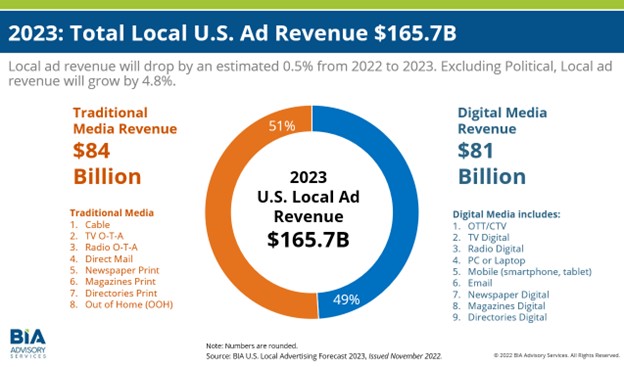

BIA Advisory Services thinks that revenues across all U.S. media will decline — slightly — in 2023, no thanks to a big dropoff in political advertising after this year’s elections.

The company issued its latest U.S. Local Advertising Forecast. It thinks the total number across media will be $165.7 billion, down 0.5 percent from the company’s estimate of $166.5 billion for 2022. Taking political advertising revenues out of the calculations, BIA thinks local ad revenue will grow 4.8 percent.

“The almost flat revenue projections for the year indicate continued economic and supply chain concerns, yet the forecast is more bullish starting mid-2023,” the company said.

BIA expects U.S. radio revenue to decline slightly to $13.5 billion next year, from $14 billion this year. That estimate includes all spot revenue from OTA radio, from national, regional and local advertisers, as well as radio online advertising.

Nicole Ovadia, VP forecasting and analysis, was quoted in the announcement: “This year has been filled with contrasting economic indicators creating several challenges for the local advertising marketplace. Supply chain issues continued to plague the first couple of quarters of 2022 making it difficult for local media sellers. In the summer, we had higher hopes for the remainder of the year; however, inflation issues and recession fears started to set in and that stalled anticipated rebounds in key verticals such as automotive.

“For our 2023 forecast we lowered near-term expectations to reflect the current economic climate that we anticipate will stay with us into next year.”

The firm expects digital platforms to continue to gain on traditional media, growing their share to 49 percent of the overall advertising spend.

The top paid media channels for 2023 will be direct mail, mobile and PC/laptop, it said, though direct mail’s growth has slowed substantially. TV digital, Over-the-Top (OTT) and mobile will see the largest increases by percentage.

Business verticals that are expected to grow the most include education, retail and restaurants. Sectors expected to show declines are political (down a huge 78 percent), as well as leisure/recreation and real estate. “The automotive vertical is projected to grow 4.9 percent, but not until the latter part of 2023,” BIA said.

Ovadia said the outlook could improve if the Federal Reserve slows or stops raising interest rates, inflation slows or the anticipated recession is smaller than expected. “Even with the economy in flux, the continuing strength of the labor market and corporate profits makes me feel confident that key verticals will show growth in the year ahead.”