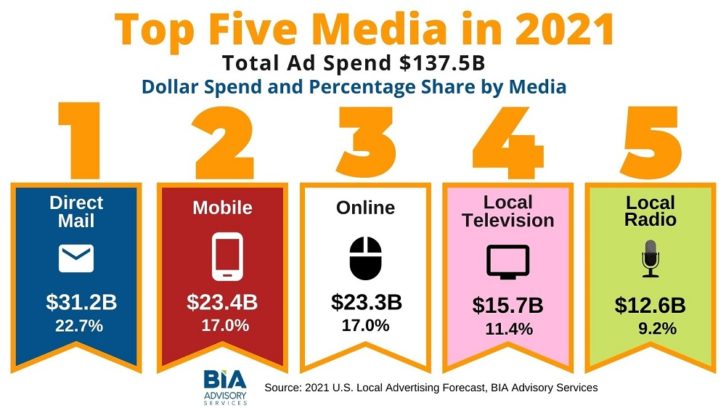

The commercial radio business may be challenged in the United States right now; but it will still be in the top five media platforms in terms of local ad revenue next year, and it should hold onto its share of the overall local ad market.

That is the projection of BIA Advisory Services, which released its U.S. Local Advertising Forecast.

It believes total local advertising revenue across all media in the U.S. will reach $137.5 billion in 2021. “This estimate represents a 2.5 percent year-over-year growth from the firm’s final post-COVID estimate for 2020 of $134.1 billion, as businesses start to adapt and rebound from the pandemic lows,” it stated.

“As the expected presence of vaccines will help with the continuing rebound in the economy, we expect this increase will occur throughout 2021 even without the presence of significant political advertising.”

Radio, the company projects, will bring in $12.6 billion in ad revenue. (This includes all spot revenue from OTA radio, from national, regional and local advertisers, as well as radio online advertising.)

That performance would be up 1.4% from BIA’s latest estimates for 2020, the company told Radio World, and it would keep radio at about 9.2% of the local ad pie, “pretty flat” with this year’s 9%.

The graphic shows the top five categories with dollar totals and percentages provided by BIA.

Overall the company thinks traditional media revenue will see a slight decline from this year, while digital media will grow a few percentage points and reach 44.7 percent of total local media revenue.

“Although we are estimating an overall increase in total local advertising next year, we do not expect spending to recover to pre-COVID (2019) levels until 2022,” said Mark Fratrik, chief economist and SVP at BIA Advisory Services.

“The availability of a vaccine early in the new year will be a key factor to a much stronger year for almost all vertical advertising as the economy rebounds and consumers start moving around more freely and even going back into the office.”

“This year saw a very strong shift into digital media for its lower costs, accountability and flexibility,” Fratrik said in a press release. “However, it also included substantially improved targeting, attribution and ROI tools from broadcast TV, broadcast radio and MVPDs that cannot be ignored.”

Speaking of TV and radio, the company wrote: “Even with the onslaught of new digital competitors, these traditional media still retain sizable audiences that many national and local advertisers want to reach.”

But it said local mobile and online will account for more than one-third of all local advertising, and that OTT advertising will continue to grow; it described OTT TV and the connected TV segment as “game changers for the broadcast industry” because of how easy it is to purchase fragmented inventory and do audience targeting.