mobile apps could offer.

“It is so important that you are represented there,” he said. “Mobile strategy is getting more and more important with each passing year.”