It’s not too late for radio broadcasters to get a piece of the subscription audio pie. So says streaming audio technology company Clip Interactive, which wants to build a business by helping radio do just that.

“The current combined U.S. subscription revenues of Apple Music, Pandora, SiriusXM and Spotify are worth $11.5 billion annually,” said Bill Freund of Clip Interactive this spring. Had U.S. radio developed its own on-demand subscription streaming audio service a decade or more ago, Freund added, they could have grabbed a big slice of that.

“Such a service could include commercial-free content, plus all of the personalities, local information, sports and all the other entertainment that broadcast radio provides,” he said. “They could have really leveraged this space and made money from it.”

The opportunity to make money from ad-free/on-demand subscription audio is not lost, as far as Clip Interactive is concerned. The Colorado-based company has developed a paid radio streaming app called Magic. What Freund calls a “technology demonstration app” was released to some broadcasters the final week of June.

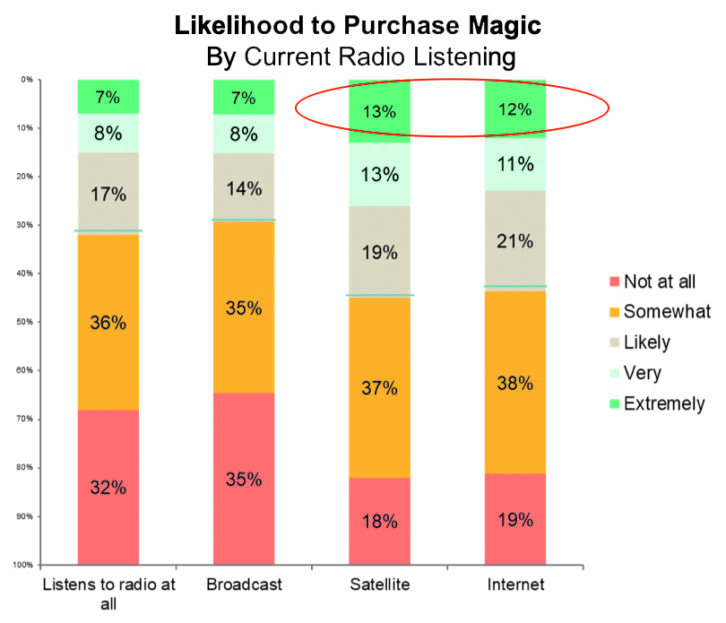

The company believes at least 10 to 15% of radio listeners are willing to pay $12 each month to hear ad-free local radio. According to Freund, even that is a conservative estimate.

“Actually 32% of 2,000 listeners surveyed in a Harris Poll said they’d be willing to pay $12 a month for commercial-free on-demand broadcast radio streaming,” he said. This breaks down as 45% of SiriusXM, 43% of internet radio listeners and 29% of AM/FM listeners.

$12 PER MONTH

It would be expensive for individual broadcasters and even radio groups to develop their own subscription radio services. But using a Magic-style app, Clip says, listeners could replace on-air commercials with favorite songs/talk segments, request local traffic and weather on demand, and yet stay synchronized to a station’s on-air transmission, whether listening directly through their smartphones or smart speakers or in the car.

This is why Clip wants to aggregate all U.S. radio streams onto the Magic platform, a significant difference from iHeartRadio’s offering that only aggregates iHeartMedia streams and podcasts.

Freund explains, “It is really like the radio dial for all existing stations, only without commercials.” Freund also highlighted the simplicity of the Magic user interface, which will utilize voice controls to skip and request content. Finally, Freund says that the commercials will not just be skipped but will be “covered by new content,” such as other radio segments, music discovery created by program directors, podcast clips or perhaps even user-generated audio.

[From 2015 — Clip Interactive Launches Independent Broadcaster Program]

The company will handle the heavy lifting involved with ad/song substitution and skipping, on-demand content requests and stream synchronization. The mixing would be handled by Magic’s artificial intelligence, which would act as a curator/DJ to ensure smooth transitions. The Magic AI would also keep tabs on each user’s content choices, to suggest song/genre choices to them.

“Say the user was listening to their local Cumulus CHR station, and that station went into a commercial set,” said Freund. “Our AI could be programmed to switch the user to another Cumulus station in the same genre, seamlessly switching them back to the local station once the commercial set was over.”

The bottom line for Magic subscribers would be ad-free broadcast radio that they could let run uninterrupted or control at will using voice commands. Either way, the commercial sets that many listeners find irritating would be a thing of the past, at a cost of $12/month.

BUSINESS CASE

The fact that some of radio’s listeners would now be tuned into Magic rather than over-the-air broadcasts would not substantially affect radio’s OTA advertising revenues, Freund contends, but would give these stations access to subscription revenues that didn’t exist before.

How much money each station could make would depend on how many subscribers on the Magic platform select their audio streams, and for how long. This is due to the business structure of the Magic platform: All of the subscriber revenues are combined into a pool, whose net is split between Clip Interactive and its member stations.

For its portion of the take, the company will handle all aspects of the Magic playout platform, including paying royalties and all other fees on the broadcasters’ behalf. The Magic platform makes it possible for broadcasters to earn revenues from subscription radio without doing anything beyond providing a stream to the company.

Clip Interactive is promoting its Magic platform to U.S. broadcasters and sponsored a session at the recent NAB Show to spread the word. The message Freund wants to get across to broadcasters: “Magic would allow them to get a share of the subscription audio market, without having to do anything on their part.” With $11.5 billion in play annually, is it a business case worth considering? Freund says it’s currently working on a Nasdaq initial public offering slated for September, concurrent with the release of an alpha pilot of Magic, during which the company plans to work with its first partner broadcaster. Later in 2019, Magic’s beta version will be released, and Freund says the company “hope[s] to expand to any broadcaster who is interested.”

ABOUT CLIP INTERACTIVE

According to its website, Clip Interactive develops “technologies that identify, unitize and deliver audio content to consumers so they can listen to what they want, when they want.” Among its offerings, Clip coordinates placement of digital ads with on-air ads using machine learning algorithms; and it aims to offer “a comprehensive marketing technology platform that can target and measure like digital.”

The firm was founded by Jeff Thramann. Michael Lawless is CEO. In early 2018, Clip Interactive announced it hoped eventually to become a public company.

Bill Freund is EVP and chief business development officer as well as an equity partner. He is perhaps most familiar to the industry as co-founder of Triton Digital. He has also worked at Podcast One, Westwood One, Katz Media Group and AM/FM-Chancellor, and he founded a capital advisory company.