iHeartMedia’s recent announcements of new partnerships with TikTok and Amazon are further proof of the its evolution, company officials say, as it seeks to improve its earnings through digital growth.

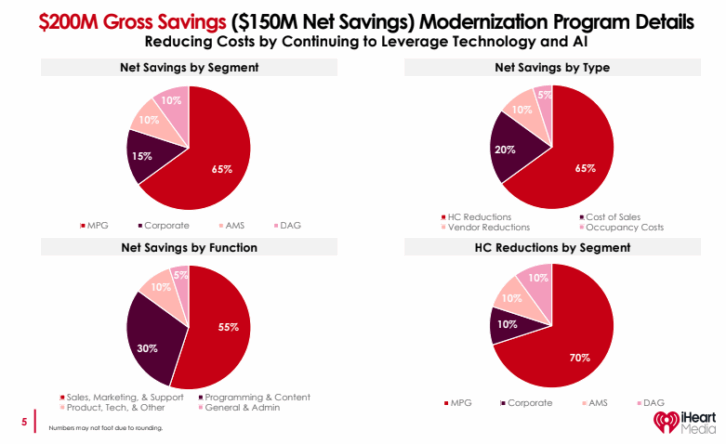

However, cost structure is also playing an important role in reshaping the media company, says CEO Bob Pittman. iHeart is still on track to generate $150 million net savings in 2025, he says. The company’s third quarter 2025 results included $40 million of net savings, said Pittman.

Additionally, there’s potentially another $50 million of incremental annual savings beginning in 2026, Pittman said.

“We run the company with a relentless focus on maximizing the efficiency of our operating structure, including using new technologies like AI-powered tools and services,” Pittman said on a call with analysts on Monday.

The majority of those cost savings will benefit the company’s Multiplatform Group, which includes iHeart’s radio stations, according to iHeart President Rich Bressler. Radio World previously reported that the company implemented another round of cost cutting in October that resulted in head-count reductions.

[Related: “Reports Mount of Cuts in Staff at iHeartMedia”]

Pittman said Monday the new relationship with Amazon Ads and the new TikTok partnership are critical to the media company’s future.

“We are committed to exploring new ways to unlock the value of our unparalleled assets, maximizing the unique position we occupy in the evolving media landscape, and creating innovative cross-platform opportunities to bring new products and services to our consumers and our advertising partners,” Pittman said.

Last week’s announcement of iHeart’s programmatic audio partnership with Amazon will provide advertisers using Amazon DSP access to the broadcaster’s vast audio portfolio, he said. iHeart’s non-podcast digital inventory will be available immediately, and podcast and broadcast radio inventory will follow in 2026.

“One of the essential components of our programmatic capability is the digital iHeart audience database, which includes the radio simulcast listening on our digital services,” Pittman said.

The TikTok announcement on Monday includes the launch of the TikTok Podcast Network. The alliance also includes the launch of TikTok Radio, a national broadcast and digital station pairing TikTok influencers with iHeart personalities.

iHeart says its consolidated revenue for the quarter ending Sept. 30, 2025, was $997 million, down 1.1% compared to the same period the prior year, but up 2.8%, excluding political revenue, from 2024. The company had a net loss of $66 million for the most recent quarter.

Digital remains a bright spot for iHeart. Digital Audio Group revenue of $342 million was up 14% this year compared to Q3 in 2024. Meanwhile, podcast revenue increased by 22% to $140 million in the third quarter.

The Multiplatform Group reported revenue of $591 million, down 5% year-over-year. However, excluding political revenue, the division’s revenue was down 3% overall. Broadcast radio brought in $427 million in the quarter while Premiere Networks accounted for $114 million.

Broadcast radio still plays a critical part of the company’s overall strategy, Pittman said.

“We have more radio listeners today than we had 10 years ago or 20 years ago,” Pittman told analysts. “Our challenge is one of monetization.”

Pittman says the company is confident the radio station group can get its revenue growth on the right track.

“Historically, we’ve seen that the largest advertisers and advertising agency groups are a good indicator of what’s to come and we continue to see growth in the performance of the top 50 advertisers and the four largest advertising agency groups for both the Multiplatform Group and the total company,” he said.

Meanwhile, iHeart’s Audio & Media Services Group reported revenue of $67 million in Q3 2025, down 26% YoY. Most of the decline was again attributable to the loss of political revenue at Katz Media, according to the company’s filing with the U.S. Securities and Exchange Commission. Excluding the impact of political revenue, the division’s revenue was down 3.4%.

While iHeart is still closing the books for October, Bressler said the company expects October revenue to be approximately flat, excluding the impact of political revenue from Q4 2024.

The company anticipates strong growth in podcasting revenue and a robust political advertising cycle in 2026, according to its financial release.

It reported $4.6 billion of net debt as of the end of September.