Nielsen is moving ahead with an important change in how it measures radio listening.

We had reported earlier that the company was considering this plan to shave two minutes off the time required for a station to garner credit for an average quarter hour (AQH) of listening. A three-minute threshold instead of five would qualify more listening to be counted for measurement purposes.

That plan is now proceeding. “As a result of this enhancement, radio and its advertisers will get credit for more of the audience that hears their ads and content,” the company told clients this month. It said the change was made after five months of planning and analysis. It will begin with the January 2025 PPM survey period and affects 48 Nielsen Radio PPM markets. [Read a Radio Advertising Bureau summary sheet.]

Nielsen listed expected benefits in its letter to clients. It said the change will increase measurable ad impressions; provide more comprehensive daily cume reporting, “expanding the base of panelists that make up each station’s ratings and adding granularity in audience measurement”; expand options for advertisers by creating more viable dayparts and format opportunities for better-targeted campaigns; and allow broadcasters to experiment with the length, quantity and placement of commercial stop sets to maximize tune-in.

Pierre Bouvard, chief insights officer of the Audio Active Group at Cumulus Media/Westwood One, wrote about the expected change on his blog earlier this fall as described in a story by our contributor Randy Stine. He said the change could result in an increase in reported listening levels of 24% in Portable People Meter markets and 10% nationally.

Bouvard said the change could mean that AM/FM radio listenership would surpass TV in 25–54 average audience ratings and widen its ratings lead over linear TV among 18–49s by 47%. He thinks the implications for radio would be profound: The trend of radio listening surpassing TV would accelerate, he wrote; 2025 post-buy analyses would overachieve 2024 media plans; and AM/FM radio would achieve “reach” growth in advertising schedules. He believes radio ads could also become more effective as stations increase the number of commercial breaks with shorter durations.

“Since the introduction of the Portable People Meter, most AM/FM radio stations schedule their two commercial breaks around :15 and :45 past the hour. This strategy was designed to maximize five-minute listening durations,” he wrote.

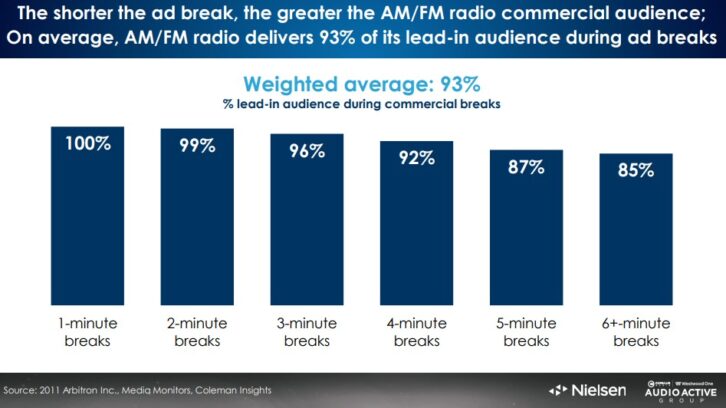

With a three-minute quarter-hour qualification, stations could create more breaks of shorter duration, which he thinks will significantly benefit advertisers. He cited data showing that two-minute ad breaks retain 99% of the lead-in audience. Six-minute ad breaks retain 85% of the lead-in audience. (See the accompanying graphic.)

He said recent analysis of PPM tuning showed that nearly a quarter of listening occasions are three or four minutes. “Under the current edit rules, none of that listening is credited,” he wrote.

Nielsen recently reprocessed all 48 of the May 2024 PPM markets, comparing the listening estimates based on the existing five-minute edit rule and the proposed three-minute edit rule. Overall, most of the 24% growth in listening would be due to growth in time spent listening, but reach would be up by mid-single digits in all demographics.

In a video accompanying his blog Bouvard said the change in how Nielsen tabulates listenership would mean a 19% increase in weekly time spent listening and a 4% weekly cume increase. Read the Bouvard post.

Network radio advertisers transact on Nielsen’s national audience service called Nielsen Nationwide. A projection by Scott Anekstein, VP of research at Westwood One, shows Nielsen Nationwide AQH for AM/FM radio will increase 9% to 10% in 2025 due to the effect of the switch.

Bouvard said it’s possible some stations will see wider growth in reported listenership levels depending on the format. “Spanish tropical, hot adult contemporary, rhythmic contemporary hit radio and urban contemporary will show the greatest potential average quarter-hour audience growth.”

Not all observers posted raves when the change became official.

Glenda Bos of media research company Harker Bos Group wrote last week, “We’re glad to see Nielsen moving toward more accurate measurement.”

However she cautioned that Nielsen won’t release full data until April. “But here’s the thing: January is critical for sales, and stations can’t afford to wait until spring to leverage these numbers. Nielsen already has the data — so why the delay? Stations need to sell now, not four months down the road.” (Read that here.)

Consultant Tracy Johnson of Tracy Johnson Media Group wrote, “AQH is how stations justify ad rates. Smart buyers will recognize the sleight of hand and recognize that they are paying for increased ‘listening,’ but their ad has up to 33% less chance of being heard.” His commentary here discusses the strategy implications for programmers.

Johnson concluded, “Will the magic trick work? Maybe. It should increase quarter-hours and make stations feel better, but whether that provides relief for ailing ad revenues is another topic.”