We already knew that U.S. commercial radio was going to bring in a lot less money from local advertising this year; but the latest projection is not any more encouraging.

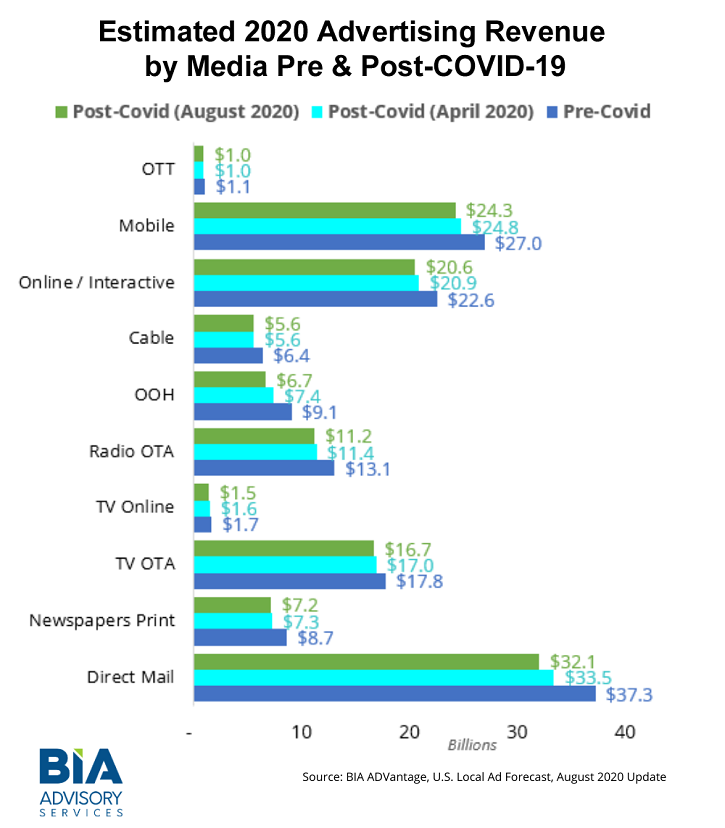

BIA Advisory Services expects over-the-air radio advertising to finish at about $11.2 billion for 2020. Its prior projection four months ago was $11.4 billion; and before the pandemic, BIA originally had projected that OTA radio would bring in about $13.1 billion.

So this latest forecast suggests a –15% differential from “what might have been” for radio this year. (The estimate includes spending by national, regional and local advertisers on radio; it does not include spending by national advertisers on radio networks.)

The chart below compares the latest estimates for each media segment to two prior BIA forecasts:

More broadly, the research company predicts that spending on all local advertising in the U.S. will be down about 6% despite strong anticipated political advertising.

The firm lowered its previous estimates in almost all media categories. It now projects total 2020 local ad spending at $140.4 billion, down from a projection of $144.3 billion four months ago.

Its chief economist Mark Fratrik said in the announcement, “Right now, we believe a realistic view of the economy overall and the advertising marketplace is that after a dramatic decrease in the second-quarter and a bumpy start to the third, the remainder of the year will turn positive but end up with an overall decline in local advertising for the year.”

He pointed to local political ad spending as one positive area, with campaigns making more use of online rallies and events.

Segments showing “some COVID resilience” include healthcare and finance & insurance, but even those are down in terms of overall ad revenue spending.