Gordon Borrell has seen a lot of changes in radio over the past seven years, and he’s pleasantly surprised.

Not that long ago, he was reporting that the industry was slow to embrace digital media. “Then, all of a sudden, they did! I wouldn’t say it was a smart move, but actually very lucky. The internet first threatened print media more than broadcast, so radio has had time to observe, learn, adapt and now make the right moves.”

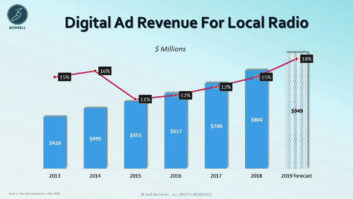

And radio is moving into digital. The Borrell Associates CEO recently released the seventh annual Benchmarking Report for the Radio Advertising Bureau. The survey of radio buyers and managers about ad expenditures revealed that local stations generated $804 million in digital ad revenue last year, up 15% since 2017.

There is probably no one happier about this than RAB President Erica Farber.

“There was a time when, if an ad buyer told their radio rep that they’re spending more on digital ads, the reaction was, ‘Oh well, we’re losing our money.’ Now, radio has a strong story to tell about digital,” Farber says.

According to the report, the average radio station brought in about $256,000 in digital revenue in 2018, and the average market cluster $1.15 million. Digital revenue represented 8.8% of total ad revenue and is forecast to reach 10.7% in 2019. The top performing station groups are generating three to five times the average digital revenue for their markets.

While bigger radio companies with stations in major markets had the means to invest in digital earlier, much of the new growth is now in smaller and medium markets. Borrell cites the stations owned by Mid-West Family Broadcasting as an example.

“They’re all on board with a positive attitude about digital,” Borrell says. “They’re dyed-in-the-wool radio people, and you might think they’d pay lip service, then hit some obstacles, and go back to just selling radio. No, not the case. They’ve said, ‘This is our future.’”

THE SECRET TO SUCCESSFUL SALES

What’s the single most important factor for success in selling digital advertising at radio? During separate interviews, Borrell and Farber both answered without hesitation, “It’s training.”

Farber explains, “It’s hard in this day and age to know everything, right? Digital can be anything from running some kind of audio and/or video spot, SEO or a social campaign or website design. It’s a different language. Different metrics, different data, and there are different ways to analyze it than traditional media.”

Borrell believes the whole sales staff should be trained in digital, even though “a good salesperson that is knocking their radio sales goal out of the water shouldn’t be distracted to force them to sell a smidgen of digital just to meet a digital goal.”

“There are some stations who have digital specialists,” says Farber. “There are other stations where everyone does everything.”

More important than a station’s internal structure is tailoring your approach to each client’s needs.

“The most successful stations go after ‘share of wallet,’” says Borrell. “They stop and strategize about individual advertisers, and they’re very surgical with vertical categories like automotive or QSR’s or health.”

SOCIAL MEDIA & PODCAST IMPLICATIONS

While most sub-categories of digital advertising sales are growing, subscribers to the report will see that social media is leading the way, along with database email, search engine marketing, streaming and video ads. Farber sees social media’s increase as good news for air personalities.

“The public is recognizing that big name national influencers are hugely compensated to endorse brands online,” she says. By contrast, “local influencers, the people they listen to every day on the radio, have a relationship with their audiences, and they’re highly trusted. They’re people who live and work in the same community.”

Borrell also predicts significant revenue growth from podcasting ahead. “It’s really lit a fire under radio because it’s something that they finally understand. What the hell does the average radio manager know about search advertising or social media? They recognize the opportunity with podcasting, because it’s audio.”

The study found that 25% of radio’s customers are buying digital advertising from them, “which means 75% aren’t using radio’s digital assets. That’s a huge opportunity,” says Farber.

[Does Radio Drive Store Traffic]

There’s even a small but growing portion of radio clients who are only buying digital from them, not radio. Farber says, “The days of saying, ‘I’m going to go out and sell radio spots’ don’t exist anymore. We are partners who understand what the client is trying to accomplish, and we now have all these tools to deliver customers to the advertiser.”

As a longtime advocate urging traditional media to incorporate digital in their offerings, Borrell says these survey results “are a delight to see. At first, digital is threatening, it’s scary, it’s confusing, but people are getting past that initial reaction. More and more people love digital equally with radio. They’re taking that positivity into the marketplace, and good things are happening.”

Borrell and Farber will participate in a session at the NAB Show on Tuesday April 9 called “Digital and Data: From Disruption to Acceleration,” along with executives from Univision, Hubbard and Townsquare Media.