People are talking to Alexa; but the smart speaker isn’t the only one listening. Radio industry leaders are paying attention — designing digital plans to make listening to their own streams on voice assistant platforms as easy as possible.

Smart speakers in the home have expanded the audio landscape quickly. Radio broadcasters have been watching this trend from its outset, as we have reported, and they continue to seek ways to take advantage of the voice-driven technology.

How Americans consume audio is always evolving, experts say; but smart speakers continue to be on the leading edge of change right now. A recent blog post by Westwood One was headlined “Smart Speaker Popularity Continues Full Speed Ahead.” Jacobs Media’s Techsurvey 2019, which polls radio listeners, found that about one in four of their homes have a speaker. More broadly, the Consumer Technology Association puts the number at 31%. Some estimates are even higher.

Interestingly, uptake appears to increase significantly in major markets like New York and Philadelphia, where nearly 50% of homes have one, according to recent data from Nielsen. It tracks the number of smart speakers found in PPM panel homes.

Jacobs Media’s Techsurvey indicates that the most common use of a home smart speaker (at least by the radio listeners Jacobs focuses on) is asking a general question, but a quarter listen to music from an AM/FM radio station. Fifteen percent listen to news or talk from an AM/FM station.

IMMEDIATE OPPORTUNITIES

Analysts interviewed for this story expect the home speaker movement, led by Amazon’s Alexa and Google’s Home, to continue to expand into more homes. Changing economics created by technology advances appear to have created a sense of urgency among major radio group owners to bulk up efforts to reach audience via home smart speakers.

The Jacobs survey found that 9% of respondents say they listen to a lot more radio since owning a smart speaker. The respondents were fairly evenly split among those who listen for music and others who listen to news/talk radio stations.

That same survey found that just over half of listeners say all or most of their AM/FM radio listening is done in the car, which leaves broadcasters scrambling to fill the home listening market, experts say.

Bob Kernen, chief operating officer for jacAPPS, the mobile app developer division of Jacobs Media, said savvy radio broadcasters are focused on smart speakers as a new way of getting radio into — or back into — the home.

“Broadcasters are focusing more on their digital streams, but the opportunities go way beyond that,” Kernen said.

“Podcasts are another immediate opportunity.”

Capitalizing on Amazon skills to make sure internet streams can be found easily on voice-driven technology platforms is important, Kernen said.

“It’s all about getting the invocation name right. And that’s getting tougher and tougher as more and more skills get produced, because you can only get one. Then stations need to promote that on the air,” Kernen said.

Radio broadcasters typically guard their streaming numbers closely, so it’s difficult to estimate the overall growth from home speaker listening, several observers told Radio World.

Major broadcast groups like National Public Radio and iHeartRadio are making significant efforts to penetrate the home speaker space, but many other ownership groups are diving in too.

“LONG INTO THE FUTURE”

Larry Linietsky, senior VP of operations and business development for Cumulus Digital, said the radio broadcaster has put a lot of emphasis on the smart speaker segment.

“We have Alexa skills for 367 of our 428 stations, and we have Google actions for 17 of our largest podcasts,” Linietsky said.

Cumulus’ digital department works on streaming, podcasting, web and station application solutions. It has developed Alexa and Google home skills that help extend radio messages into digital consumer touch points, Linietsky said.

“Via our partnerships with iHeartRadio and Tunein, we have access points on all smart speakers through numerous methods. We think smart speakers bringing shared listening behavior back into the home, which is something radio has always been good at.

“Cumulus looks at the percentage of listening per month that is coming through smart speakers and it is about 20% of total online listening hours in 2019. That’s from nearly zero percent in 2017,” Linietsky said.

The broadcaster’s digital platforms for streaming include websites/desktop, mobile apps, connected TVs and smart speakers. The majority of the company’s streaming occurs on mobile and desktop, according to Linietsky.

Meanwhile, Beasley Media Group is extending its brand to be “highly relevant across as many platforms as possible,” including smart speakers, said Justin Chase, EVP of programming for Beasley.

“As good as our Alexa skills are now, we are in the process of improving them and rolling out skills on the Google platform. Beasley sees the incredible growth of smart speakers and we will continue to be committed to the strategy long into the future,” Chase said.

Beasley was the first major broadcast company to roll out custom Alexa skills, Chase said, and the company is seeing at least 20% of its streaming audience on smart speakers.

GOING DEEPER

The move from tabletop home radios to smart speakers will likely benefit AM radio stations with poor signals facing increased signal interference, according to James Cridland, a radio “futurist” watching the space closely.

“The research shows that people use more audio after they purchase a smart speaker, and they are in a shared space like the home, which is beneficial,” Cridland said.

So far aggregators that provide live streaming and on-demand audio services are doing a pretty good job at the basics, Cridland said, especially those owned by the radio business, like Radioplayer in Canada, the U.K. and parts of Europe; RadioApp in Australia; and iHeartRadio in Canada and the United States.

“However, TuneIn appears not to care about radio, frequently carries outdated and wrong information about stations, and is a poor experience, especially with smart speakers,” Cridland said. “It›s a disappointment that the radio industry continues to be so reliant on a partner that is so disinterested in them.”

Podcasts and on-demand content on smart speakers are not especially popular, Cridland said, and are likely better suited for headphone listening.

“Some broadcasters are adding additional streams to smart speakers; others are even dabbling with contesting, on-demand sports reports and audio event calendars. But a smart speaker seems ideally positioned to carry the live radio station output,” he said.

Radio broadcasters will follow when listening patterns shift, said Mike Bergman, senior director technology and standards at the Consumer Technology Association.

“If these personal digital assistants become a dominant mode of entertainment in the home, radio is certainly smart to find penetration opportunities,” Bergman said. “If a broadcaster is not tapping into connected speakers they are probably missing out.”

NAB says it touting the benefits of voice assistants in the home, believing smart speakers now allow local radio broadcasters to reach millions of listeners.

“Music listening and tuning into news programming are two of the top uses for smart speakers. As smart speaker ownership continues its growth, local radio will benefit greatly from this new opportunity to engage with our audience,” said Zamir Ahmed, VP of media relations for NAB.

Other tech leaders say radio is making significant gains in stream counts and time spent listening by promoting specific skills to find local stations on smart speakers.

“We have seen data that show radio groups that promote their skills on air are measuring more than 50% of digital listening on smart speakers,” said Pat Higbie, CEO and co-founder of app developer XAPPmedia.

The company works with NPR and Cumulus on delivering voice interactive campaigns for advertisers like Chex, Mattress FIRM, Case Knives, ADT, Walmart, Lagunitas, Target and others. XAPPmedia is pushing radio clients to maintain a high level of on-air promotion of skills.

“The potholes are there for stations that stop the on-air promotion of skills, because Alexa and Google Assistant are becoming more prevalent in the car, so radio owners must keep their stations top of mind in order to stave off competition in the car,” Higbie said.

“In addition, having your radio station only accessible behind an aggregator skill reduces discovery and your ability to hone the listener experience.”

Voice interactive advertising is changing radio monetization on smart speakers, Higbie said. Voice interactive ads include a call to action for listeners to connect with the advertiser via Alexa skills and Google Assistant actions, he said.

RADIO GETS ITS SHARE

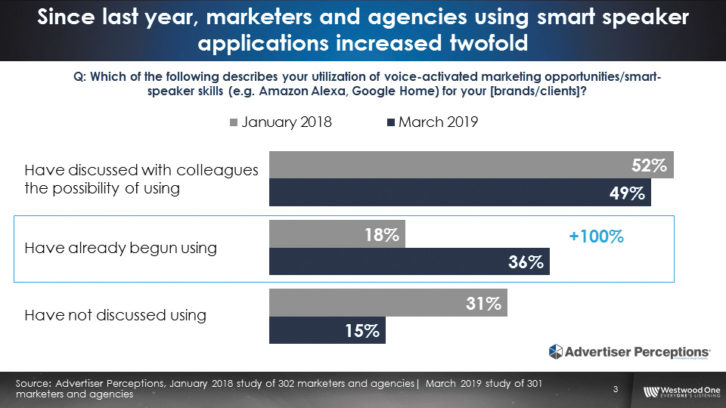

The following are highlights from the “Westwood One 2019 Audioscape” report, which uses data from Edison Research and Advertiser Perceptions.

“AM/FM radio and Amazon Music lead in share of smart speaker time spent listening” — The report found that in the second quarter of this year, AM/FM radio (18%) and Amazon Music (17%) led in share of listening on a smart speaker, according to Edison Research. “This is a result of AM/FM radio stations developing voice-activated applications to enable listening on smart speakers and their aggressive promotion of Alexa and Google Home listening.”

“Smart speaker ownership growth isn’t slowing down” — It said the number of Americans who reported owning a smart speaker increased threefold from the second quarter of 2017 to the same period two years later. Estimates on ownership vary, but Edison Research put it at 30% of Americans owning a smart speaker now.

“Marketers and agencies are immersing themselves in voice-activated advertising” — This is shown in the graphic in the main story and is based on research by Advertiser Perceptions. It also found that among media agencies and brands that haven’t started using smart speaker applications, “their likelihood to use these marketing initiatives within the next six months has increased.”

“Millennial podcast growth is powered by ethnic and female audiences” — The Westwood One report also explored trends in podcasting and found that in Q2 of this year, millennial 18–34 podcast daily reach grew 13% over the prior year, to 17.3%. “Driving this growth is 18-34 African Americans, Hispanics and women. These segments are growing faster than the overall 18–34 demo.”