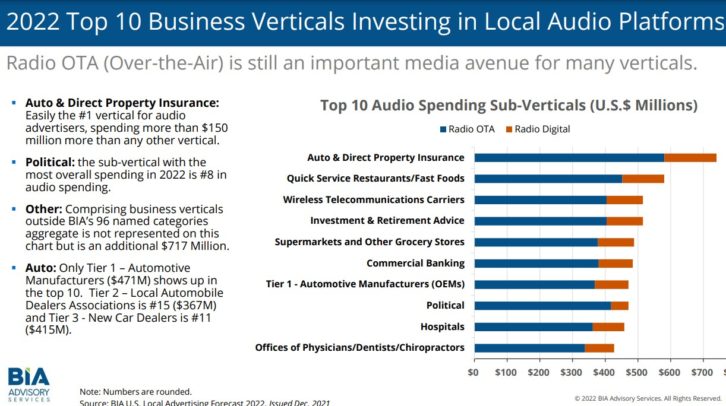

Broadcast radio remains an important advertising channel for many U.S. business verticals, but the local audio advertising marketplace continues to become more competitive thanks to streaming and podcasts.

That’s the assessment of BIA Advisory Services, which released tidbits from its latest “Local Audio Advertising Forecast.”

“While the shares of local Radio OTA (Over-the-Air) advertising is eroding, Radio Digital is increasing, providing radio stations an avenue to still increase their sales,” it wrote.

“Overall, BIA forecasts $14.7 billion will be spent [in 2022] in ad-supported local audio platforms including broadcast radio and digital audio.”

It projects the following revenue for 2022 from each of these local ad-supported local audio platforms:

Radio OTA (Over-the-Air): $12.7 billion. This category is revenues generated by local radio stations for sale of time to national or local advertisers from their over-the-air broadcasts; but it does not include advertising sold by the national radio networks.

Radio Digital: $1.7 billion: This is revenues generated by local radio stations from national, regional and local advertisers targeting a local market from their online activities. Includes display and streaming advertising revenue other than Pandora.

Pandora: $400 million. This is audio and display advertising revenue generated by Pandora from national, regional and local advertisers targeting a local market. BIA counts Pandora as local revenue, compared to other “new audio” platforms that are centered on nationwide models.

[See Our News and Business page]

BIA provides local audio forecast data for each of the 253 radio markets and across 96 business verticals.

The company also broke out the verticals that do the most business with radio.

“Overall, the Top 10 business verticals spending in local radio’s OTA and Digital platforms are shown in the chart below, led by Auto & Direct Property Insurance and QSR/Fast Foods, each of which are the top spending in both the broadcast and digital radio categories.”