Nielsen Audio continues to tweak the technology behind its radio ratings process. The research company plans to expand Portable People Meter panels by 10 percent and enhance watermarking in steps to improve its audio “currency” in the top 48 radio markets in this country.

Nielsen executives believe growing the size of the PPM panels combined with an improved monitoring process for radio stations will boost ratings and lead to higher advertising revenue for radio clients. However, there is some skepticism within radio circles about how cross-platform measurement, including podcasting and streaming, will work. Some observers point to the bigger picture that includes measuring digital and competitors like Pandora and Spotify — not to mention SiriusXM satellite radio — in order to get a true representation of radio’s value to advertisers.

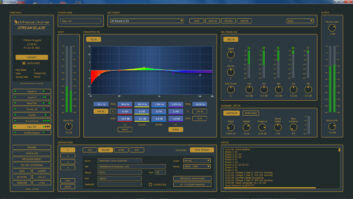

Encoding monitors are seen in closeup.

Nielsen’s radio business, acquired when it purchased Arbitron for an estimated $1.3 billion in 2013, had revenues in 2016 of $500 million with some minor slippage (0.8 percent) from 2015, according to earnings reports.

Radio World spoke to Kelly Abcarian, senior VP, Nielsen Product Leadership, and Arun Ramaswamy, chief engineer for Nielsen, about the challenges facing the measurement company in a consumer environment that is ever more complex.

The discussion touched on recent PPM technical concerns, enhanced critical band encoding technology (CBET), improved station monitoring capabilities, the Total Audience Measurement product, the Voltair controversy and the impact the $560 million acquisition of Gracenote’s metadata business might have on Nielsen technical operations.

Radio World: How would you characterize Nielsen’s current role and business standing with its U.S. radio customer base?

Abcarian: Nielsen remains the trusted currency for the U.S. radio marketplace. We continue to focus on the solutions that we can bring to our audio clients. We continue to work with them closely to meet their evolving needs and are committed to investing to grow and deliver on innovations in the years to come.

Arun Ramaswamy

RW: Late last year the Media Rating Council withheld its accreditation for Nielsen’s December data in 26 markets following some PPM connectivity issues. You disputed their conclusion. What should radio managers know about that technical problem and the outcome and do you think it has undercut their confidence in Nielsen to deliver?

Abcarian: In the case of the December monthly, I think it was no surprise that Nielsen and the MRC don’t always agree on decisions that get made. And we did not agree with their decision to withhold their accreditation for the December monthly data.

Following the PPM connectivity issue, we spent a lot of time across our data science team conducting a rigorous analysis of the data quality. The sample performance for that December monthly book was very much in line with the standards that we have used in which to release data as we had across the first 11 months of the year. As a result we stood firmly behind the December monthly estimates, which is why we chose to release them to the marketplace.

RW: Is there any ongoing discussion with the MRC?

Abcarian: We provided a set of documentation of the analysis that we performed and other details that the MRC requested, and all of that is in their hands now. We will wait to hear what the next step will be from them once they get a chance to review the data we sent them per their request. We’ll continue to work closely with the MRC.

Kelly Abcarian

RW: PPM has been around 10 years now, and you recently announced an increase in the PPM panel sample target. Nielsen calls the increase important due to the continuing fragmentation of audiences. What can radio managers expect to see? Will it further increase the number of radio stations listened to?

Abcarian: We are excited about that, and our clients are as well. Increasing the PPM sample size has been a priority for our clients. We are currently working through the plans for the increase. It takes a lot of planning to roll out a sample increase and it requires a lot of planning and process to get that in place. We don’t want to do any harm to the current sample while we expand it.

Our goal right now is begin the sample increase mid-year 2017 and then roll it out over a series of a few months so that the complete rollout in every market will be completed in 2018. Each PPM market will receive a target increase of 10 percent increase across all demographics. We think radio managers will be excited that we add more than 6,000 new panelists to the overall panel and that will represent over 65,000 people contributing to the ratings on a daily basis. We’ll soon have more than 80,000 meters carried or worn across the 48 metros. [Nielsen’s PPM receiver can be worn by participants for up to two years. — Ed.]

RW: A year and a half ago, trade headlines were all about the Voltair unit. Those developments raised questions about the quality of Nielsen encoding and whether others should be involved in the capture of PPM code in this way. For Nielsen, what is the outcome or result of that entire Voltair debate?

Ramaswamy: One thing I want to emphasize is the continued improvement from a technology perspective. Even prior to that condition, Arbitron and Nielsen had been continuously working on improvements to the algorithm. We are always looking at the environment for media measurement and how the consumers are changing. And one of the areas we targeted was enhancing the watermarking and to help in areas where it is hard to detect due to high background noise and those genres of music that are sometimes harder to encode.

Those algorithm improvements were comprehensive, and once we had development complete we took care to make sure deployments were flawless and seamless. We have worked closely with clients on the upgrade of the encoders for enhanced CBET to make PPM codes stronger and more robust. The nice thing about this technology is that it has brought in uniform improvements across all clients, which was absolutely needed.

In addition to the improvements to watermarking, we also set out to improve the monitoring by radio stations. So since then we have introduced the brand-new encoding monitor, which provide clients a lot more granular information on how the watermarking is performing. It’s a connected device so clients have database interfaces and a database backend to look at to give analytical insights on the watermarking.

RW: Update us on the rollout of enhanced CBET and introducing a new encoding monitor. What percent of radio stations in PPM markets have upgraded to enhanced CBET?

Ramaswamy: We began deployment of enhanced CBET in December 2015 and as of now 3,600 U.S. radio stations have been upgraded and about 8,400 encoders have been upgraded. We began deploying the new encoding monitors to clients in the PPM markets in June 2016 and I believe about 60 percent of our radio stations have put those online.

RW: What kinds of things are radio engineers able to pull off the improved monitors?

Ramaswamy: They can pull out logs filed from it. There are alarms that give them a very granular view of how encoding works. Now they can look at what part of the programming did my watermark perform best and what are the analytics around it. And of course the box is connected so we are looking at other enhancements we can do to assist the clients.

RW: What are Nielsen ratings’ theoretical margins of error in its radio measurement? Both paper diaries and PPM?

Abcarian: Clients can use the Nielsen Ratings Reliability Estimator to determine the margin of error for demos and day parts reported in our E-Book Service.

RW: One major complaint about PPM accuracy has been that the belt pack receiver can pick up decoded audio and register it as real listening when the carrier is not paying attention to that audio. Is Nielsen looking at ways for PPM to overcome that deficiency?

Ramaswamy: I wouldn’t necessarily consider that a deficiency. If you think about PPM as a premium currency grade device that mimics the human ear, every time the human ear can hear audio it is being registered and captured. You have to look at PPM as not just an isolated device, but an end-to-end system. We have made improvements to the watermarking, which should help in hard-to-encode environments, and we have made improvements to the detection part to detect those watermarks. We are obviously looking at all the metrics and trying to upgrade the fundamental operation of the PPM.

RW: What about the cost of all the upgrades?

Abcarian: We are putting investment dollars into radio to help continue to support our clients and grow the industry. This is obviously a large investment for this undertaking and initiative. Our goal is to help our clients to continue to advance the radio story in the marketplace. I can’t give you an exact figure, but we are investing lots of dollars in radio to help drive measurement forward.

RW: The software development kit or SDK allows Nielsen to measure audio consumption and engagement across devices. What kind of challenges does measurement of on-demand audio and podcasts present as audio publishing grows?

Abcarian: The interesting thing about podcasting is that the technology we have built for our digital streaming services is really fully encompassing across our strategy of our total audience tech, and nicely interplays with what is needed for podcasting. We have had lots of interest from clients to bring this solution to the marketplace.

Thanks to the work of Arun and his team for getting the SDK up and running in the 2013 timeframe, we have over 7,500 client-side software deployments up and ready across the radio landscape. So we are already in the first phase focusing on measuring AM and FM digital streams in a pre-currency preview period, and as we move into the second half of this year we will be expanding this to include all forms of audio podcasting, which will include podcasts and on-demand music streaming services.

This is really using big data to bring this type of measurement to our clients. We have a number of clients deeply engaged with us. We are working with ESPN closely on this. They are heavily committed to podcasting and working with Nielsen in order to test our solutions.

Ramaswamy: The SDK measurement for audio brings in the scale that is needed for this sort of measurement. By being embedded in apps and browsers it can capture and leverage the big data element.

RW: What technical updates should radio managers know about that are coming next?

Ramaswamy: We are continuously looking at all aspects of the audio platform from watermarking, to consumption to measurement. When we talk about PPM, which is a currency grade device and extremely high acoustics to pick up audio around it, the one technical track we are on is miniaturizing the core elements of the PPM that could then be embedded in other consumer devices, including wearables and other devices. We are studying ways the technology can be carried to measure audio consumption.

RW: When might we see more of that research pay off with technology in the marketplace?

Ramaswamy: We do have some working prototype right now. But when you look at the lifecycle of how something like this gets into the marketplace, obviously we have to stand behind the currency grade of the device. We have to make sure it meets the market needs, and to do that we have to get the data and product teams involved, making sure it is producing the right kind of data. And human compliance in term of carriage to make sure it is where it needs to be. Then, of course, client feedback and approval. We think this year we will come back with some of the technical feasibilities, but then all of the other steps need to follow in place in order for us to introduce it in the marketplace.

RW: What is the practical impact for the company of acquiring Gracenote? They are known for enhanced media metadata and ACR or automatic content recognition. What should radio customers know about it and your plans for it?

Abcarian: The deal just recently closed. We are actively underway with integration planning now that the deal has closed. We are excited about what bringing Gracenote into the Nielsen family can do for our audio customers. Gracenote is embedded in over 70 million auto infotainment systems today. So we are excited about leveraging that data and enhancing our audio business, thus evolving audience measurement — having another way to touch the consumer and understand engagement and discovery across video, audio and text. Their in-car audio and in-car digital listening. This will help us share with our customers how their content is being exposed to consumers and guiding purchasing behaviors and other tangible business outcomes to help grow business.

RW: Let’s discuss the Total Audience Measurement philosophy and truly integrated, cross-platform consumption measurement. What is the status of Nielsen’s efforts in that direction?

Abcarian: Even before we acquired Arbitron they were already measuring the multimedia environment. The PPM technology can measure radio and TV. We plan to formally bring in the PPM data into our local television currency services that will double sample-size and introduce out-of-home measurement in 44 local TV markets. It will bring that true currency cross-platform linkage to help give our radio clients a better understanding of the full view of exposure data across radio and television. Our Total Audience Measurement strategy has been to bring together measurement and activation of video, audio and text across the planning and buying landscape. We have made great progress on that front and we have made sure audio remains featured prominently in that customer storyline. We spotlight radio’s strength with our Nielsen Total Audience and Comparable Metric report that we publish on a quarterly basis. That shows radio remains the top local reach medium in the U.S. The multimedia landscape continues to evolve. Nielsen is always looking at cross-media opportunities for clients.

RW: What is Nielsen’s philosophy on total measurement to include things like Pandora, Spotify and SiriusXM to see where radio really stacks up in overall listenership?

Ramaswamy: Providing comparable metrics across all platforms is one of our foundational cornerstones for Nielsen Total Audience measurement. When thinking about audio measurement in particular, we like to think about three fundamental ways of looking at audience exposure and engagement: how many people listened; how often did they listen; and how long did they listen. Nielsen’s goal is to provide a bundle of metrics for the industry to use based on the circumstances of their research or the story they’re trying to tell.

The key is for each of these metrics to be calculated in a comparable way across platforms and for the industry to be consistent and clear in their use of these metrics when comparing terrestrial stations, satellite or digital pure plays.

RW: Is Nielsen working to aggregate terrestrial radio plus digital measurement to be able to comprehensively measure a radio station’s true reach? And how will that work?

Ramaswamy: Digital audio is a critical part of our total audio strategy: measuring a consumer’s listening behavior wherever they are, regardless of device and combining that listening across terrestrial and digital audiences into the currency to enable our clients to more seamlessly monetize these audiences. Tremendous progress has been made over the past year. We’ve achieved alignment on which metrics should be used and how the data should be displayed.

RW: Are there further technical enhancements to existing products you are working on?

Ramaswamy: When we looked at the new monitor we brought out, we were looking for way to add value for our clients. We are collaborating closely with a lot of our technical counterparts at our clients. We are adapting more agile methodologies in order to demonstrate in smaller chunks the improvements we are bringing to the marketplace. And we are going to follow the same principle when we look at new technology. For example when we look at PPM wearables, at the right point we will pull in clients and make sure we are headed in the right direction.

Comment on this or any story. Email[email protected]with “Letter to the Editor” in the subject field.