Audio listening habits have shifted over the past five years — sometimes dramatically — according to Edison Research’s most recent “Share of Ear” study, covering the third quarter of 2021.

One interesting finding in the report runs counter to popular perceptions: listening via Pandora and Spotify has stagnated while AM/FM listening and podcast consumption both continue to see steady gains.

The Edison report also revealed that podcast audience listenership has continued to rise. Over past two years, the daily reach of podcast listening among those aged 13 to 34 rose 43 percent with daily reach up 51 percent among those aged 25 to 54.

[Previously in Radio World “Podcast Listeners By the Numbers”]

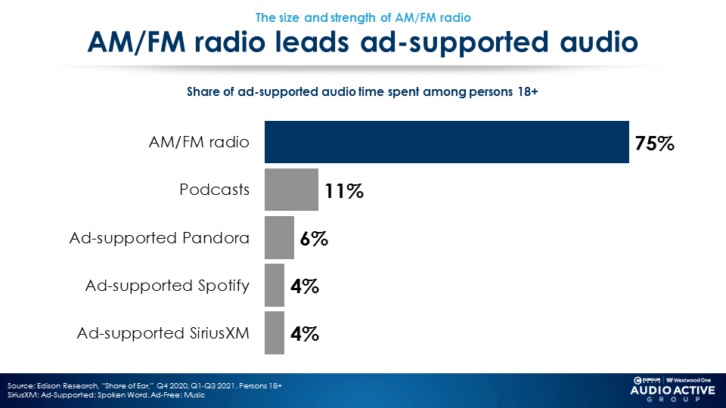

The other audio platform seeing consistent growth: AM/FM radio streaming. In the most recent “Share of Ear” study, Edison found that AM/FM radio dominates advertiser-/supported audio with a 75 percent share of listening. Podcasts are capturing 11 percent of ad-supported audio time among those aged 18+ while the ad-supported streaming platforms of Pandora and Spotify are at 6 percent and 4 percent, respectively.

The latest “Share of Ear” study found that AM/FM radio leads ad-supported audio across major demographics, regardless of age. AM/FM radio is most popular with those in the 35 to 64 age range with an 80 percent share of ad-supported audio time spent listening to the AM/FM dial, followed by ages 25 to 54 (71 percent), ages 18 to 49 (64 percent) and ages 18 to 34 (55 percent).

Perhaps not surprisingly, most AM/FM radio listening occurs away from home with in-car listening hitting an 88 percent share of listening time. The research also found that Pandora and Spotify listeners primarily use those platforms while at home.

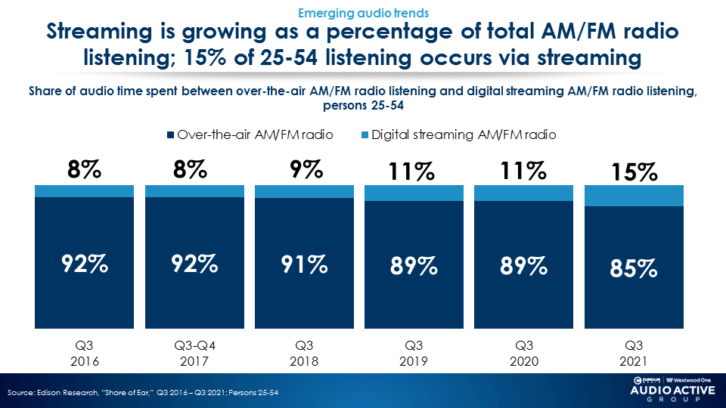

When it comes to growing audio platforms, both podcasts and AM/FM radio streaming take the lead. The research found that AM/FM streaming is now 15 percent of total AM/FM listening. One of the growth drivers of that boost are smart speakers, with audiences listening to AM/FM radio on smart speakers more than any other ad-supported platform, the report found.

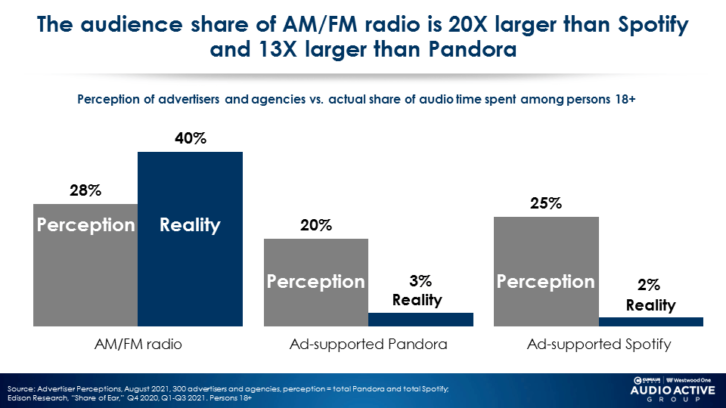

One unique finding, reported by Cumulus Media|Westwood One Audio Active Group President Pierre Bouvard in a recent blog post, is that there is be a significant perception vs. reality problem when it comes to estimating the audience shares of AM/FM radio vs. platforms like Pandora and Spotify.

The Audio Active Group quoted a finding from the firm Advertiser Perceptions that asked brand and media agencies in August 2021 to estimate the audience shares of Pandora, Spotify and AM/FM radio. The marketers and media agencies assumed that the share of listeners for Pandora and Spotify were significantly higher than actual levels.

Over the past five years, Pandora and Spotify have seen their ad-supported audience levels erode. In 2016, Pandora was seeing strong listening shares among those aged 13 to 44. Some of that support eroded when Spotify introduced an ad-free subscription service — so much so that Pandora suffered share losses in the 48 percent to 70 percent range among that age group. Meanwhile, Spotify not only saw its reach surpass Pandora but also watched its ad-free subscription service rise 309 percent from the third quarter of 2016 to the same time period in 2021.

[Our Previous “Share of Ear” Report Coverage]

The groups estimated Pandora had a 20 percent share of listening and that Spotify had a 25 percent share of audience. In reality, the audience share of ad-supported Pandora and Spotify is seven times and 12.5 times smaller, respectively.

Media agencies also surmised that the perceived share of AM/FM radio is 28 percent, when in reality AM/FM radio’s actual share is 40 percent, a finding Bouvard called a “massive disconnect” in terms of the perception and reality of audio shares.

Comment on this or any article. Email [email protected].